Things which have nothing to do with the future

German user freiheit50 did just 4 fun a survey about when people think, bitcoin will hit 20k. 41 people took part. For us scientific people their answers, of course, have nothing to do with the future (maybe one or two have glass balls but for the statistic, it does not matter). We have used the survey data to model the strategies of human prediction and have found two basic strategies. One strategy is based on naive optimism and the second is based on making a statement where the consequences of perceived pain from being wrong are so far away, that the individual feels comfortable.

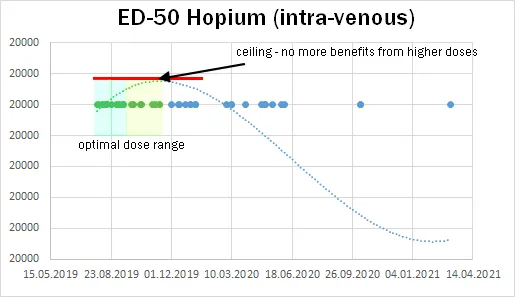

[The efficiency/ dose-effect curve of a drug called hopium]

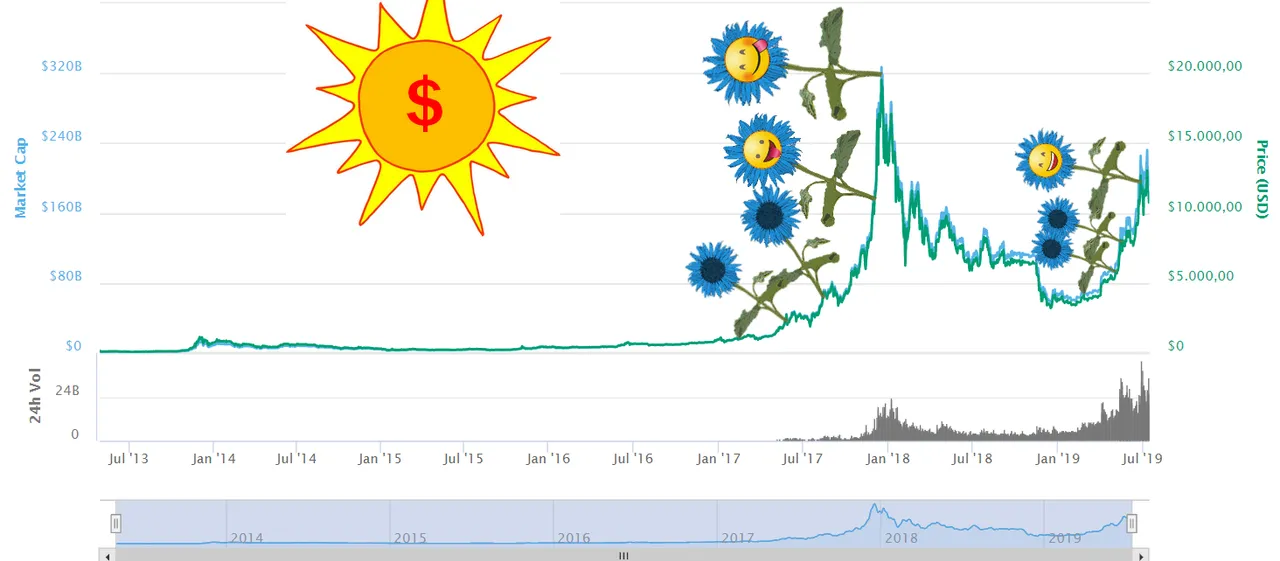

The plant from which hopium is derived is called optimismus confidencia. It grows uphills and only on the sunny sides of mountains of volatility.

Its blossoms are blue like the eyes of blue-eyed optimists. It best grows where the ground is vertical, it can even grow in thin air. It's consumed in bull markets to go all in and bear markets to tranquilize and kill the pain.

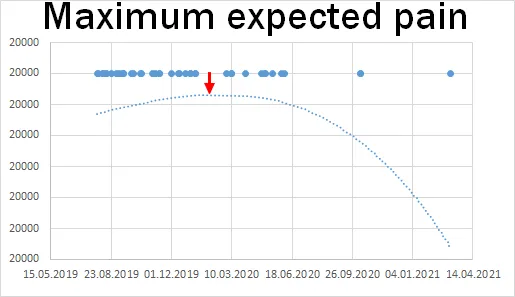

[perceived and expected pain curve. Those people on hopium maybe know about the pain but they don't care. On the other side people pushing out the perceived consequences care very much of not getting hurt in the near future]

Here you see the point of maximum consequences and pain. In the beginning, you have a high gain from hopium. Hopium, like every drug, hits a ceiling where the efficiency doesn't increase any further and the possible dangers increase. When you don't rely on hopium you better rely on pushing out the consequences of your statement. The further away your "prediction" is, the further away is the fear of the pain from being wrong. It's clearly a pain avoidance strategy.

Conclusion.

Most people take the blue hopium pill and don't fear the consequences of being wrong, the fear and pain-suppressing effect is too strong. Its like hooligans taking tilidine and ephedrine to go all in. Maybe they think their belief can positively effect the course of time.

Of course, we can see the survey as a barometer for optimism, but never the less, this set of beliefs does not share any information with the future. Yes, there are reflective structures in markets, but since all participants are no billionaires... their effect on the course of history is too small to rely predictions on. We can conclude that the optimal strategy is to bet that we see the 20k on August-Oktober 2019. (this does not mean, that it is optimal to bet your money on this, just that its optimal for an individual to dream about reaching the moon in the next month)

Notes

There is no significant gain from observing the herd. But if you want to analyze swarm effects, a group average is highly misleading. First, you should subgroup for different behavioral strategies and then analyze the clusters in isolation.

My investment is not based on price predictions, so I will not participate but just4 fun will try to analyze the market data. Anyways this is a market for Chuck Norris-type-people with balls of steel and not balls of glass. Good night.