Which cryptocurrency tax calculator is right for you? I compare features, pricing, discounts and more...

If you are debating on whether or not to report your earnings for 2017 cryptocurrency investments, you may want to go ahead and bite the bullet. I know it isn’t pleasant, but it is necessary if you don’t want to get some hefty fines in the future. It is obvious a large chunk of investors are neglecting to report these earnings if you look at some simple statistics: Coinbase reported over 10 million accounts served, yet only a fraction of those individuals report their earnings. That is a big discrepancy, and you can be sure the government is going to find a way to ensure these earnings are reported in the future. Does that mean that Americans will be fined for not reporting in past tax years? Maybe, maybe not. But the longer you wait, the bigger your risk of being fined…or worse. FYI: A court case in 2017 required Coinbase to report accounts that bought, sold, sent or received over $20,000 in a year from 2013-2015. So the precedent has already been set. If your crypto investing is anything like mine, a single trade on my end is usually broken up into something like 10 transactions, each having its own price. Unless you want to look up the price for each and every one of those transactions for your tax reporting (and let’s face it, I don’t), then you need some type of tool that can do it for you. I did the work manually for 2016, but I am not going through that nightmare again. My research into these tools uncovered these websites: Bitcoin.tax and Cointracking.info. I could not find any information comparing the price and features of these tools, which is why I wrote this article. I’m hoping it can help you, too.

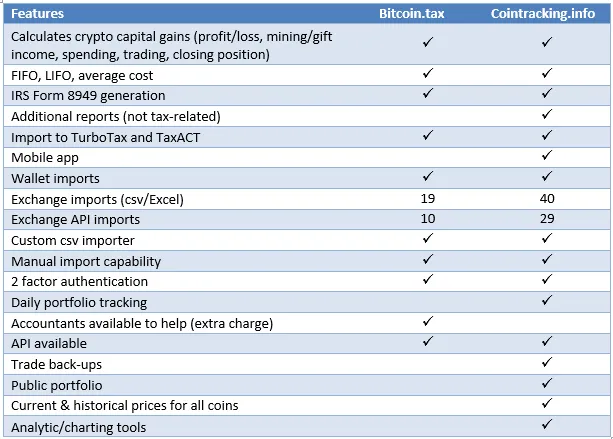

Features

Clearly both sites have an abundance of features for its users. After my research into both, I determined Cointracking.info was right for me and purchased an account. In using the tool, I discovered several airdrop coins (like OMG, VIU, XNN and DATA) in my portfolio that I did not know I owned. And let’s face it, who doesn’t like free money? In full disclosure, Bitcoin.tax may have revealed these airdrop coins to me as well, I cannot say either way. Another useful ability I found using Cointracking.info is the user friendliness when dealing with manual entries. As the chart above shows, both sites offer wallet imports. Cointracking.info supports way more wallet types than Bitcoin.tax; but, neither support the Ledger S. I had to manually add the entries for that one. Cointracking.info made this task much easier than it would otherwise have been. As I manually added coins for this wallet, Cointracking.info would automatically pull in the price of the coin for the date I specified. Cointracking.info had current and historical pricing data for every coin I had in my portfolio, which included several alt-coins. Bitcoin.tax appears to requires you to input the pricing data, which means a lot of additional work for the user. Also in Cointracking.info, I was able to edit/clone/delete rows in bulk as well. Bitcoin.tax allows for bulk delete only. I did encountered difficulty when using Cointracking.info’s manual csv import, though. The Poloniex API has a cap on the number of records for the lending portion (which I exceeded), so I had to use the manual csv import. The csv file contained a comma at the end of each row. While the commas were present, the tool continually gave me an error, but was not descriptive in what the problem was. I had to play with the formatting for awhile before I uncovered the solution was to remove those trailing commas.

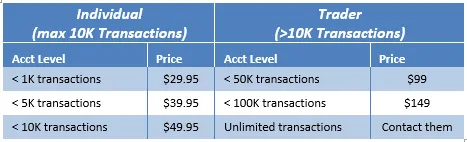

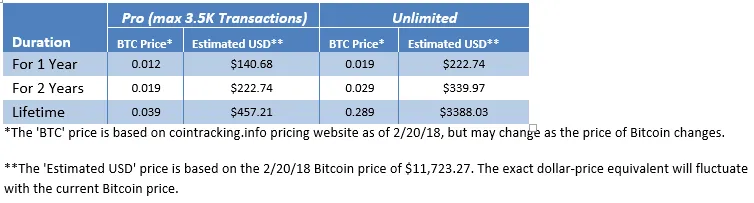

Pricing

Both sites have various account plans you can purchase, depending on how many crypto transactions you plan to import. They both also offer a free account, with limited features and a limited number of transactions. It is important to note that neither free version allows you to generate capital gains tax reporting forms. If that is your goal, one of the paid-for versions is required. The pricing page for Bitcoin.tax accounts is only available to those who have signed up for a free account. I have listed the information down below, but am unable to provide a working link for your reference. On the other hand, the pricing page for Cointracking.info can be found here. Note: When purchasing an account through Bitcoin.tax, you are paying for use of their site for a specific tax year. When purchasing an account through Cointracker.info, however, you are paying for use of their site for a specified amount of time. Thus, in theory you could purchase a 1 year plan in February or March 2018 and use the site for both 2017 taxes and again for 2018 taxes.

Bitcoin.tax

Discounts

I tried to find discounts online for Bitcoin.tax, but was unsuccessful; however, it is already much cheaper than Cointracking.info, so that is a plus. You can purchase a Bitcoin.tax plan using this link.

Cointracking.info

Discounts

You get a 10% discount if you purchase a Cointracking.info plan using this link (and I also receive a bonus for referring you). You get an additional 5% discount if you pay for your plan using Bitcoin.

Summary

The bottom line is that you really ought to report your crypto gains/losses, and both of these sites will save you time doing that. Which one you use depends on your individual needs. If your main concern is the cost, Bitcoin.tax is much cheaper. If you have a lot of alt-coins or use an advanced portfolio tracker, you probably want to go with Cointracking.info for its extra features. As I said, I purchased a Cointracking.info account and was able to successfully submit my tax reports, but my friend purchased a Bitcoin.tax account and was also successful in submitting his tax reports for the year. I hope you were able to take away something useful from this post. If you have personal experience with either of these sites, please feel free to leave a comment to help our readers. If you choose to purchase a plan via Bitcoin.tax or Cointracking.info, please use my affiliated links provided in this article. This article was written for informational purposes only. It does not represent financial, tax or legal advice, and is not intended to be used by anyone for those purposes. I am not a financial advisor or accountant – please consult a professional before taking action.