Are you investing in EOS, perhaps got rid of your Bitcoin Cash lately? Or perhaps you day trade in NEO, Dash and IOTA?

In my third Steem post I listed the top 20 cryptocoins on Coinmarketcap and made the mistake of treating them as "equals".

Screenshot from Coingecko's top 3 coins categorised at Proof of Stake. (2017-08-05)

For all coins are not treated equal, even Coinmarketcap knows this, and thus in addition to the main list, it has a "Currency" list and an "Assets" list. If you want to compare which technologies coins use, it is not meaningful to list actual working cryptocoin technologies together with tokens that rely on these. So when I wanted to compare "stake" technologies, should have used the "Currency" list in my post.

Coinmarketcap itself has good definitions of the two:

A Currency is a cryptocurrency that can operate independently.

An Asset (or Cryptoasset) is a currency or token that depends on a cryptocurrency as a platform to operate.

I can add that a "token" can usually be viewed as synonymous to the above defined "asset", and a "coin" can be both a currency or asset.

As you can understand, assets and currencies are quite different. Assets rely on currency technologies, so to speak, and are often just a promised (or not even that) future technology/coin that you are buying into. Somewhat similiar to buying shares in a startup stock company, thus the use of ICO (Initial Coin Offering), akin IPO (Initial Public Offering). EOS is a good example. It is attractive because the developers have a track history and have written an attractive white paper. However, they don't promise anything, in their instructions for buying EOS tokens, you are made aware of, among other things, that "EOS TOKENS MAY HAVE NO VALUE. YOU MAY LOSE ALL AMOUNTS PAID."

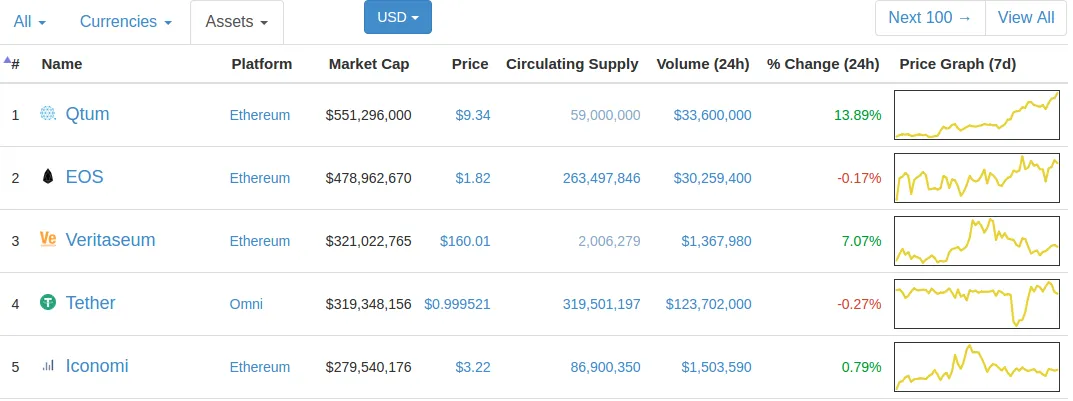

Screenshot from top 5 assets on Coinmarketcap.com. (2017-08-05)

Also, while cryptocurrencies are risky on their own, assets which have their own very substantial risks, are also subject to the risks of the currencies that they rely on. If Ethereum is hacked, then that could be to the detriment of EOS and many other assets that rely on it as well. At the same time, as so many tokens rely upon Ethereum that gives a very high importance to Ethereum as a currency platform.

So with this in mind, I'll limit myself to top ten of currencies and assets from Coinmarketcap:

Top 10 cryptocurrencies (2017-08-05)

- Bitcoin: PoW

- Ethereum: PoW (with plans to "migrate" to PoS)

- Ripple: Proof of Correctness

- Bitcoin Cash: PoW

- Litecoin: PoW

- NEM: Proof of Importance (PoI)

- Ethereum Classic: PoW

- Dash: PoW

- IOTA: PoW

- Monero: PoW

Top 10 assets and their platforms (2017-08-05)

- QTUM: Ethereum

- EOS: Ethereum

- Veritaseum: Ethereum

- Tether: Omni

- Iconomi: Ethereum

- OmiseGo: Ethereum

- Golem: Ethereum

- Gnosis: Ethereum

- Augur: Ethereum

When evaluating cryptocoins you might also want to have a look at Coingecko which also ranks based on liquidity, development activity, community, and public interest.

Conclusion

When looking at risks, investment opportunities, and trying to predict the future, don't forget that not all coins are made equal! Especially not currencies and tokens ;-)