Reading through posts and news articles, I find it somewhat peculiar that most of us in the space tend to compare the perceived cryptocurrency bubble to the dot com bubble. There's certainly no doubt about the presence of excessive speculation. These two so-called bubbles are related to the world-wide web after all, tapping into the global collective. There's a great difference between these old world and new world organisations, but nevertheless, I think we can learn from those that survived the dot com bubble.

Looking back, the dot com bubble came about in a time when traditional companies were as closed and as rigid as they can be. These aren't open, decentralised organisations at all - which simply means that any outcome is largely in the work of its limited set of owners. Open communities like the ones found in Bitcoin, Ethereum, and Steem are made up of large, active communities that contribute to the betterment of their platforms on a daily basis.

On hindsight, capital markets back then also weren't all that fluid and connected to its true global potential at all. Speculating and investing just weren't very convenient activities. Today, anyone can pretty much buy and sell any of these tokens or cryptocurrencies in simple peer-to-peer fashion, spreading support, co-ownership, and mindshare. Over time, there will be less chances for any concentrated groups of people acting as a point-of-failure, especially when it comes to market under-performance.

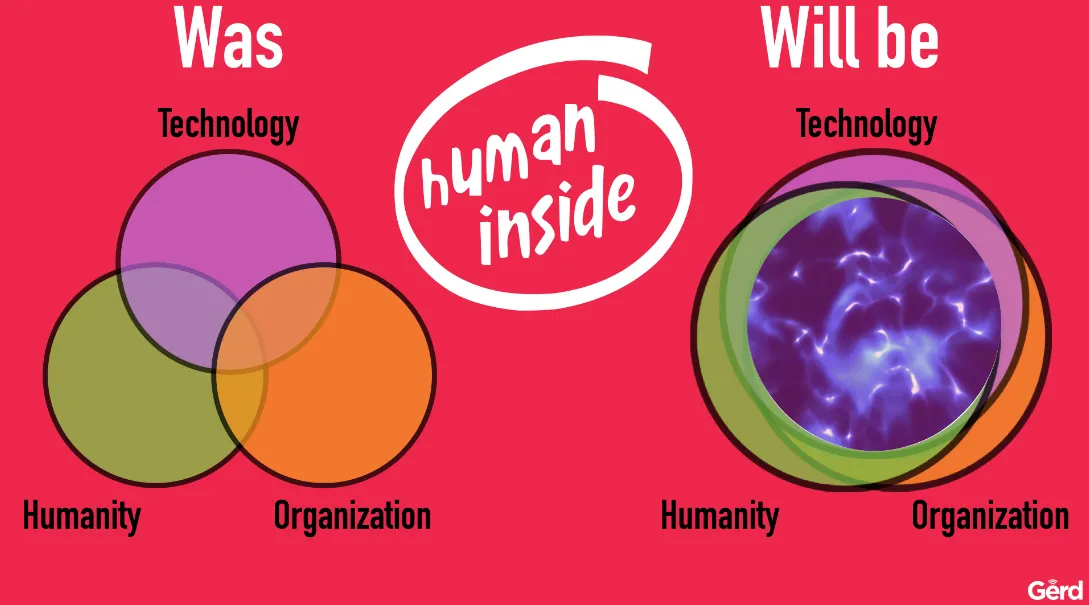

As technologically-charged as it sounds, dot com companies during that ~1995-2001 bubble had very little to do with any intersections between technology, humanity, and organisation. Naturally, companies that survived the dot com bubble all exhibited similar characteristics of being some kind of platform, such as eBay and Amazon. So now, think about what happens when anyone can become co-owners in similar platforms that survived and thrived through the dot com bubble?

Choose cryptocurrencies that have:-

- A massively growing decentralised community.

- Been in the game for more than a year.

- Core use cases.

- Diversifies itself into diversity.

- Eco-friendly architecture.

- Flash-fast transactions.

- Gamifications elements.

- Holocratic structure.

- Independence from big money interest.

- Jobs and gigs.

- @kevinwong as a user.

- Low-friction microtransactions.

- Memes and meet-ups.

- Newbie help channels.

- Original content.

- People from all walks of life.

- Quests and missions.

- Return-on-Community.

- Self-regulation as a common activity.

- Tinfoil tendencies.

- Underground music enthusiasts.

- Vocal and outspoken individuals.

- Whiners and winery operators.

- X-rated stuff just for the X of it.

- Youtubers!

- Zero transaction fees.