img src

Ironically enough, I'm participating of some sort of speculation just by making such assertion. Yes, without a doubt the indicators chart analyst talk about are hard numbers, they are not comparable to tea leaves if we are to be honest. But, I've also seen a chart completely betray common sense. "Was that not a bull flag?"

The important question here to me is quite different than "What Elliot wave are we on?" as I have little to no interest in that information these days. To me the focus should be one word, one ugly word: regulation.

As long as we don't know anything, and I do mean anything about how regulation laws are going to play a role in the near future, we might not see the big players, and I do mean big, come out from hiding.

Perspective

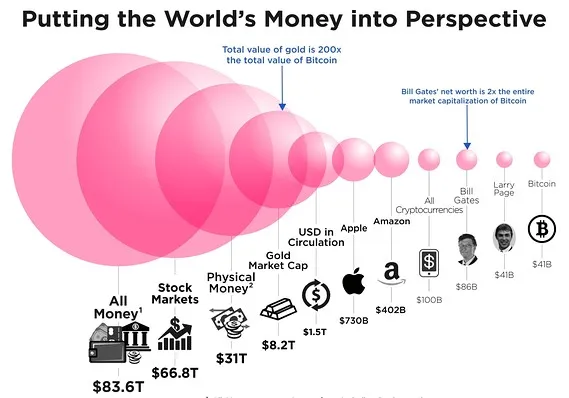

This is also not new knowledge, or at least it's not new to those of us who are curious enough to dig a little deeper into how the economy works. Cryptocurrencies in all, for all their grandiose might, sheer volume, technological advancements, are still a tiny and I do mean tiny portion of the money of the world.

This is relevant to know, because we think at times, wrongfully so, that we have big money in crypto, but we certainly don't. Yes, there are whales, yes there are accounts holding massive amounts of tokens, but they are pennies and I do mean pennies in comparison to the money that is out there so to speak.

Not really mass adoption

I'm not talking about everyone using BTC, or any altcoin to buy their groceries with, I think that time will come, but we are still far from it. What I'm talking about is a somewhat "safe" ecosystem for the giant players to feel comfortable enough to take big bites of the pie.

More financial products are needed, and I'm not only referring to ETFs (Exchange Traded Funds) which is what everyone seems to be focusing on at the moment. To me something that has to exist, something that cannot be missing from the picture is a true pegged asset. An asset that can hold, legally, the 1 to 1 with the strongest currency in the world, the US dollar.

As I typed that last line I'm aware I've just offended the purists among us, but truth be told none of them would complain if the market skyrocketed in valuation as much as they might say otherwise. However for this to happen, laws and regulations need to be clear.

The currency cycles

The crazy bull runs followed by excruciating bear markets in my view are nothing but a small number of players manipulating everything. In other words, the market's volatility is so intense, so wild, because there are little to no traditional investors participating of the markets, they are almost made up entirely of speculators.

Am I saying the bull runs are over? Of course not, quite the opposite, but what I am saying is that when the next one comes, and it will, it will be followed by another painful bear cycle sure to shake off all the naive minds who entered the space screaming "moon" to the winds.

So how do we moon?

Short term, we are probably close to it again. Long term, regulation and law clarity. As much as that might anger early adopters, I don't see any other way it could happen, but I'm open to being wrong. After all, I was one of those who did not understand why cryptocurrencies were valuable and here I am contradicting myself a few years later.

let me ask you, What's your position on regulation?