Today, I received an important e-mail from an electricity company advising me that I owed them money. If you recall, I recently decided that in order to keep the bedroom warm on cold, wintry Australian nights, with kangaroos tapping at the glass; I would re-purpose one of the home computers into a crypto-heater.

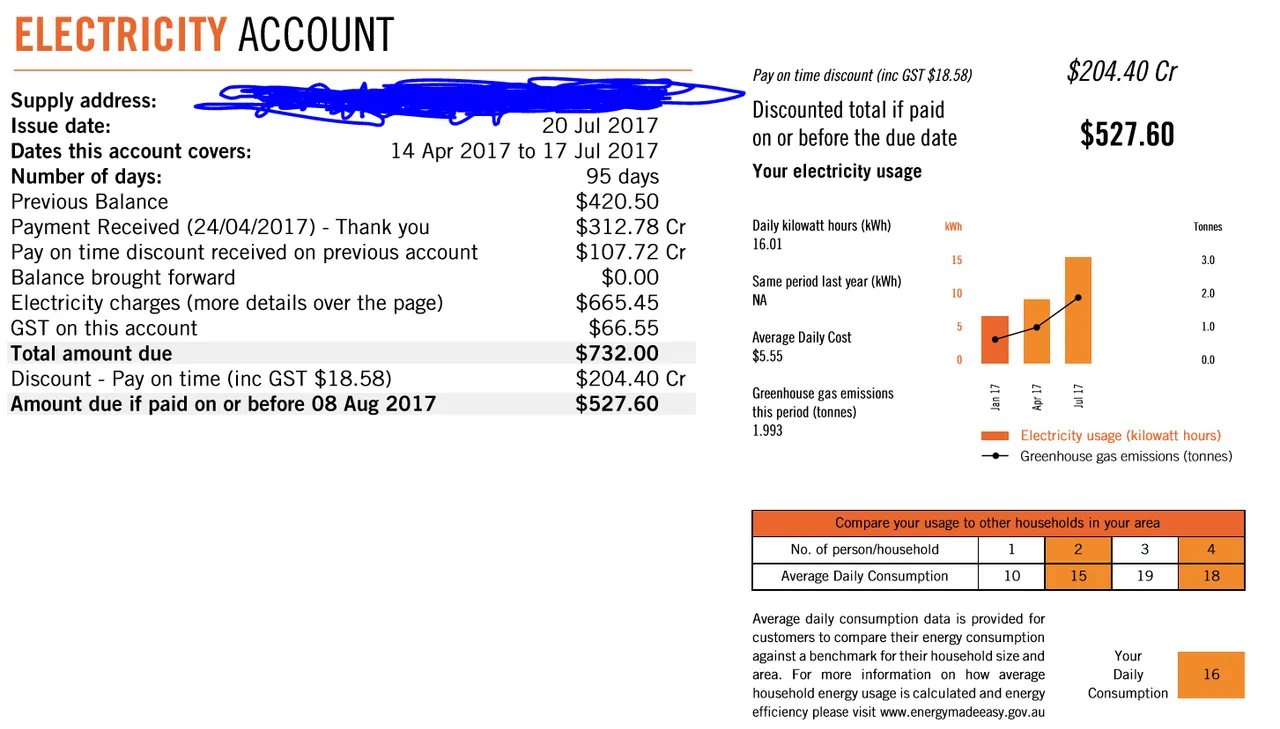

Here's the bill:

Miss holoz0r gets cold at night, you see. I have been steadily mining UBIQ on the bedroom system instead of paying for a worthless electronic heater to warm the bedroom to bearable levels.

My last electricity invoice required a payment of $312.78; and the invoice that I received today requires a payment of $527.60. That's a difference of $214.82; so, have I come out ahead?

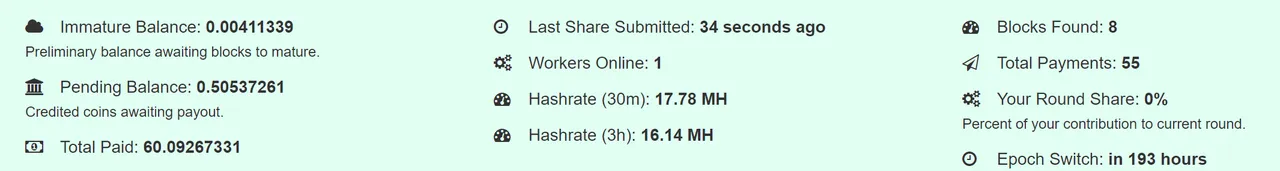

I have had two machines mining twenty four hours a day since the 23rd of June. Since then, I have accumulated 60.09 UBIQ tokens. At the current exchange rate, amid crypto-geddon, this is worth $81.12 Australian Dollars, in which my power is billed.

I have also had another machine mining in the living room, a lowly 1080TI with a dash of 980TI added in; this has been mining on nicehash, and the revenue from this has been funnelled into BTC directly, with which I have purchased a mixture of LTC and ETC.

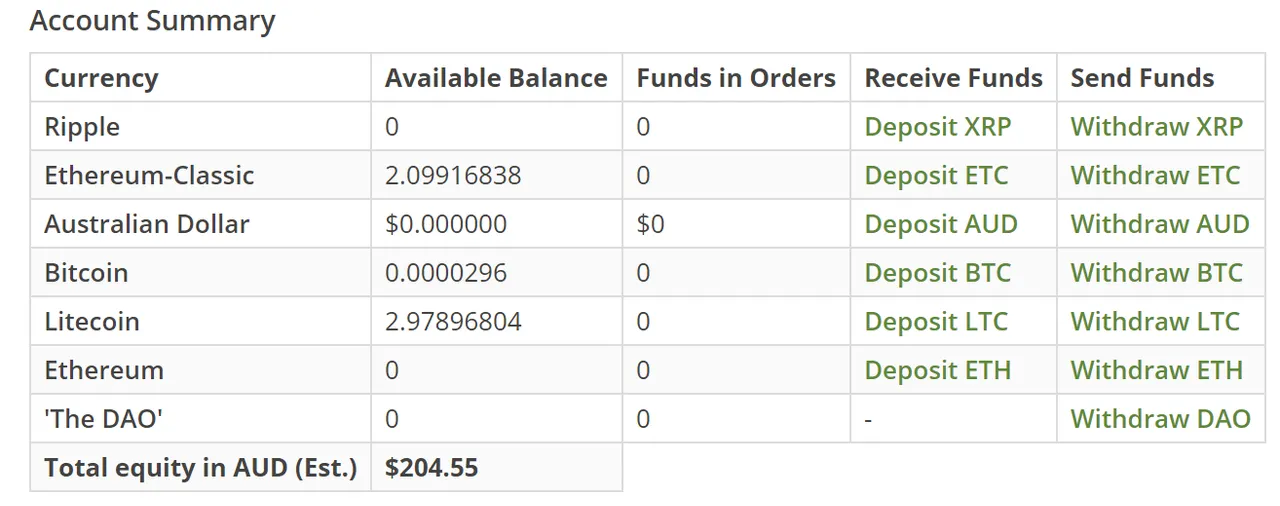

If I was to liquidate this crypto immediately, at current market rates (in Australian dollars) - I would obtain $204.55 AUD.

So, in the short time that I have been mining; I have made a profit of $70.85; after power costs, given that my other electricity usage was the same. The house has been warmer, and the crypto-mining heater has been a success. I'm going to continue.

But @holoz0r, doesn't South Australia have the most expensive power prices in the WORLD? Yes, yes it does; and it would be cheaper to mine else where, even with the downturn in cryptocurrency prices, I can still pull a profit. Even with the raw power prices, (I get a 32% discount on the rates below) - it is still profitable, just!

So stop making excuses and start supporting the networks of the cryptocurrencies you love.