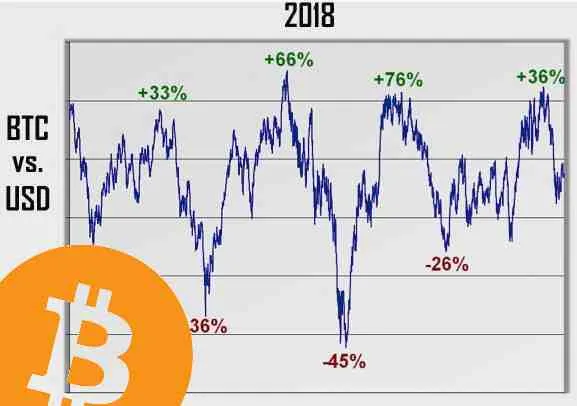

| If you read my article on Market Volatility or watched bitcoin do its up and down on every Coin in the last 2 months |

|

There is another solution.....And its pretty simple... And I'll explain. And I gave this solution to my friends and family when they asked it I would help them with investing to start....

But first, a disclaimer: I am not a licensed investment advisor, an economist or Journalist. These are just personal observations and thoughts, Essentially I am a pundit and have taken positions in some of the things I talk about...

Just a little background while I am no where near an expert in the cryptocurrency world,

I think my background helps me a just a smidgen.

I have worked programming for & consulting to Thomson Financial Systems, CS First Boston, Chase, Morgan Stanley, Software Options, a Fund taken over by Price Waterhouse and Independent Investors and served as an expert witness in two cases.

Specifically working on: Trading Systems, Portfolio Management, Order Routing Systems, Position tracking software, Analysis Case Tool, Risk Analysis software, and Arbitrage systems.

And presently I provide services as a business operations consultant. A position which includes me protecting clients by reading seeing and handling trends.

I am presenting my observations here, you must first decide if they make sense to you and if you can use it in someway.

But You must do your own analysis, findings and go do your own investment, this is just part of the information I use to make my portfolio decisions.

Full disclosure I have an investment in this....

But whether you invest in it or not will not be affected by me telling it to you or not.

And more importantly me telling you that your investing or not will make no difference in my positions net worth.

Le's start with some background....

Mutual Funds came into use because people who want to leverage markets/industries,

but do not have the time to trade OR

but do not have the time to trade OR

|

know that they are not experts and/or can't pick winners & losers |  |

A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities. Mutual funds have advantages and disadvantages compared to direct investing in individual instruments-. The primary advantages of mutual funds are that they provide economies of scale, a higher level of diversification, they provide liquidity, and they are managed by professional investors.

Thats fine and good when you are dealing with an stocks, bonds, and the commodities markets, because and small investment houses have been around for years. And you can go pick the best funds from the good investment houses from the yearly forbes list or the wall street journal any day.

So then it becomes the issue of picking the professional investor.....

But we all know that the CryptoCurrency Market does not have investment advisors to the common man today because its still growing and its more then just a stock.

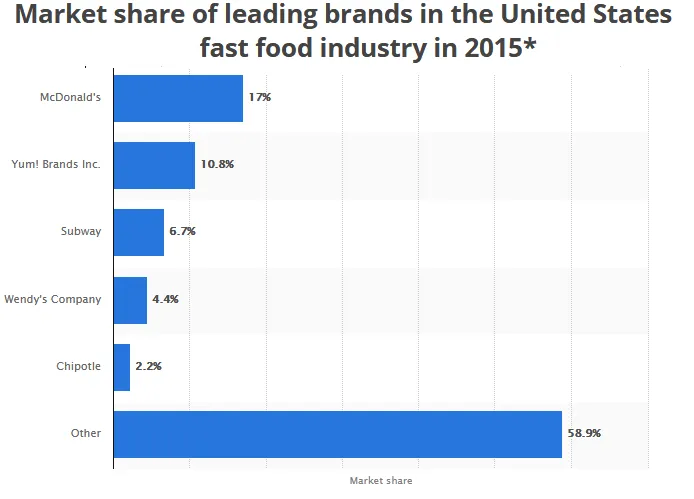

Lets take a look at two industries, American fast food Restaurants and Car Manufacturers Worldwide.

Specifically let's check out the Market Caps.

Note the Top 7 in both cases have over 40% of the industry in both cases ... And in these two cases they are actual close to 50%.

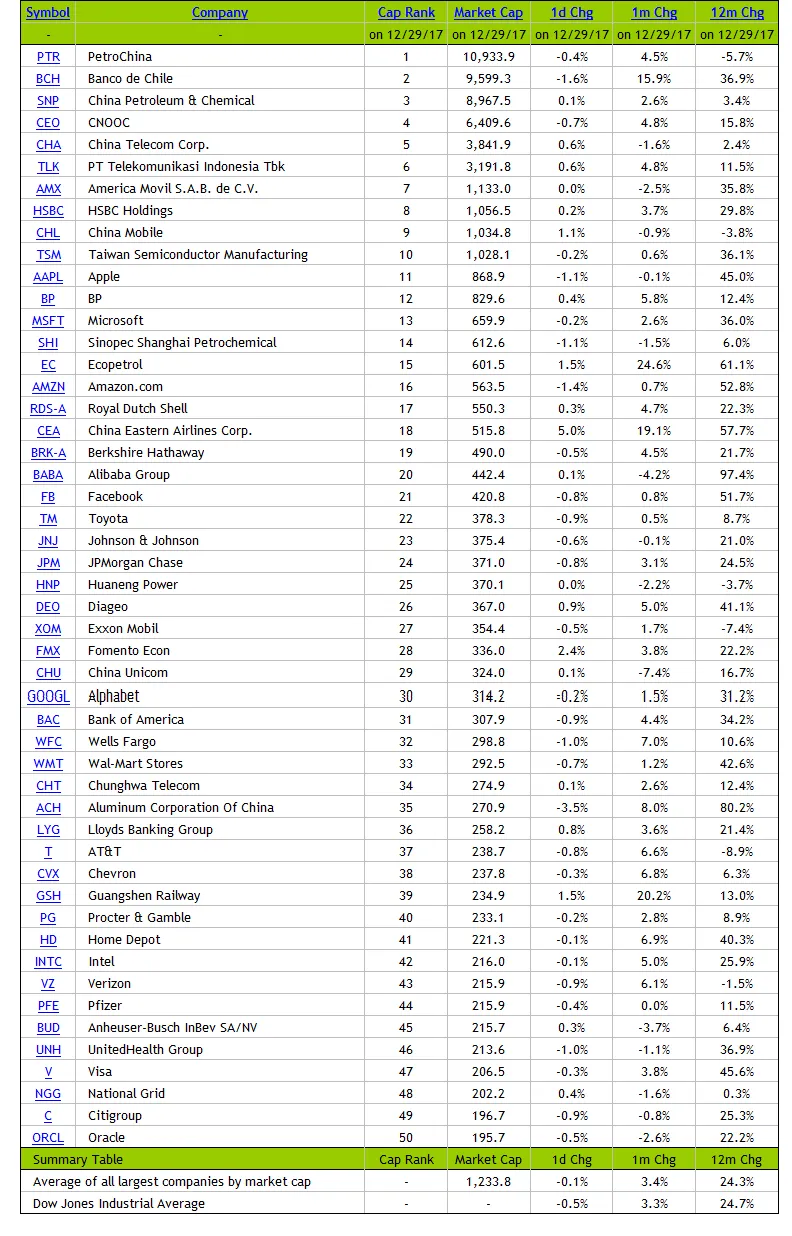

If we look at the 50 largest publicly owned companies based in the World we see that the Top 5 have more than 50% of the market cap.

The Dow Jones Index is made up of the top 30 companies by Market Cap on the Dow Exchange....

Dow Jones Industrial Average Market index

from Wikipedia - The Dow Jones Industrial Average, or simply the Dow, is a stock market index that shows how 30 large publicly owned companies based in the United States have traded during a standard trading session in the stock market.

If you tracked the Dow over the last 10 years you would have seen this:

are more than 40% of the Industry. If they go up or down the Industry goes up or down and as a whole if the Industry goes up they go up they follow. Essentially they correlate and control the industry... After all they are a major portion of it acting in concert.

As a rule: In every established industry/market and the largest 10% usually has at least 40% of the market.

That means if you have a piece of the of each of the top 10% in the proportion they have in market cap to the industry... As the industry grows or falls your investment will move with the industry/market.

That's why Index Mutual Funds have always out performed the markets they are in as a whole, because the top performers are in the index.

The other thing about index funds is it is not about the fund manager or investment house. Its about how they decided on the rules of the fund. There are strict formulas for what positions are kept and all trades to perform. This is to keep its assets aligned with that of percentages of the top performers !

After all the top 20 in any industry can have a few change places over time and some completely fall out of the list.

So a safe investment if you think and industry has a future but you don't know how to follow it is to buy into an Market Cap Index Fund.

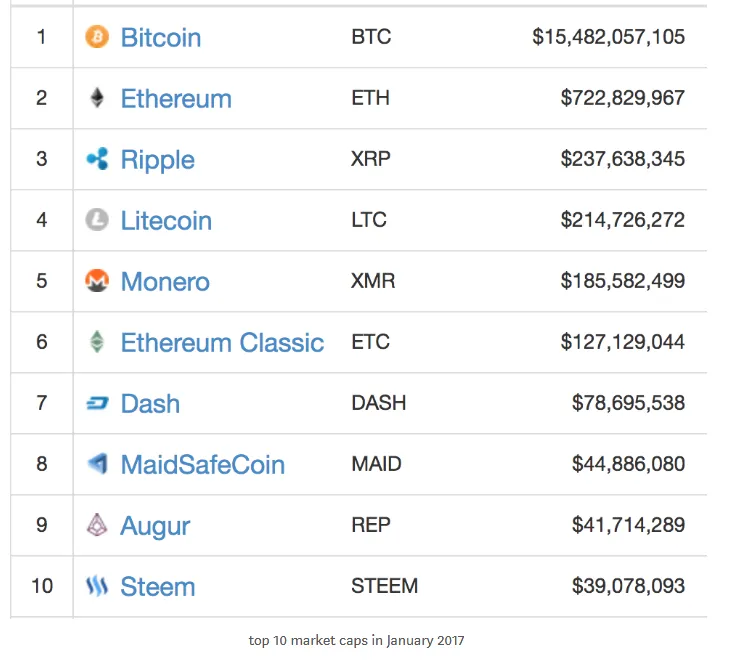

Here's the top 10 in january 2017

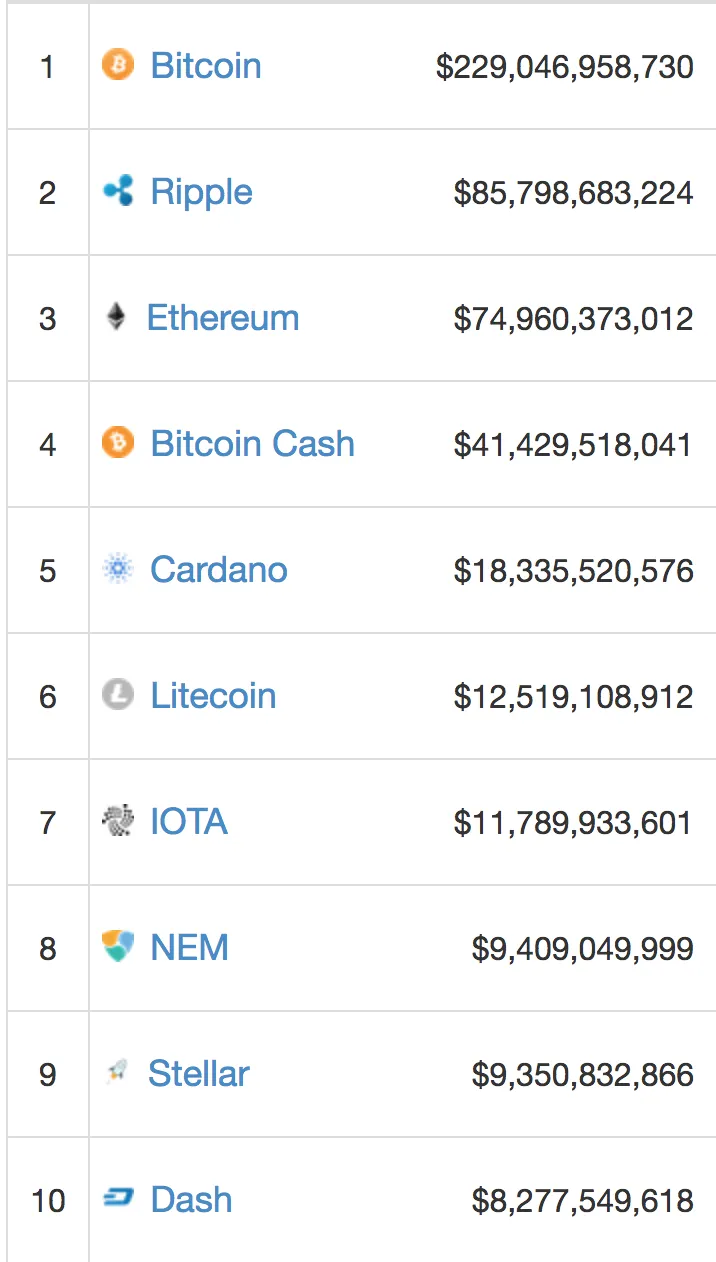

And here's what it is today a year later:

So I think its obvious had there been an index fund on the top 20 coins this past year you would have done well.

The fund would have dropped Augar and picked up Stella and done the adjustments with the other Coins....Gone up and down but essentially you would have had some very nice profits.

And if you believe like me that blockchain is here for the future and the best coins/tokens will be increasing value over time...A index fund for it might be a great thing to invest in!

Whoa stop listen to this right now......

I'm broadcasting this out right now........

I'm broadcasting this out right now........

Busting open the best kept secret in cryptocurrency!

| IT TURNS OUT THERE IS AN INDEX AND IT'S ATTACHED TO A COIN SO NO NEED TO GO TO AN INVESTMENT HOUSE!!!! |  |

| The First Tokenized Crypto Index Fund is: Crypto20 |

Directly from the fact sheet:

"CRYPTO20 aims to track the cryptocurrency market index. ...

an autonomously operated, tokenized cryptocurrency portfolio ...

that trades with an index strategy.

The entirety of the ICO funds where used to buy the underlying cryptocurrency assets.

C20 tokens are directly tied to the underlying assets with a novel liquidation option that can be exercised via the smart contract."

So at anytime you can liquidate the coins on the crypto20 site and get the underlying currency....

Wow !!!!!

This means that if the price of the coin ever dropped below the coins that make it up, you can sell it back to them and receive the underlying coins.... So essentially the price of the coin will never fall below its true value! because people would not sell them on an exchange in that case because they would just sell them back for more money!

A little more background from there Fact sheet:

"CRYPTO20 offers instant diversification to the top 20 cryptocurrency assets by holding a single token. The tokens are tradable on exchanges. Post-ICO, no further tokens will be issued after the ICO. CRYPTO20 is a hybrid market-cap weighted portfolio trading with an index strategy that is comprised of the top 20 cryptocurrencies by market capitalization, with weekly re-balancing. Assets are capped at a maximum weighting of 10% - this prevents any asset from dominating the portfolio,

Whether it be bitcoin now or another cryptocurrency in the future. Index funds have consistently beaten the average managed fund since their inception and CRYPTO20 is analogous to such funds. CRYPTO20 has a combination of parameters that ensure it has broad market exposure and acceptable turnover without allowing a single asset,

and thus single source of risk, to dominate. Index hyperparameters for the portfolio were carefully determined via a structured data science approach. More detailed information is available in their white paper."

Here's the link to the siteCrypto20.com

And it is presently trading on:

This only the first (I'm coining the term) cryptoindex(tm) ....But I am sure there are going to many many more!

So if your sure a sector or technology solution in the cryptocurrency market will be rising, very shortly in the future you need not invest in a specific coin and worry about getting flim flamed because CryptoIndex Coins will be coming....

| As a final disclaimer I do have an account on HitBtc and 2.5% of my small portfolio is in C20. |