The ban on ICO in China has prompted the emigration of ICO projects in neighboring neighboring regions, particularly Hong Kong and Singapore, which have proved more friendly to this type of initiative.

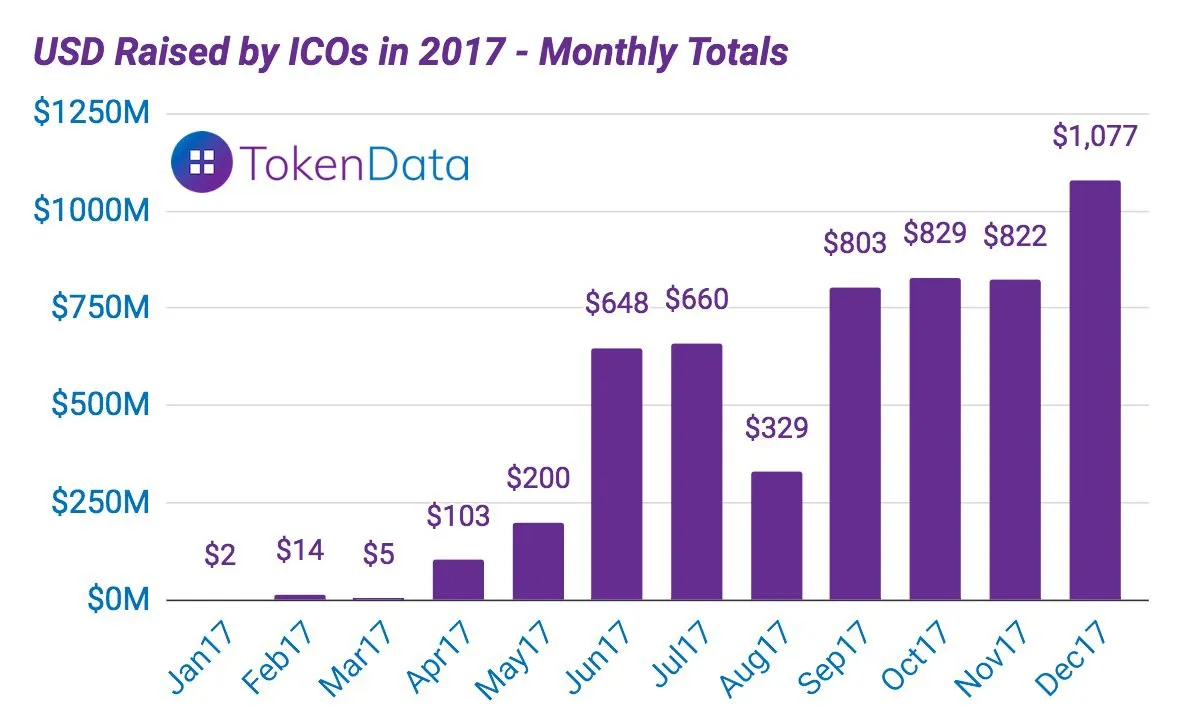

According to market analyzes, the first quarter of 2018 saw a major increase of up to $ 6.3 million, exceeding the amounts accumulated throughout 2017. At the beginning of the year, the demand for new tokens is on the rise.

In September 2017, China banned ICOs from running across the country, prompting the move of these initiatives to Hong Kong and Singapore, which have more friendly regulations and tolerant authorities.

Immediately after China's decision, Hong Kong issued a guide to ICOs, including the conditions under which tokens are considered securities and must be registered with regulators.

Also, in January, Hong Kong authorities launched a public education and investor education campaign on cryptomonas and ICOs, and one of the big exchanges, Gatecoin, operates in Hong Kong.

Regarding Singapore, the head of the national cryptocurrency and blockchain association said that since September last year, a large number of ICOs have been registered in the country, but there is still work to turn it into a true hub for this kind of start-ups.

In the last quarter of 2017, Singapore has ranked third in the world (after the US and Switzerland) as the value of funds raised through ICOs (according to FunderBeam data).

One of the reasons behind this development is that the authorities have decided to support blockchain startups by creating business incubator programs and departments dedicated to the crypto market.

The process of registering a company in Singapore involves spending about $ 200,000, but the legality of the business is ensured, as Xender's start-up public relations director, who chose to register in Singapore.

Information about ICO that is currently available:

https://icobench.com

https://www.trackico.io

https://foxico.io