Many governments consider crypto-crypto trades tax events. As of May 29, the Finnish Tax Authority considers crypto-crypto exchanges tax events, too. That is potentially a big problem for users of future distributed applications that use multiple blockchains and cryptocurrencies. In particular, if cross-chain atomic swaps become very commonplace the swaps might happen mostly under the hood even without the knowledge of the app user. For example, an app might automatically work out the cheapest currency to use to pay for a service while holding balances of different cryptocurrenciess for different purposes. It would make a lot of sense to store different sums of different sizes in different cryptocurrencies owing to different trade-offs between security, transfer fees and speeds of different blockchains.

Cross chain atomic swaps explained

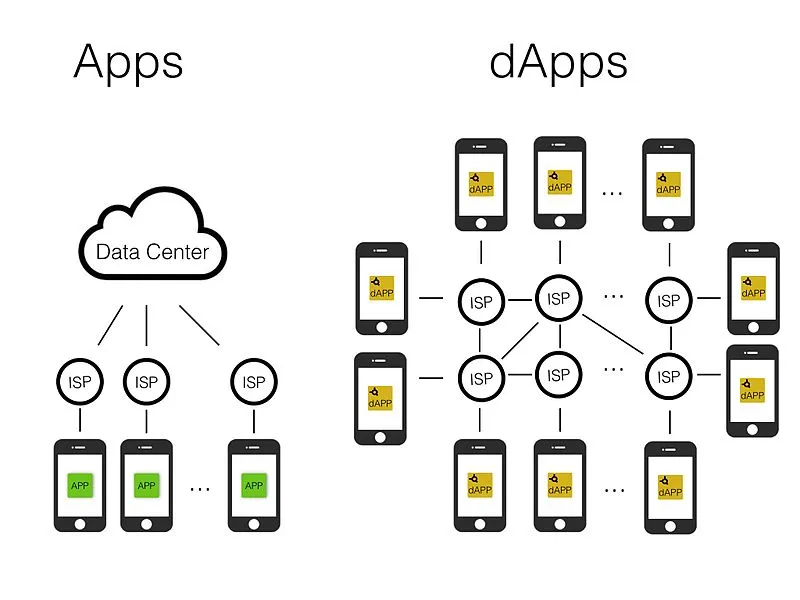

With considerable volatility of different cryptocurrencies, a DApp user might unwittingly profit considerably from a percentage of the swaps over time while losing a lot of money in other swaps. With the tax rules not allowing for deducing any losses from any gains in crypto trading, the user may be in for very steep tax liabilities over the course of an entire year of using DApps. This may become a serious problem under the current rules. Not all apps can even be used anonymously.

This is why I think tax authorities should listen to a wide range of experts on the field before using their power to issue guidelines delegated to them by legislative bodies. The simple model of crypto taxation where only crypto-fiat or crypto-goods/services trades were tax events that Finland had until May 29 of this year was adequate despite some minor flaws. The current one may prove very harmful in hurting Finnish software companies who wish to develop DApps for the domestic market. I hope that the latest tax guidelines published by the Tax Authority will not be the final word.

Check out my post on the new tax guidelines on virtual currencies (in Finnish).