This bitcoin future is a reality. Can we see bitcoin ETF soon? Why not? A bitcoin ETF will help the public and institutional investors can take a position in the new asset class. Additional checks and rules that come with these new presentations will also boost confidence in cryptocurrencies. This is still the political head warning that the present banking system can be on its way.

Although, though this development is positive for the future of Bitcoin and Altcoins, it is going to be a roller coaster ride for the final destination. Therefore, we believe that there is no good strategy to borrow money to trade or mortgage the home to invest in bitcoin.

This can be a long trajectory, while intermittent drift will arise and may be very painful for those who are betting home to do business in cryptocurrencies. Therefore, do business only with the money that you can safely lose and trade safely. This fast rap is back to number four in the case of market capitalization after ripple. Due to the continuous change in the position of these top seven cryptocurrencies, we have decided to include seven in our analysis for the benefit of our readers.

BTC / USD

It has shrunk the daily range of Bitcoin since last two days because we had guessed it in our previous analysis. After this huge run, these merchants are taking a break which is a healthy sign. If the digital currency is consolidated near the high potential of the lifetime then the bull will again try to break out $ 16,700

If this successful bicorn will resume on its own and will move towards its pattern target of $ 24,291.58. It is likely to encourage the bear failure on the other side, which will push the virtual currency towards the 20-day EMA. At present levels we are not getting any attractive setup, so we do not recommend any business at this time.

ETH / USD

This ethereum has broken through the target objective of our $ 652 and has reached a high level of $ 784.77. It has an intense rally of 89% within seven days; currently its digital currency has made a doodle candlestick pattern, which shows exhaustion.

They expect to pull cryptocurrency up to $ 643.52 and $ 599.89, which are 38.2% of the rally and 50% Fibonacci retracement level. If these pullback ends or if the atom bounces once again in life, then this next business will be established. Until then, we will wait

BCH / USD

In our last analysis, he recommended a long position on Bitcoin Cash in $ 1500. This has crossed the target of $ 1750, it broke the digital currency from the upper end of the range, but it could not maintain high levels. Because of this, the traders can book up to 50% profit at the present level and can increase the stop lodge to break the rest position. If bitcoin can remain above the upper limit of the cash category, then it is likely to rally for the goal of its next goal of $ 2387.

If these bulls manage to break out of $ 2387 then it is possible even after higher posts. If digital currency succeeds in reaching $ 2,700 level, then these traders should be fully profitable. Although if the bulldoze fails to maintain above $ 1758, the virtual currency limit will remain tied.

XRP / USD

This wave is skyrocketing after coming out of long-term consolidation; it started this year at the same rally this year in late April. These pattern targets were $ 0.67074 at the breakout of $ 0.12700 to $ 0.39887. This digital currency has already increased with its minimum target objective.

They believe that the wave will now face considerable resistance at $ 0.86 points. Therefore, for long periods of time, traders should check the partial profit at current levels and the rest should be kept with a suitable stop loss. They will be able to attract support levels only after the digital stages have stopped.

IOTA/ US Dollar

They were waiting for the breakout of the proxy formation to start the long-term posts. However, this digital currency pattern has broken, which is the evolution of a recession.

They now expect that the bear catch the opportunity and push digital currency towards the 20-day EMA, which is close to 50% of the rally Fibonacci retracement. Unless the IOTA draws out of the downtrend line, it will be under pressure. They will wait to fall before recommending any new long positions.

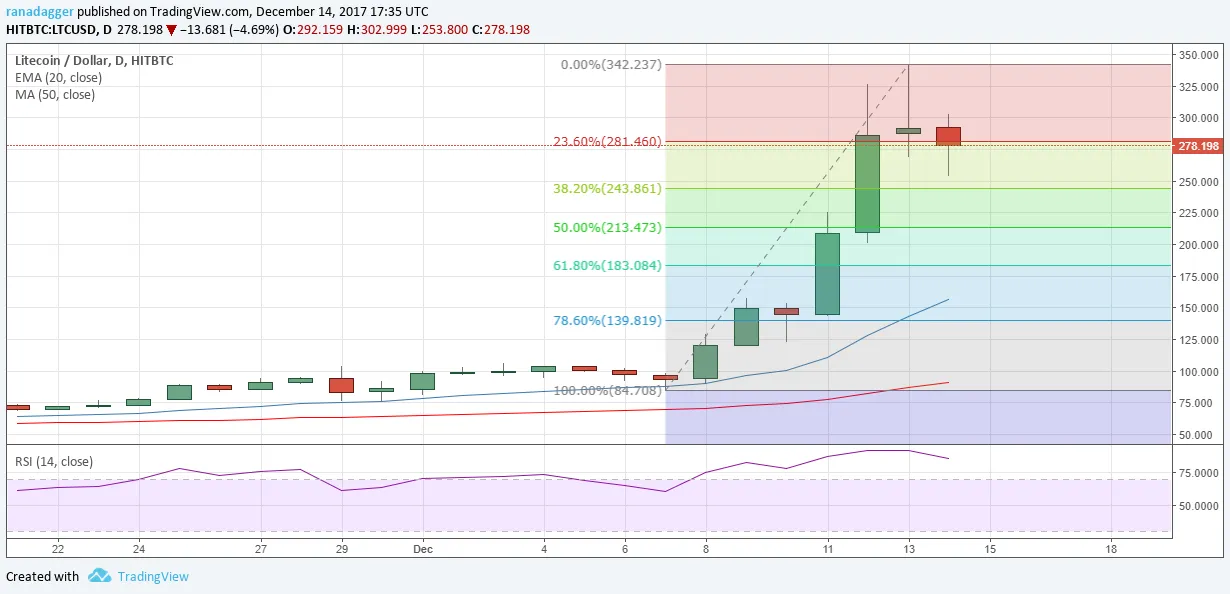

LTC / USD

In our previous analysis, we had mentioned that the level between $ 312 and $ 340 is likely to act as a strong resistance and that is what happened. Litecoin started a pullback after it reached a high level of $ 342.237.

These pullbacks have strong support of $ 243.86 and $ 213.473, which is 38.2 percent and 50% of the rally's Fibonacci retracement level from $ 84.708 to $ 342.237. It can see the period of consolidation or improvement after such a strong rally. Because of this, they do not advise any new long positions at the existing levels.

Dash / USD dollar

This dash has broken out of the overhead resistance of $ 815 on December 12. However, he had expected a fast rally at 979 levels, but the move is selling level above $ 900. If the traders have bought long positions based on the vision of our bull in the previous analysis, please book the 50% profit at the current level and increase the stop-lock for the remaining 736 dollars.

This rally is tired. As long as we see the fast pace within a few days, then it is likely that digital currency will fall below $ 815 once again. Therefore, they propose to reduce the risk. Although above, if these dash goes out of $ 979, then it is likely to rally up to $ 1199.01. That's why they are keeping 50% posts open.