If you haven't heard by now, there has a been a huge change on regulation when it comes to taxes and trading cryptocurrencies for Americans. Late last year Trump signed a new tax code which will be effective January 1, 2018. In an amendment of tax code IRC section 1031 (a)(1) with regards to “like kind exchanges”, significant changes have been made where cryptocurrency is to be a taxable commodity. The Senate proposes a "first-in, first-out" (FIFO) accounting framework, which could make reporting cryptocurrency very difficult.

Every transaction is a taxable event. Any gains/losses from deposits or withdrawals to fiat need to be reported, as well as trades between cryptos.

So if you buy Monero with Eth, that must be recorded and is taxable.

Selling Monero to buy Dash, taxable.

Selling Dash in order to buy more Dash at a better position, taxable, for both the sell and buy order.

If you're a long-term hodler and aren't making too many transactions a year, it's still pretty inconvenient. If you trade often or day trade, it's almost damn near impossible. I would say I'm a hodler that plays around and make anywhere between roughly 200-400 transactions a month. Luckily, I was an accounting major and I'm pretty good about keeping a ledger of my transactons. Even so, I do find it super frustrating and extremely tedious.

Lets get real, nobody wants to report crypto earnings to the IRS nor have so much of their personal information and crypto activities available to financial institutions. You will not get away with it easily or at all. More and more exchanges are requiring KYC rules and the IRS are already enacting plans to be able to identify wallet owners. All though there has been pressure to ease regulation to make it actually possible for crypto owners to be compliant, no new updates have passed to push this through.

I've been trying to go about this the right way and figured now, just finishing the first week of January, is the best time to find a good system. Currently I was manually entering all my transactions, price at sale, price of eth at sale, exchange, gain/loss, etc into Excel and was also using Blockfolio. It was a mess. There were days where the market was so busy, I had to keep an eye on multiple orders, charts, prices, and try to report everything correctly. I'm not going to lie, sometimes I just guesstimated. I figured, the IRS is not going to go through every single transaction out of thousands, who cares. I should also mention that I have had issues with taxes and fiat in the past.

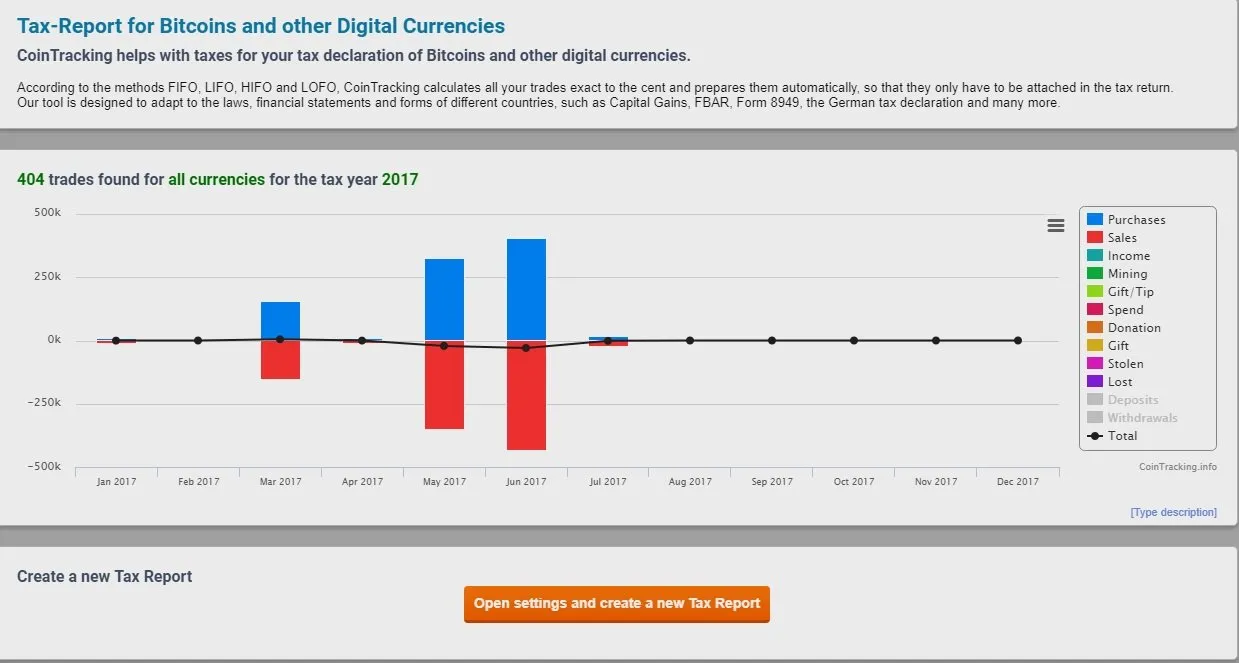

It's better to be safe in these situations and the market is producing many investors insane profits, safeguarding your assets should be a priority. There are quite a few services available to make the 2018 tax season much smoother. I'm currently trying Cointracking free version and I'm not trying to shill you, you need this or something similar. Unless you are an accountant who enjoys navigating tax codes, investing in protecting your funds will only save you money in the long run.

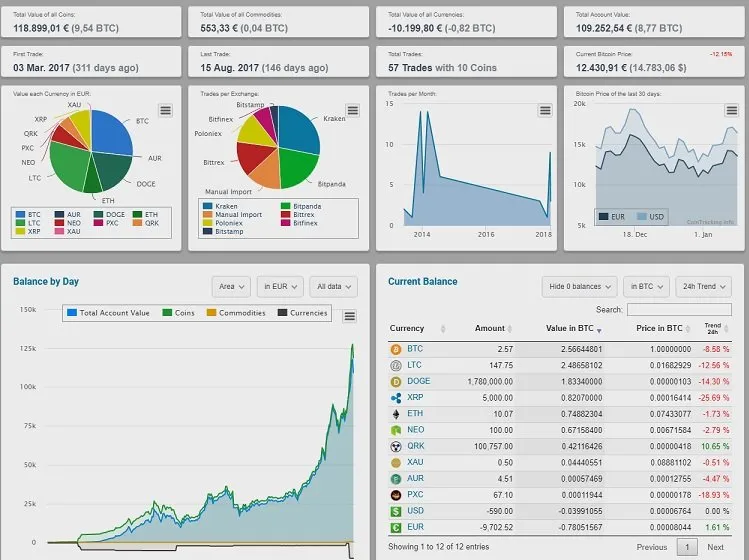

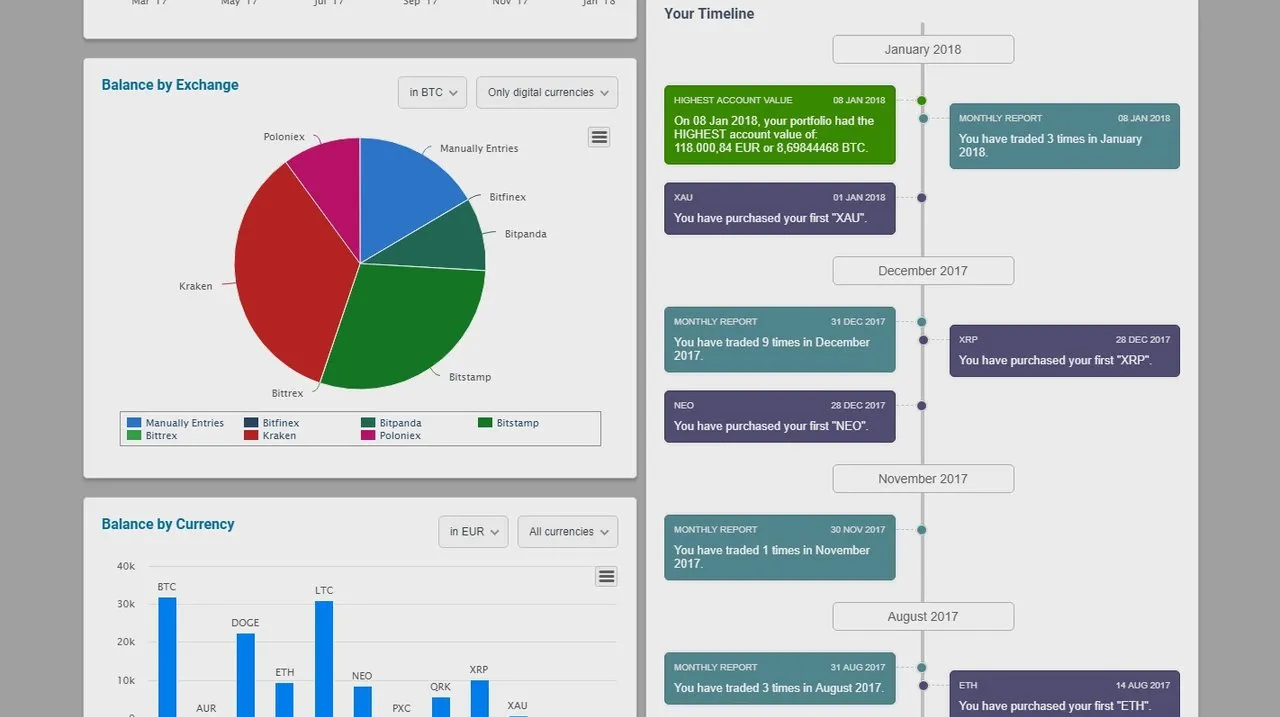

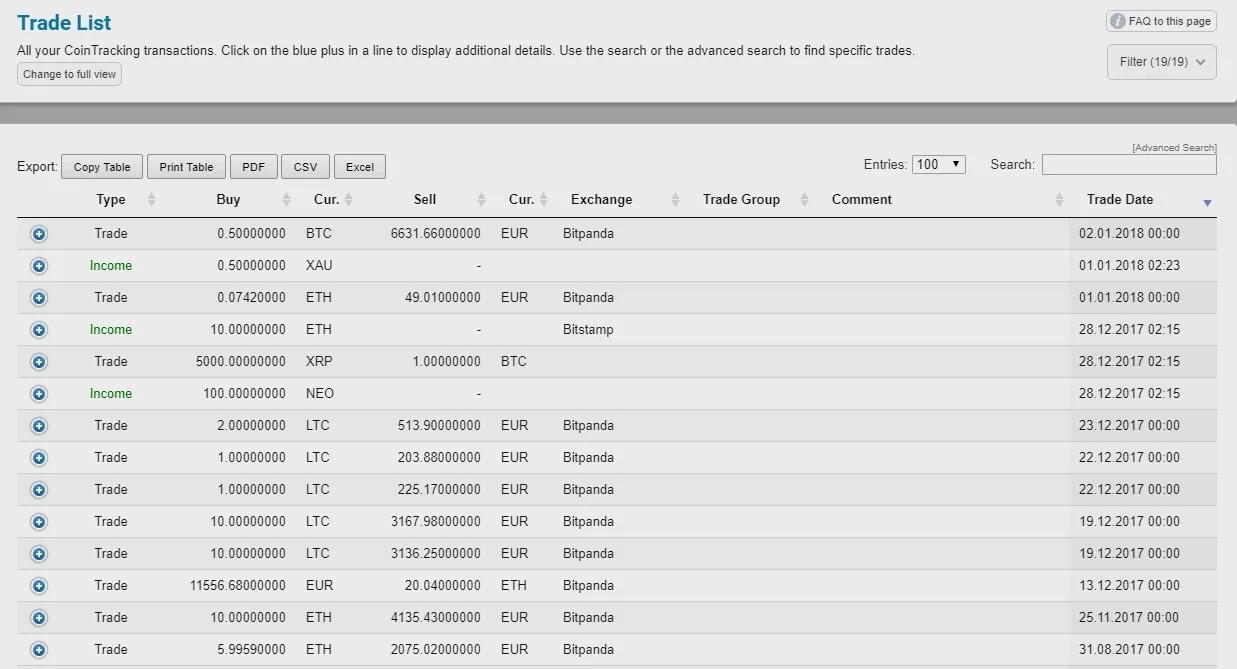

The dashboard can be customized to show any metrics and simple to navigate. There was way more information and more technical UI than Blockfolio, which is what I was using as a crypto portfolio in the past. You're able to see trade statistics, list of all trades, trade prices, balances at any measure of time, balance by different exchanges, currencies, all fees incurred, gains/losses, and more.

What really sold it for me was the ease of importing trade information. I am happy to say I have not touched Excel since. I am using the free version (I will definitely upgrade as there are limits) so I have been downloading my order history CSV's off Binance and importing them into Cointracking.

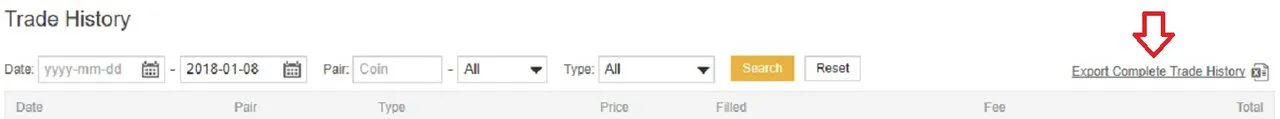

Export trade/withdrawal/deposit history from Binance.

Import into Cointracking.

Almost all known exchanges are available. If you upgrade past the free mode you are able to enable automatic API imports/exports. If you don't trade often, the free version is really all you need. I'm using it and it really takes no effort to download an updated CSV file every night and upload it on to Cointracking. There are limits though, which is why I will most likely upgrade to Pro (if and when the price of BTC goes down a bit kek).

After uploading your trade info (or having the automatic API do it for you) all of your activities are accurately displayed and easily exportable.

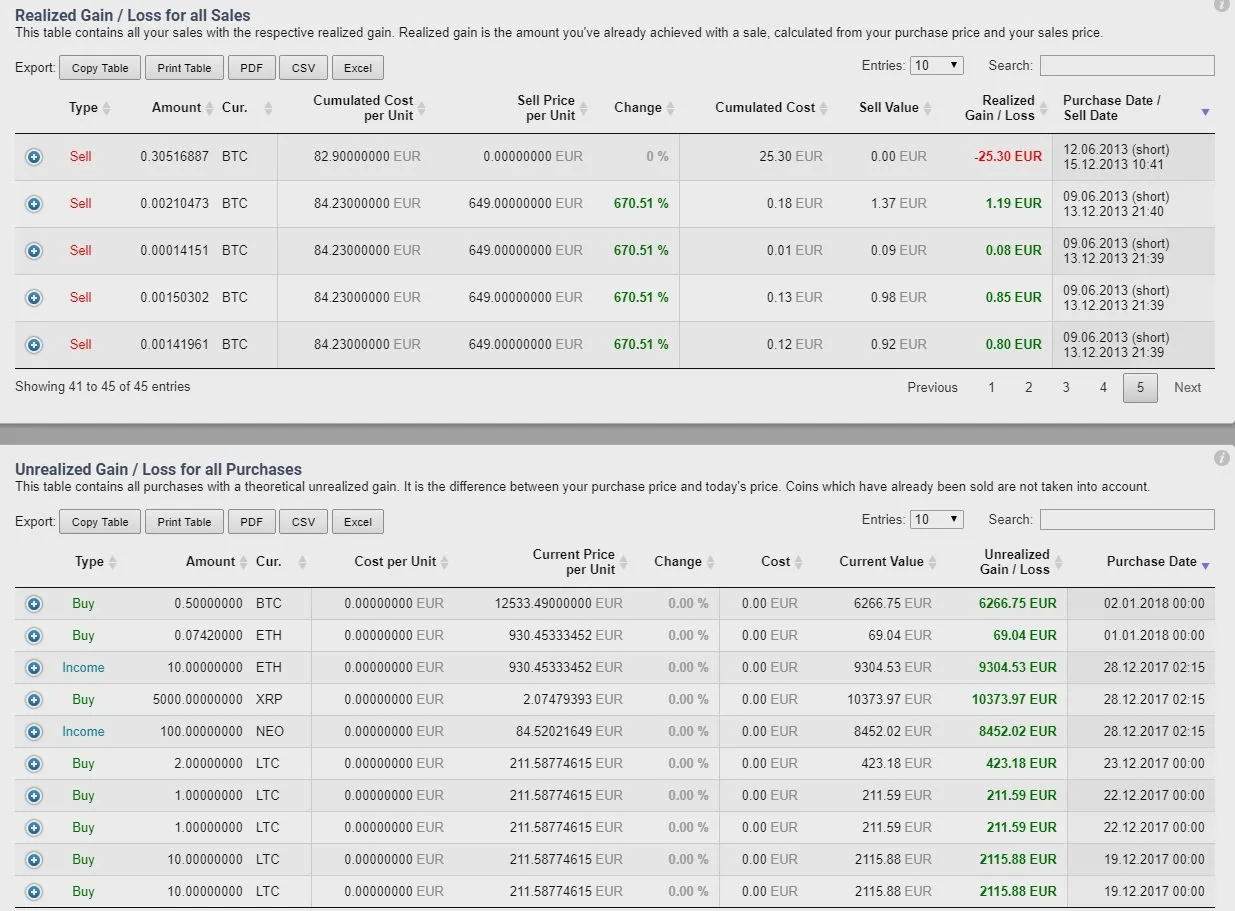

You can also view, and this is what we really need for this year's tax season, every single transactions gains and losses.

Not having to manually enter and calculate this on a daily basis is worth it for me. This has saved me hours and took a lot of stress off my back. Trading is so much easier when taking having to report every single detail out of the equation. There is even an option to help you fill out and be compliant with your tax forms.

My original plan was to continue with my shoddy Excel reporting, find an accountant who has some experience with crypto, and hand over everything and most likely confuse the hell out of them. Easy $300-$500 spent. All thought it's not a bad idea to meet with a financial adviser of some sort, especially if you're having a phenomenal year, being able to know how to complete your taxes yourself will save a lot of confusion, time, and money.

The features mentioned is only the tip of the iceberg. There are multitudes of charts, trends, and statistics that will only help you better understand and plan what you're doing in crypto. All altcoins are available on the platform and more are always being added. There are no private keys or personal information being held, everything is done through CSV files or API. There is a DEMO account you can mess around with before signing up, I highly advise checking it out. The tax situation may be more lax in the future the more crypto holders fight back, but it is not going away any time soon. You must protect yourself.