Is BitConnect Legitimate/Sustainable?

I started investing in Bitconnect about 4 months ago, and so far I have been paid based on their daily interest calculations (https://bitconnect.co/learning-center/bitconnect-bitcoin-price-volatility-software#).

The high paying interest rates make you think that the whole thing must be a BS. However, being in this extremely volatile environment of Bitcoin and cryptocurrencies makes you think twice.

Bitconnect (BCC) leverages on the price volatility of Bitcoin and based on the money you lend to BCC, supposedly "Bitconnect Trading Bot" buys/sells Bitcoin, and as a result makes profits on the BTC price differences.

To answer question above, I have implemented 1) A data analysis on BTC volatility and BCC rates, 2) A trading experiment.

- Bitconnect Payouts Graphed Against Bitcoin Volatility

- An Experiment: "Would you be able to make $1/day (on average) if I lend you $100 to trade in BTC through, let say, Coinbase?"

(I originally published this analysis on July 23th in Steemit)

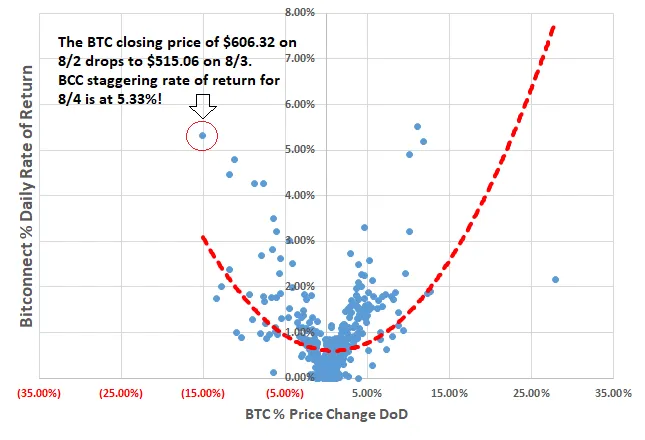

I did an analysis on the Bitconnect % rate of interest vs. Bitcoin price changes using 520 data points. As you can see in the chart below, the two have a parabolic behavior (the red trendline is fitted to the data using Excel "Trendeline Options"):

This implies that, the more Bitcoin gains or loses in price, the more money you make on your investment through Bitconnect. Therefore, in the case of Bitcoin price depreciation, you can think of Bitconnect as a hedging instrument.

The BCC rate of interest seems to correlate to Bitcoin price changes of the prior 2 days (e.g. today's rate of interest (July 23nd) depends on the price fluctuations between July 21st and 22nd).

Data period: 2016-03-12 to 2017-08-14

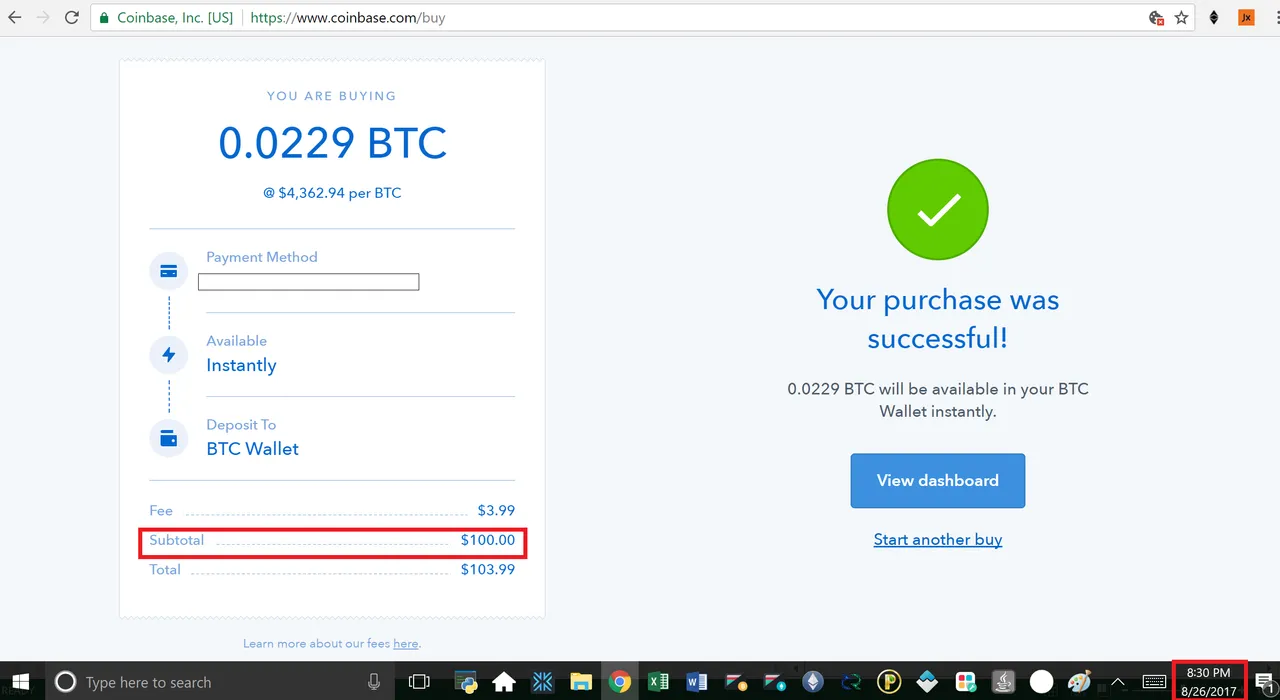

I recently conducted this experiment to see how plausible the BCC daily return is by buying $100 worth of BTC at 8:30PM on Aug. 26th, monitoring it for 24 hours and trying to sell as soon as I gain a profit of $1:

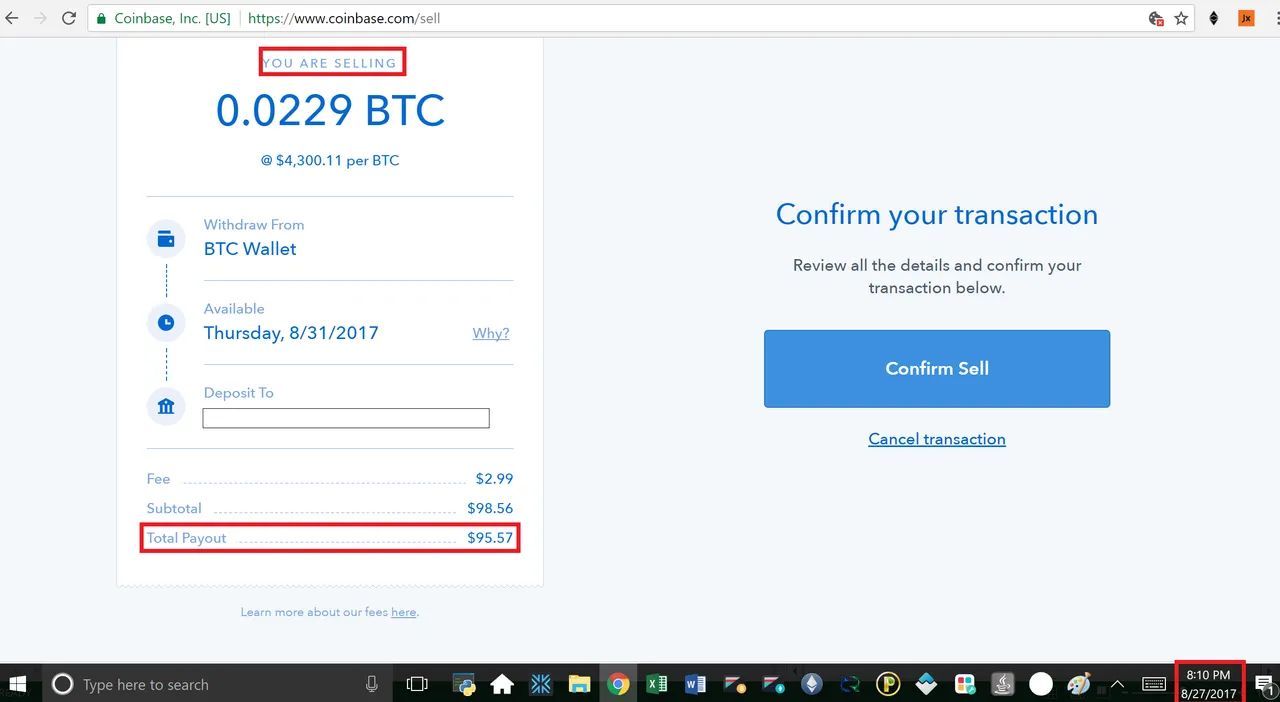

Also, to be conservative, I wanted to reach my goal of profiting $1, after all exchange fees are paid for. So in this case the selling price of 0.02292034 BTC should reach $107.98 so that it covers the buying fee of $3.99, selling fee of $2.99, PLUS $1 profit on top of them. I could already tell that I'm not able to make the $1, because BTC price movement was very limited during the 24-hour period (hovering around $4,340). "Total Payout" was hardly reaching even $100:

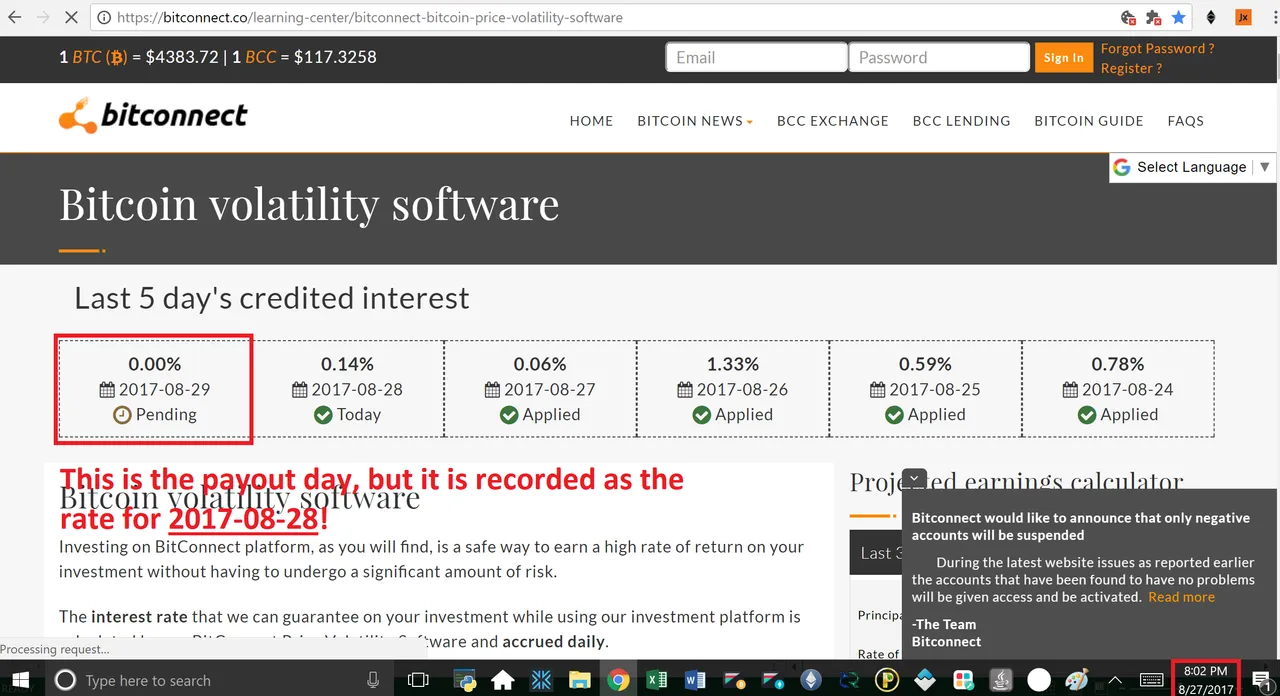

Interestingly, when I looked at Bitconnect % return for the same date (i.e. Aug. 28th), I was surprised to see that their rate of return had also turned out to be 0%:

Of course this is only one day, and it could be just a coincidence! It's not statistically significant to infer any solid conclusion. However, basing our reasoning on both (1) & (2) tells us that BCC high rate of returns cannot come only from their referral program, but BTC price volatility plays a strong role in driving BCC rates.

IMO, I believe BCC is sustainable as long as there exists wild volatility in BTC prices. You can also say that if BTC becomes less volatile over time, BCC can implement the same process for other volatile cryptocurrencies!

Still this question remains that how BCC makes money when BTC prices drops. I believe they use some type of financial instruments such as exotic swaps to achieve these returns.

From the google Legitimate is defined as "conforming to the law or to rules". Do you think Bitconnect is conforming to the law & rules?!

Sources:

https://bitconnect.co/learning-center/bitconnect-bitcoin-price-volatility-software

https://coinmarketcap.com/currencies/bitcoin/historical-data/

https://www.coinbase.com

User: lexiconical