Hello dear and loyal readers, on this occasion I would like to share with all of you some interesting expert analysis and their perspectives on how the massive liquidations of short positions are laying the groundwork for new investors to prosper in the cryptocurrency market.

And certainly everything points to the fact that short position liquidations have eliminated speculators from the cryptocurrency market, considering that on-chain and exchange data now point to an improvement in the spot market and net exchange deposits.

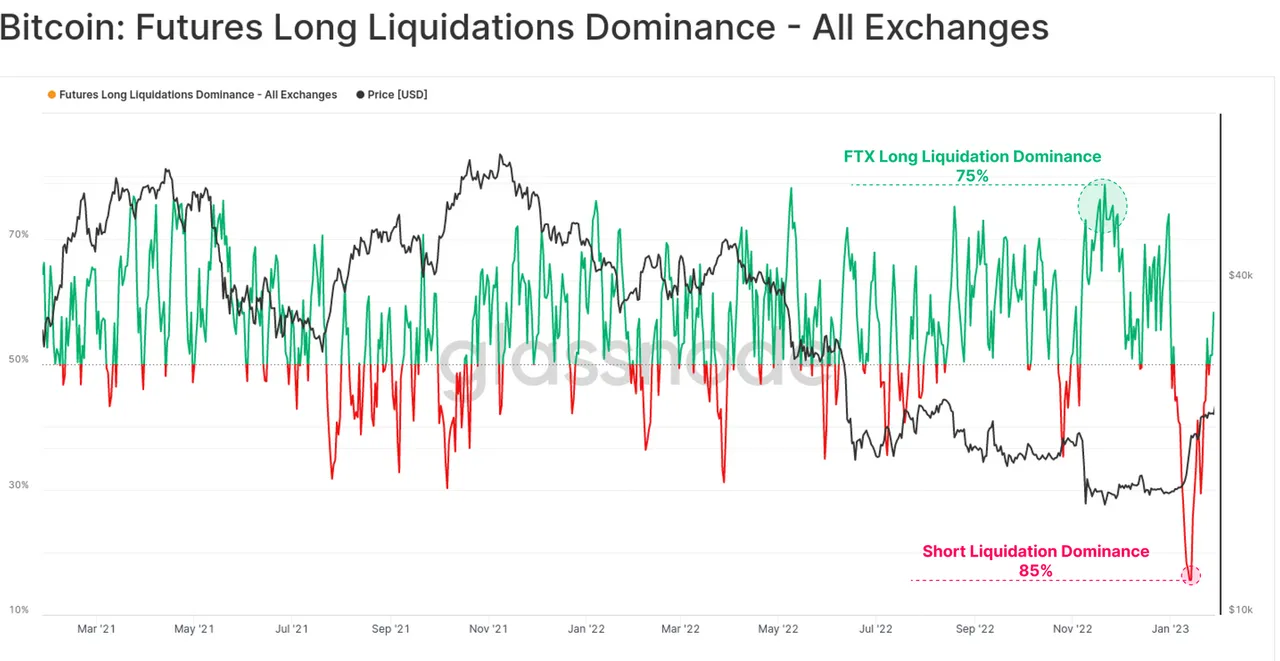

According to information published in Cointelegraph, two futures data usually maintain a balance between long and short positions, as when the market moves, investors tend to update their futures to avoid liquidations.

While these behaviors eliminated speculators and that in turn this somehow creates health in the cryptocurrency market, we must consider that the macroeconomic scenario affecting most economic and financial structures on a global scale including the crypto market.

In this sense, most likely the new macroeconomic episodes to be announced by the FED in the next hours what could trigger again destabilization in the price action.

I would like to know your appreciation on what has been discussed here.

SOURCES CONSULTED

Cointelegraph Bitcoin on-chain data and BTC’s recent price rally point to a healthier ecosystem. Link

OBSERVATION:

The cover image was designed by the author: @lupafilotaxia, incorporating the public domain image background: Cointelegraph