The world of cryptocurrency offers exciting avenues to grow your wealth, and it often boils down to two main approaches: active or passive income. Understanding the difference is key to finding what suits you best.

Active Crypto Income: The Daily Grind

Active crypto income involves directly participating in market activities, often requiring significant time, effort, and skill. Think of it like a job where your daily actions directly influence your earnings. The video you watched showcases a prime example of an active strategy: day trading.

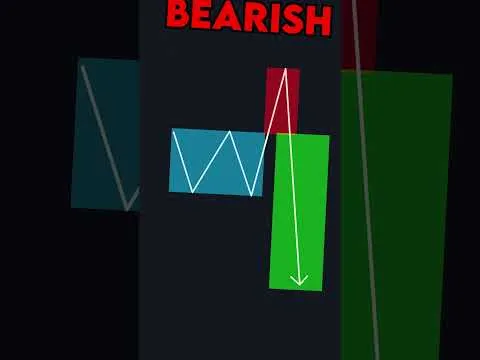

In day trading, you aim to profit from short-term price movements. The video suggests looking for specific market patterns around 10 AM EST, such as "accumulation" (where big players are gathering assets) followed by "manipulation" (a quick price dip or pump designed to catch other traders off guard), and then identifying a "fair value gap" – an area where the price recently jumped quickly, often revisited before a bigger move. The idea is to enter a trade at this precise moment, anticipating a profitable bounce. This strategy demands constant attention, quick decision-making, and a deep understanding of technical charts. It's a high-risk, high-reward game, where potential significant gains come with the possibility of substantial losses.

Pros of Active Trading:

- High Potential Returns: If you’re skilled and make the right calls, daily profits can be very substantial.

- Control: You are directly in charge of your trades and can react to market changes.

Cons of Active Trading:

- Time-Consuming: Requires hours of screen time, research, and analysis daily.

- High Risk: Markets are volatile, and losses can accumulate quickly without proper risk management.

- Steep Learning Curve: Mastering technical analysis and market psychology takes considerable time and practice.

- Stressful: The constant need for monitoring and quick decisions can be mentally demanding.

Passive Crypto Income: Earning While You Sleep

Passive crypto income, on the other hand, aims to generate returns with minimal ongoing effort after an initial setup. It's about letting your crypto work for you. While the video didn't cover these, they are popular options for beginners looking for less hands-on involvement.

Here are some common passive crypto income methods:

- Staking: Imagine a high-tech savings account. You lock up your cryptocurrencies in a blockchain network to help secure its operations and validate transactions. In return, you earn new coins as a reward. This is a common feature for cryptocurrencies using a "Proof of Stake" system, like Ethereum 2.0.

- Lending: You can lend your crypto to others through centralized or decentralized platforms. Borrowers pay interest on their loans, and you, as the lender, earn a portion of that interest. This is similar to how traditional banks operate, but with crypto assets.

- Yield Farming: A more advanced form of passive income, yield farming involves providing liquidity to decentralized exchanges (DEXs) or lending protocols. You deposit pairs of cryptocurrencies into liquidity pools, helping facilitate trades, and you earn trading fees or special reward tokens in return. This can offer higher returns but also comes with higher risks, such as "impermanent loss."

Pros of Passive Income:

- Less Time-Intensive: Once set up, it requires far less daily management.

- Consistent Returns: Can provide a steady stream of income over time.

- Good for Long-Term Holders: Allows you to earn on your assets while holding them for potential price appreciation.

Cons of Passive Income:

- Lower Potential Returns: Generally, passive strategies yield lower percentage returns than successful active trading.

- Platform/Smart Contract Risk: Your funds are often held by a third party or within code, which can have vulnerabilities.

- Liquidity Risk: Some staked or lent assets might be locked for a period, making them inaccessible.

- Market Volatility: The value of your underlying assets can still fluctuate, impacting your overall returns.

Choosing Your Crypto Income Path

Deciding between active and passive crypto income depends entirely on your personal financial goals, risk tolerance, and the amount of time you're willing to commit. Active trading, as shown in the video, offers the allure of rapid gains but demands significant expertise and time, along with considerable risk. Passive strategies, while typically offering slower growth, provide a more hands-off approach, allowing your assets to potentially grow over time with less daily stress.

Ultimately, the cryptocurrency world is evolving rapidly, and new opportunities emerge constantly. Whether you choose to be a diligent market analyst, seeking out daily opportunities, or prefer a more laid-back approach, letting your crypto work for you, remember that continuous learning and careful consideration of your risk tolerance are your best allies on this exciting financial journey.