I dove head first into the crypto world on December 30, 2017 after having heard from a few friends that had invested a few thousand dollars over the summer of 2017 to find themselves sitting on tens of thousands of dollars all of a sudden. Four and a half months later, countless hours digesting as much information as I can, and with a portfolio 35% down, I am more excited than ever for the future of this space. Although, being down is never fun, I have learned countless lessons and most importantly, I didn't put in any money I couldn't afford to lose. (Not saying it wouldn't sting a bit, but doesn't anything worth doing have that problem?)

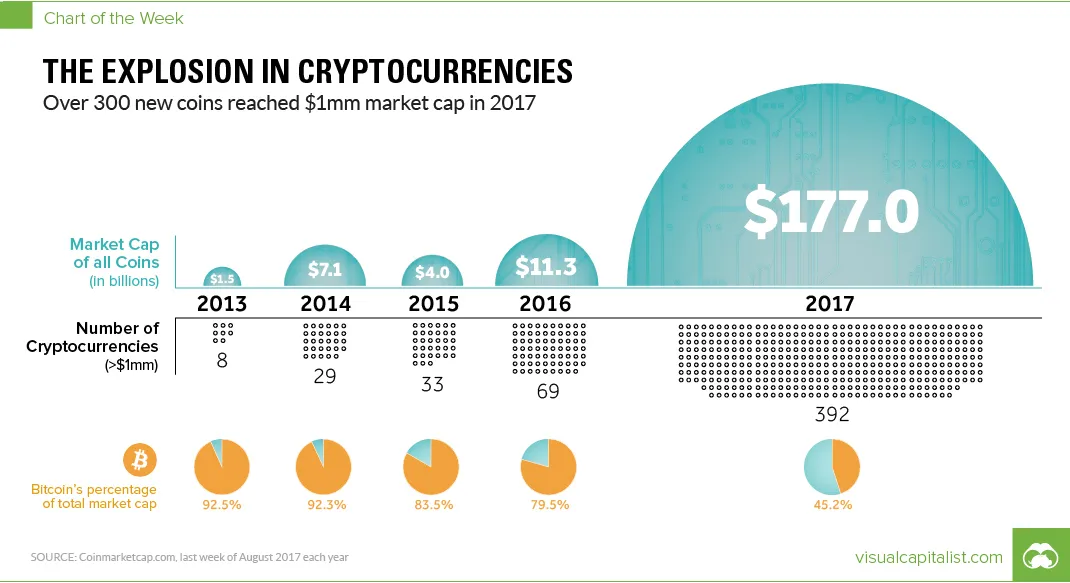

Anyone in the tech space had heard about Bitcoin and cryptocurrency and maybe even understood the finer technical details, but the jaw-dropping bull run at the end of 2017 made even the most skeptical among us have to pay attention to what was going on. The infographic below shows the scale of the alt coin market explosion in 2017 and the decline of BTC dominance to the first time it had ever gone below 50 percent.

Now that we have come back down to earth and BTC is now below it's 200 day moving average (and has been for a good several days), it's continuously looking more probable that money will come flooding back into the market in the coming months. At its peak, total market cap in crypto was around 820 Billion USD, and we are now down around 324 Billion USD. How soon will we get back to 800 Billion and beyond? Your guess is as good as mine, and don't let anyone tell you they know exactly when things will skyrocket again.

now to my main point...

People have gone B-A-N-A-N-A-S

... But I don't mean that in a bad way.

People have gone bananas realizing that they can utilize coins and tokens to get in on the ground floor of projects that will revolutionize the world.

People have gone bananas realizing that banks no longer will control their financial futures.

Young people have gone bananas realizing that investing their money in these digital assets will help secure their financial freedom. More people are feeling confident that they can build something for themselves through these technologies.

This is a brain virus that will capture the imagination of billions.

The technological barrier of entry will continue to drop and we will see direct fiat pairs to a wide variety of coins and tokens. Exchanges will quickly raise their security procedures to an acceptable level as we head towards fully decentralized exchanges. People will be able to learn how to become their own bank. It will be much like when we hid money under our mattresses but this time we have cryptography on our side. We will see an exorbitant amount of money come into this space in the coming years, because people want to control and invest money as they see fit.

Finally...

Vires in numeris. Strength in numbers.

credit: https://cryptograffiti.com/collections/fine-art/products/vires-in-numeris-2014

Donations Welcome

Nano Address: xrb_3b39jj7fzrtie6tb195986ghy9mi1uc75kq9fo5u1oy8dam3bdx5ua96nuus