Haejinality vs. Reality (XVG Review)

In continuing the series I started here:

-

https://steemit.com/cryptocurrency/@pawsdog/haejinality-vs-reality-rdd-review

Based on the idea by @just2random whom did some excellent coverage on the previous BTC calls of @haejin here:

-

https://steemit.com/crypto/@just2random/14-days-of-haejin-20-20-hindsight-btc-results-from-1st-14th-jan-2018

I am now reviewing the XVG calls made by @haejin for accuracy

In all fairness I will start at the oldest first and work from there.

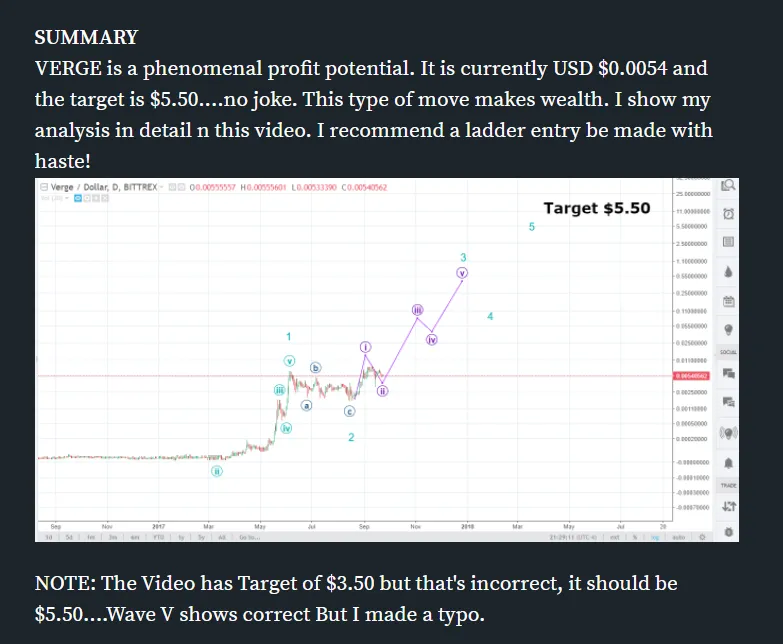

On September 2nd 2017 XVG was .0055 cents, @Haejin Called XVG to be $5.50 cents by October of 2018.

Same Chart enlarged for Clarity

-

https://steemit.com/bitcoin/@haejin/verge-xvg-update-target-usd5-50-measured-using-elliott-waves-and-chart-pattern-recognition

As we have yet to reach that date, I cannot say whether his ultimate target will or will not be correct. I can only judge the shorter range targets he set in his analysis.

Haejenality: XVG would be 60 cents at the end of December

Reality: XVG peaked at .24 cents before taking a nose dive below .04 cents and currently sits around .06 cents.

Other factors: BTC was trading around $4400 at the time and this call was made during the beginning of the China ICO Ban BTC crash; over the next two weeks BTC dropped to $2980 USD. Before recovering and going on an almost 700% run to reach nearly $20,000 in a massive Bull market.

Opinion:Objectively looking at it I believe the increase in XVG price was the inevitable result of the Bull Market. So yes, the call made by @haejin on XVG during the exceptional BTC bull market would have been profitable as a result of the greater bull market

And then the BEAR comes to town.

On January 8th XVG was .18 Cents and @haijin called XVG to hit .65 by January 29th and go onto hit 1.70 according to his chart diagram and wave overlay.

Haejenality: XVG to hit .65 before January 29th according to his chart diagram and wave overlay.

Reality: Overlay shows the next highest XVG close was .1924 cents the following day before diving to an all time low of 3.2 cents on February 2nd 2018; currently holding around .06 cents.

Other factors: The day prior to this call BTC closed at $16,215 having just shed 10% the day prior, the day of this call BTC would shed another 16% to a low of $13,700, closing the day with a 9% loss at $14,900. This extremely bullish call on XVG was made in a very obvious downtrend in BTC prices.

Opinion: Can’t hit the curve, nonsensical call for higher highs on an ALT coin going against the greater trend of the crypto market. Had you of purchased on his January 7th recommendation at .18 cents, you would be sitting on a 76% loss. BTC lost roughly 47% during the same time frame. Ergo HODLING BTC in a confirmed BEAR Market would of been a better idea, than purchasing the buy call made by @haejin.

We shall See