What is it backed by and what is it worth? These are often asked questions with cryptocurrencies. And, they're fair questions.

Note: although I focus on @Hivebits (HBIT) here, this is just as an example. This post likely applies to any other Hive-Engine tokens, especially tip tokens.

Backed by...?

Let's start with bitcoin because it's the standard. Critics say bitcoin is backed by nothing. Wrong. Bitcoin is intrinsically backed by the immutable code and mathematics that defines its scarcity, emission and everything else Bitcoin, as well as by the literal electrical power and laws of physics required to secure and run Bitcoin the system. Bitcoins don't exist without energy having been put into "mining" them and in keeping them secure.

Measuring the kilowatt hours (time and energy) required to mine and secure the network and then converting those energy hours into dollars was the first way bitcoin was value-assessed. Satoshi himself alluded to this in the bitcoin whitepaper (section 6), writing "In our case, it is CPU time and electricity that is expended." In May of 2009, Satoshi linked electricity to bitcoin value more directly: "The value of bitcoins would be relative to the electricity consumed to produce them."

Math, code, and the laws of physics and electricity, are what back bitcoin. And, they give a starting point in answering, "What is it worth?"

And worth...?

A classic way of valuating something is in this question and answer scenario:

Q - "What is this worth?"

A - "It's worth whatever someone is willing to pay for it."

This, of course, gets very subjective. We've likely heard of the duct taped banana "artwork" worth $6.2 million.

Combining the intrinsic, what-it's-backed-by value, and adding the subjective market-dictated value, we get the final value. In the case of the banana art, the banana itself certainly had value in that you could eat it (say, $0.25 USD), and the duct tape strip had value itself in that you could use it to patch something (say, $0.05 USD). Then the subjective "artistic" value added a whole lot more...and we get to $6.2 million, for a final value of $6.2 million and 30 cents.

Hive Engine tokens

I've been thinking about H-E tokens lately and value. Particularly, I think of @Hivebits or HBIT. Since its start three years ago, I've relayed that I feel HBIT is unique in that every single one exists in the wild solely because someone purposely set out to "mine" it via a post/comment/reply. Zero have been airdropped, collected in interest, or emitted in any way other than a someone consciously calling an HBIT command.

In this way, there is time and energy/effort expended..."proof of comment" I've called it, which is actually proof of literally doing some small measure of work.

Lately, I've begun to consider the Resource Credits (RCs) involved in addition to the proof-of-comment. Somewhat like expending electricity with bitcoin, Hive users expend RCs to mine HBIT. So, I wonder, can we estimate the value of RCs used to mine HBIT to estimate a value?

RCs are hard

Figuring the cost or value of Resource Credits (RCs) is hard to do. There is not a simple snack bar menu like:

| ITEM | COST | USD |

|---|---|---|

| comment | 1,000 RCs | $0.05 |

| post | 5,000 RCs | $0.25 |

The "cost" of RCs is dynamic and, as I understand, depends on these variables:

- How busy the Hive network is at the moment - the busier, the higher the RC cost.

- How much info/data is in your post - the more data, the higher the RC cost.

- The type of post (top level, comment, transaction, etc.) - top level uses more RCs.

RCs applied to HBIT

To mine HBIT, one simply uses a "!" command like ! HBIT (without the space). I believe these are typically very short posts, usually as comments. So, these are low RC costs.

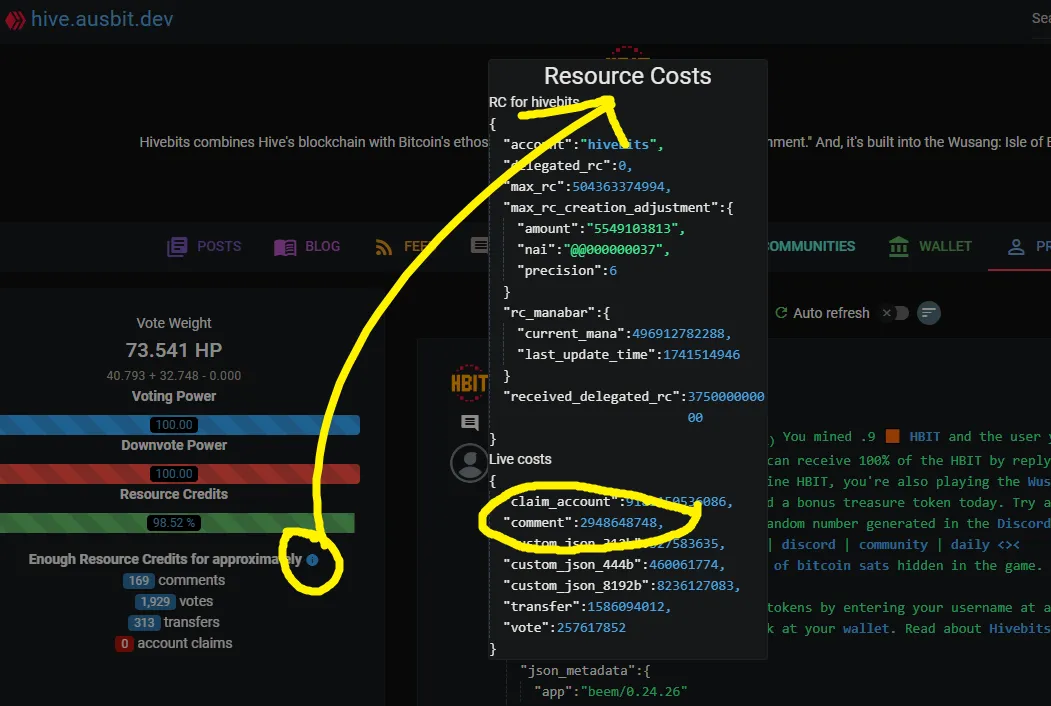

Below is looking at https://hive.ausbit.dev/@hivebits and clicking the small blue "i" icon to estimate live Resource Credits. (You can look at any Hive account, such as your own, and see the same info.)

At the moment, if I understand correctly, a comment will cost 2,948,654,006 "mana" (the unit of RCs). I'll round that number to an even 3 billion.

So, mining one HBIT will cost you 3 billion RCs. Like mining 1 BTC with kWh, then converting the kWh to dollars so as to approximate the value of the 1 BTC, you could in theory do the same valuation technique with RCs on Hive.

However, it's tricky to estimate the cost of RCs. In a way, there actually is no cost...unlike electricity, RCs regenerate on their own. The cost is the opportunity cost that those RCs could have been used for otherwise, as well as the time lost waiting for those RCs to regenerate. Let's analyze these two.

- Opportunity cost - Suppose the user would have made a comment elsewhere on Hive using those same RCs. He or she might have gotten an upvote on that comment. The value of that upvote depends on the HP of the upvoter, but say that upvote is worth 0.02 HIVE. That HBIT mining command therefore costed the Hive user the 0.02 HIVE he did failed to receive by not making that alternative comment.

- Time - The amount of time lost by using RCs depends on the user's HP...the more HP, the less time lost to replenish those RCs. It's hard, maybe impossible, to put a number value on this so I'll just skip it...but, understand, the time loss is there and it is non-zero.

Going back to the opportunity cost, we now have numbers. Using the tool at https://heconvert.on-fleek.app, we get: 0.02 HIVE or about $0.01 USD (that's actually rounded up) or about 6 sats.

Note: I like to use the bitcoin sats metric because, since we're using small values here, the sat is sufficiently tiny to get a measure without too much rounding or decimals. Maybe sats won't be "sufficiently tiny" forever, but for now, they are.

For sure, there are a LOT of assumptions going on here, getting the 0.02 HIVE upvote on another comment that those RCs could have made being a biggie. But, if those RCs were in fact used in a comment to mine HBIT, here's what we have:

- The user gets one HBIT.

- Intrinsic value - that HBIT is backed intrinsically by the conscious effort made to mine it, the hard coded scarcity of tokens, the spent RCs which could have been used elsewhere (estimated at 0.02 HIVE), and the cost in time to both comment and replenish the RCs.

- Market value - like the banana art, we must add the market value as well to the intrinsic value. The market value of a token can be seen, well, on the market. https://tribaldex.com/trade/HBIT shows the order book and chart, but this converter simplifies the HBIT market value: https://heconvert.on-fleek.app/tokens/HBIT.html

These values are based off the most recent trade at TribalDex. They are the answer to the question, "What is someone willing to pay for it?"

Summary

A token like HBIT (or bitcoin, or an H-E token, or a duct taped banana) has value that is intrinsic (like hard code, energy used to mine, opportunity cost) and subjective (what someone will pay for it).

We now have a formula:

Final value = intrinsic value + market value

V = I+M

In the case of HBIT, the intrinsic value is ROUGHLY estimated at 6 sats and the market value is currently 1.13 sats.

So, BRUTALLY ROUGHLY, I'll estimate one HBIT to be valued at 7.13 bitcoin satoshis.

Apply this formula to your favorite token, or fruit, and have fun.

I go by @crrdlx or "CR" for short. See all my links or contact info at https://linktr.ee/crrdlx.