Disclaimer: I am not a financial advisor and am merely presenting my opinion. Do your own research before investing into any ICO.

On a side note, if you agree with my thoughts on the prospects of this opportunity, please feel free to up-vote my post to help spread the word!

Overview

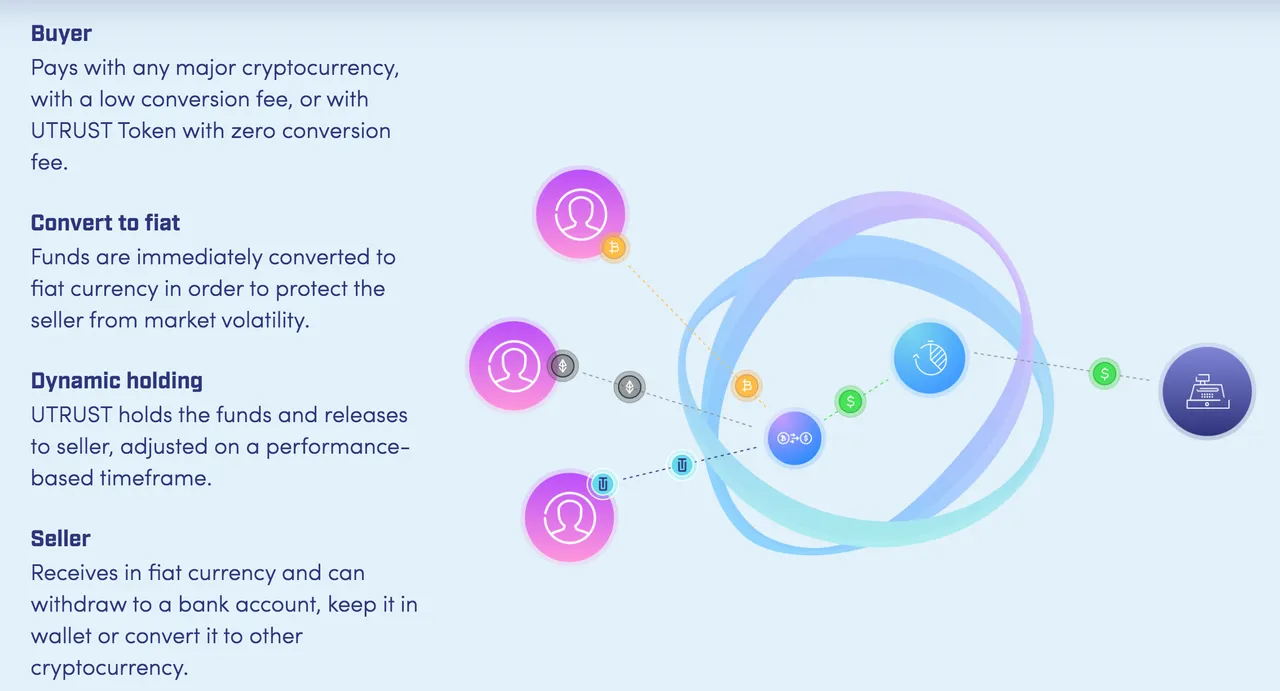

The concept behind UTRUST is fairly simple - a PayPal-type service that offers purchasers the ability to pay for products and services in crypto-currency with the seller receiving, in turn, the equivalent payment in fiat.

Those who have done any kind of dabbling in crypto-currency will be aware of their one major limitation - lack of mass adoption. When you purchase anything from an online retailer, you will be unlikely to find an option to pay in Bitcoin or Ether, for example. There is one very simple reason for that - price volatility. Why would any retailer want to sell anything to anyone on the back of a currency whose historical price chart looks like the graphical equivalent of a heart monitor attached to a patient on steroids?

UTRUST aims to address this question by providing a mechanism to tackle price volatility at the point of purchase - in other words, the seller provides his own prices in a stable currency - USD, say - and the UTRUST platform will perform the necessary hedging on the back-end to ensure a stable, corresponding quote in Bitcoin, say, that will persist over the course of the entire purchasing life-cycle.

Consumer Confidence is Key

The platform will also set out to provide other insurance mechanisms to inject confidence into crypto-currency transactions that consumers currently only enjoy in fiat-land - consumer protection and dispute resolution mechanisms being chief among these. On top of that, it plans to serve up an Amazon-type trust platform which will deliver transparency to consumers by exposing bad faith merchants through reputation scoring and the application of penalty fees for poor service and late (or non-) deliveries.

New merchants looking to be hosted on the platform can also expect to be subjected to longer holding periods by UTRUST until such time that they have built up a sufficiently high reputation score within their own client base.

Token Value

We seem, then, to have all the necessary ingredients in place for the beginnings of a promising product. The question now, however, at least for anyone who is considering participating in the ICO is - as always - the functional value of the UR token. Where can we expect the UTRUST token to derive its value from and how likely is it to take on that value? This is where things get really interesting in the context of the UTRUST project and where we found our interest piqued by the original UTRUST white-paper proposal.

UTRUST appear to have invested a lot of thought into a subject where, quite frankly, others jumping onto the ICO band-wagon - ICO project leaders and investors alike - have generally been falling down. As UTRUST themselves have pointed out within the paper, they consider the most important aspect of their project to be the ability "to mitigate the effects of earlier ICOs in which the tokens had a large demand on the first months, and then flattened, leaving the value at almost zero."

So how do they plan to do this exactly? Firstly, UTRUST will offer the consumer the ability to pay for products and services with their own token at a cost that slightly undercuts the cost of payment made with other crypto-currencies. That is a very clear incentive for consumers to convert their Bitcoin, LiteCoin, Ether or whatever else they may hold to the corresponding value in UTRUST token.

Secondly - and this is the clincher as far as we were concerned - should any customer wish nonetheless to continue with their slightly more expensive purchase through the use of any currency other than the UTRUST token, UTRUST will then undertake to go back to the UTRUST coin market with a fraction of their own proceeds from the customer transaction in order to purchase a soupçon of UTRUST token which will then simply be destroyed. In other words, they will be applying a mechanism that maintains demand for the UTRUST token in those cases where buyers choose to bypass it, whilst at the same time applying a built-in deflationary mechanism which should ensure that the token's value will rise over time.

Long Term Prospects

We are, of course, not saying - and never do - that the chances look good for this particular ICO. We do think, however, that UTRUST are ticking all the boxes here in terms of presenting attention to due diligence.

In our own minds, this puts the project up there with the relatively small number of ICOs out there proposing a long-term sustainable model. The question now comes to adoption. Can the team deliver a product of mass-appeal? And can they put the right kind of marketing in place to ensure that their message gets out there? According to their white-paper, they are aiming to raise $50 million USD. Even a cursory glance at their team's portfolio suggests that the money will be put to good use.

Summary

To summarise, our feeling is that, if they manage to raise the necessary funds, then that means there should be no issues in terms of allocating the kind of marketing budget needed to push the product. And if we can assume that the engineering aspects of the project are correctly handled, our risk assessment here then simply boils down to execution from the marketing side.

For more information on UTRUST visit its website.

Thanks for reading and don't forget to vote the article up if you enjoyed my contribution! You can also follow me for future ICO insights.