Hey my Steem friends, looking at some strange new crypto-coin and wondering if you should buy in? Well Old Neoxian is going to help you out. Here are my guidelines for judging whether a new coin is an actual crypto-currency that's worth buying.

I just want to note that these guidelines are not all necessarily 100% rules, but strong indicators. If the coin is breaking one of the rules here, be sure that you have some compelling reason for buying it anyway. As always, invest with caution and do your own research.

1) It should have a white paper. The paper should make sense, and it should talk about the basics of the coin.

If the coin doesn't even have a whitepaper at all, then the chances are excellent that it is crap.

The whitepaper should talk about the basics of the coin: things like the consensus mechanism, total number of coins, inflation rate, block times, transaction fees.

The consensus mechanism is usually proof of work, proof of stake, or DPos, or some combination thereof. If is it something different, then try to take some extra time to understand it.

If the whitepaper just talks about feel-good, pie-in-the-key, unicorns farting rainbows good things, and doesn't mention any of nuts and bolts of the coin, well, that's a very bad sign.

2) The coin must actually be decentralized!

See above, the whitepaper should describe the consensus mechanism. If it doesn't have a proper consensus mechanism, then the coin isn't decentralized and isn't really crypto-currency.

3) The coin should have a local wallet you can use on your computer.

When investigating a new coin, you should find the local wallet for the coin, download it, purchase a small amount of the coin, and play around with it.

If the coin doesn't have a local wallet, that's a red flag. A web wallet might be ok, but you have to make sure that it is using Javascript (or whatever) to generate and encrypt a key locally.

It should be possible to use the wallet and coin without having to give your personal information to anyone.

If there is a hardware wallet available, that's also a plus.

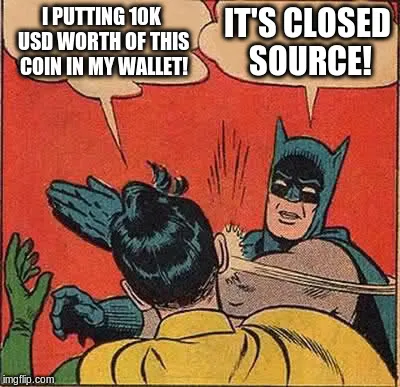

4) The coin absolutely must be open source!

This is a really important one. I would say this is the one rule you cannot break. The coin needs to be an open source coin. This means that you should be able to find (and compile if you want to) the source code for both the wallet and the consensus nodes (servers). Usually the code would be found on Github, or something like it.

Bonus points if it runs on Linux.

You can't trust a currency that is closed source, god knows what might be happening under the hood. I'm not going to buy 10K usd worth of a coin and put it into a closed source system. Madness! Madness I tell you.

(meme generated with https://imgflip.com)

Batman knows better.

5) If the coin promises an insanely good interest rate, then it's likely to be a scam.

Yep I'm talking about Bitconnect or things like it. If the coin promises 25% + APR, or like 1% interest per day, with something that requires almost no work (such as a loan platform) then yea, it's almost certainly a scam, and should be avoided.

Also, if there is a pyramid scheme attached, where you have to sign up people under you to make more money, that's also a hint to stay far way.

Invest carefully

Again, if you are breaking a rule from above, be sure you know why, or at least know that you are taking more risk. I'm sure some amazing coins will emerge in the future, but so will tons of crap ones. Hopefully this guide will help you tell which is which.