Former Goldman Sachs partner Mike Novogratz bought $500,000 worth of ether under a dollar and went on his vacation to India. By the time, he returned the ether price soared, eventually netting him $250,000,000.

Now he wants to open a $500mln hedge fund to capture trading opportunities around ICOs events. Unlike his more profiled peers, he is not afraid to trade on the crypto way up, while also acknowledging that at some point the party might be over.

“The railroad bubble. Railroads really fundamentally changed the way we lived. The internet bubble changed the way we live. When I look forward five, 10 years, the possibilities really get your animal spirits going.”

And with more animated spirits (i.e. Wall Street money flowing in) we ought to see crypto currencies going to the Moon and then beyond, which is no doubt exciting.

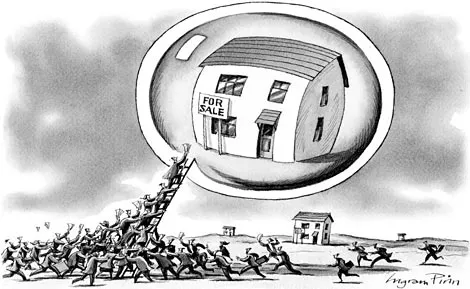

However, how inclusive this development will be? What is likely to happen to the decentralised ecosystem, when big money will be influencing the development vector? We can already see such works in ICO market, where founders are pre-selling stakes at substantial discounts in exchange of marketing clout. A (now christened) Real Estate bubble, anyone?