Although the focus of the vast majority remains on Europe and the US to adopt cryptocurrency as a store of value, realistically speaking, at present it would be more suitable for countries like Turkey whose economy is staggering and its national currency Lira is on the verge of collapsing, especially in comparison to the economies and legal tender of European counterparts.

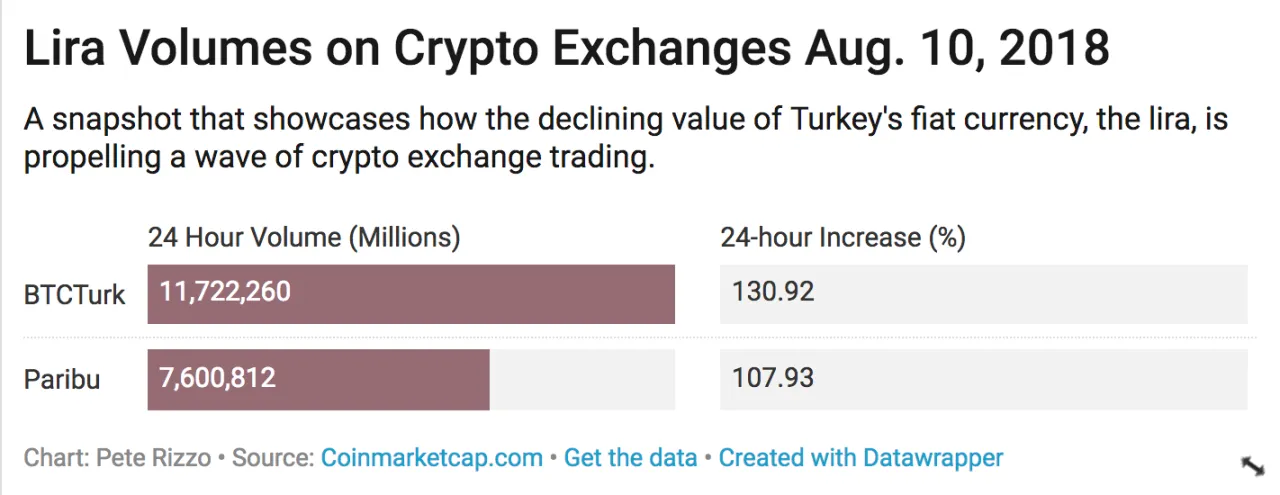

According to research by ING bank (which I had posted a couple of weeks ago), in Turkey already 18% (1/5) are invested in cryptocurrencies. That's 10% more than the US, despite the lack of access to Turkish Cryptocurrency exchanges (available exchanges Paribu, Btcturk and Koinim which do not offer alts) and cryptocurrency related sources.

According to Coinmarketcap, the volume has already started to climb in the aforementioned Turkish cryptocurrency exchanges. I guess citizens are somehow anticipating further chaos thus desperately looking for alternatives to exchange Lira prior to it becoming near worthless, after the currency hit record lows this week.

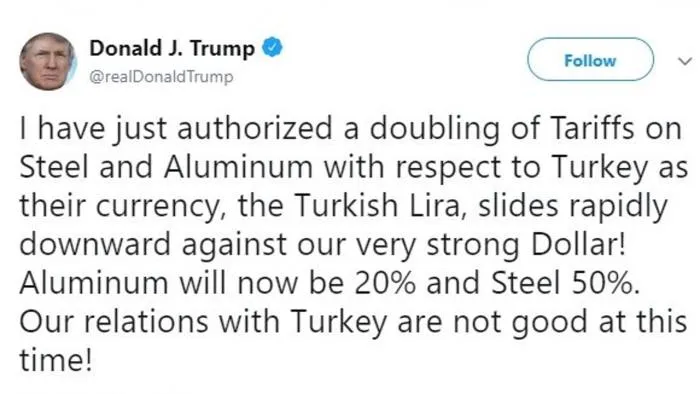

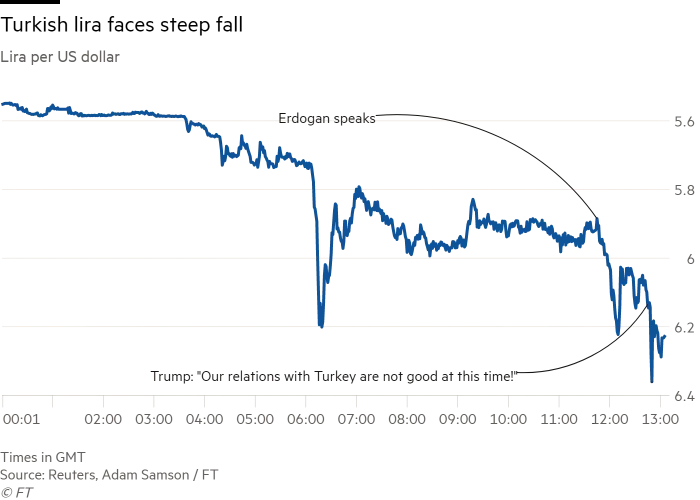

Lira dropped more than 14% against USD prior to Trump tweeting about doubling metal (alluminium and steel) tariffs on Turkey, and 20% thereafter, and in 12 months has lost 80% of its original value.

This makes the currency perhaps more volatile than cryptocurrency and Lira could see further drops in the near future, which would not do any justice to the country's already increasing inflation rates. It is comprehensible that the more widely cryptocurrency is adopted/accepted as a method of payment, the more its worth will increase and the less volatile it will be.

So having covered the volatility issue (in comparison to e.g. Lira) which makes the majority sceptical on cryptocurrency, it would be necessary to look at a few benefits it could offer.

By adopting cryptocurrency as a store of value, countries like Turkey could perhaps see some much needed microeconomic stability, less corruption and power in the hands of sovereign entities who control/manipulate the supply and large companies (especially construction) which borrowed excessively/uncontrollably from foreign currencies, and as the value of Lira dropped, it became more complex and costly to pay off the debts causing deficits, and made imports more costly.

Contrary to fiat, in cryptocurrency there is no middleman, it is governed by a consensus mechanism, a backbone of the blockchain which controls the supply. Money printing is increasing 20% per year, and insider jobs which seldom hit the mainstream media are affecting the value of Turkey’s currency. Turkey does not have a great geopolitical relationship with European counterparts (have been denied EU membership many times) so dolarizing (e.g. Equador) or euro-ising (e.g. Monaco) would be less probable. Thus the most logical solution to combat their current financial crisis is cryptocurrency.

If Erdogan does not take appropriate action to solve the economic crisis and collapsing currency, Turkey could take a seat next to Venezuela which is spiraling toward a 1 million percent inflation rate. That is not to say Blockchain is without its own challenges, but it could reduce manipulation and stop the current bandaid solution of printing of money which is increasing 20% year after year.

In my next Article, I will discuss the possible challenges countries like Turkey should look out for when switching to a Blockchain solution and how to prevent potential pitfalls.