Personal Loans on smart contracts? Bank Vs Blockchain. Why I think the bank will win.

I should preface this by saying first of all that I’m not a blockchain expert and far from a financial expert. This article is a combination of my thoughts and an invitation for others to discuss and inform me where I am wrong. I have tried to do get information on this but simply can’t find a reasonable solution to what I would consider a significant problem.

At the roots there are two main services a bank provides – Security for those how have money and loans for those who need money. Bitcoin and cryptocurrency deals with the first part very nicely. The blockchain is arguably a more secure way of storing value than any bank vault. But what about the other half - money borrowing? Unless we can tackle this side as well, banks will continue to exist and thrive.

Perhaps you might say that smart contracts are the obvious solution. A digital agreement that neither party can get out of. Here are the problems I see with this;

1. Collateral.

Let’s take the ideal situation to be that any person or thing that has money can lend that to any other person or thing and receive some long-term benefit for that (interest). To be truly decentralized there can’t be any other party or overarching authority relied apart from the lender and borrower.

For a loan to work, the lender must be confident that the borrower is able to return the amount or that a collateral can be taken in exchange. In most cases this is a house. It’s an asset that has worth.

How does a smart contract seize an asset such as a house? For that to work the contract would need to be legally binding (in all countries) and the lender would need to know the location and value of the asset. This means that there would need to be a register of the borrower’s identity and the collateral. This register needs to be a lot more significant than a digital key to a wallet. Sure, that information could be stored on a blockchain, but how is it verified by the lender? There needs to be a physical person with authority verifying that the asset has value (and is insured) and can be claimed. This circles back to a centralized system – a bank.

Sure, a bank could use blockchain based smart contract to conduct its mortgage transactions. But it’s still a bank.

So having done a little research I did come across a couple ‘decentralized’ systems that offer smart contract loans - such as ‘EthLend’. In all these cases, the borrower needs to put up a collateral in the form of another crypto tokens. This doesn’t make sense to me at all. The collateral token would need to be equal in value to the borrowed value. Why would I need to take a loan if I already had the amount I need in another form?

As far as I am aware there is no option for me to borrow money from another account without relying on a centralized authority.

2. Debt is a lot of money.

Home loans. There are very few people today who don’t need one. This is a staple for independence, at least in the middle class.

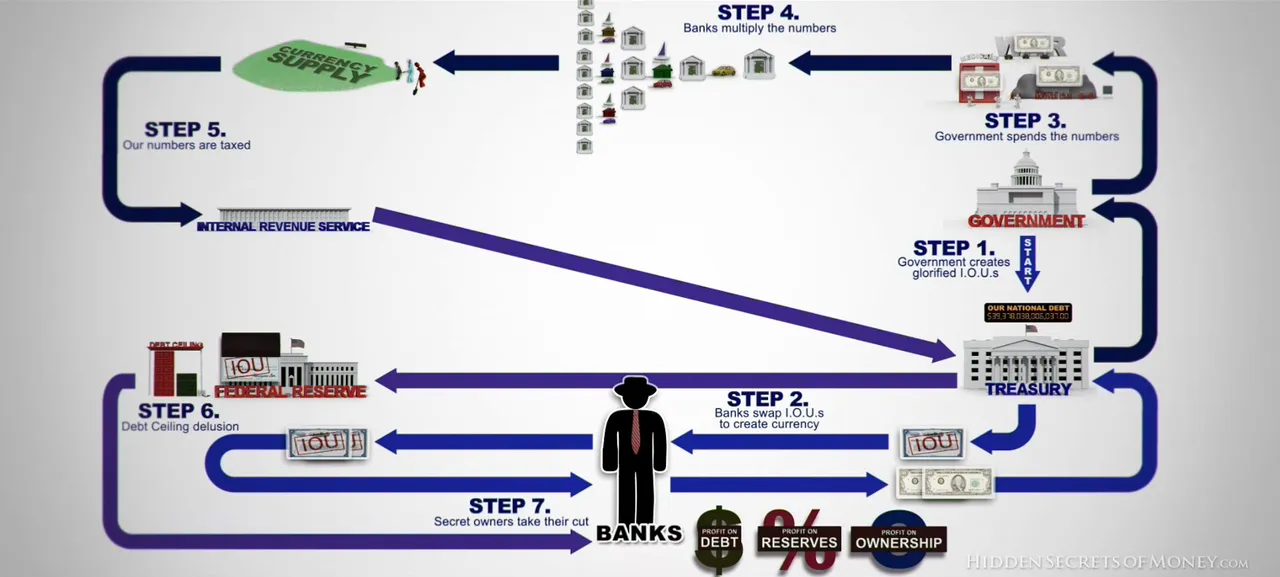

The current global debt is 217 $Trillion (Source). For a decentralized system to be able to supply the loan demand there would need to be an equal or greater amount of supply than demand. This is not the case with traditional banking because banks can essentially make up money out of thin air (through the federal reserve). Bitcoin cannot (and should not) be able to do this because it can’t go into negative balance. Instead there would need to be enough people with enough money to lend to those who need money for housing or other deficits. The fact that the amount of global debt continues to grow shows that there is not enough positive monetary supply for the current loan demand. In fact, debt level is at 325% of the worlds gross domestic product. Either Cryptocurrency needs to deal with negative values or the world needs to stop spending money they don’t have. This may sound good but would mean that you’ll be living with your folks until you’re 60.

3. Crypto currency isn’t stable enough (yet).

This isn’t an issue that can’t be fixed but its worth noting. Loans are usually long term. At this stage cryptocurrency is simply not stable enough to predict its value over a long term. If I were to take a loan of 100 bitcoin, and the value of the bitcoin doubles over the next 5 years, then I’ll be a lot more in debt then when I started. Over time this might not be an issue, but it is now, which may be the reason that other crypto loan problems are not being addressed.

As I said guys, I’m no expert. I want the world to be rid of banks but don’t see how the problem of loans is being tackled and why no one is talking about it. I hope someone out there can find error in my arguments or point me to a viable solution.