Hi traders, I am watching the $5700 level very closely.

Here's why.

Crypto.

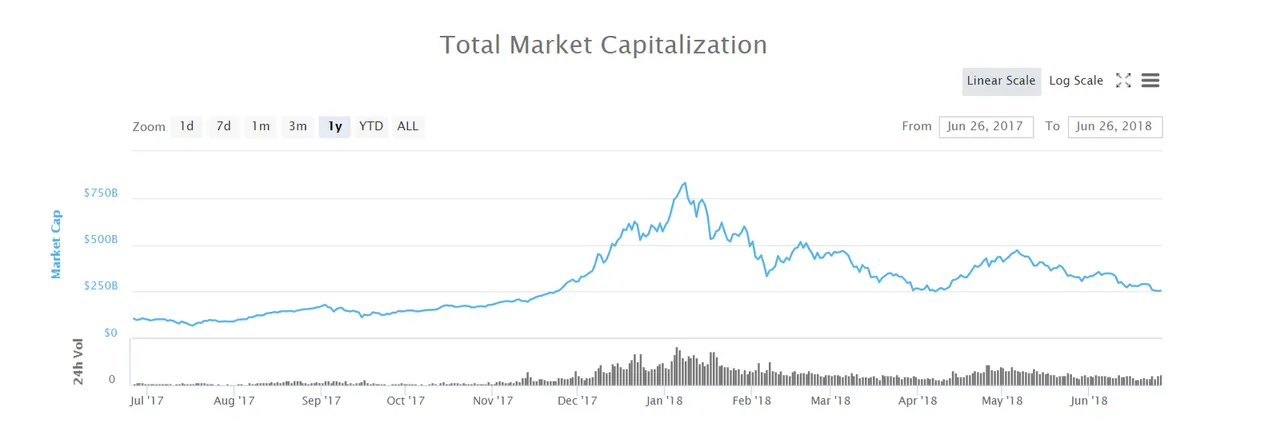

- The cryptoverse has been in a Bitcoin-led technical bear trend for over 7 months now.

Yet its fundamentals have never been stronger: Bitcoin's Lightning Network, cross-chain atomic swaps, Ethereum sharding, ZCash's Sapling upgrade or LEDGER's new custody solutions being some of many examples that spring to mind.

Add to that the involvement of institutional money, major VC funds and the promise of tokenized securities meant to revolutionize finance and a pattern starts to emerge: blockchain technology is finally going places.

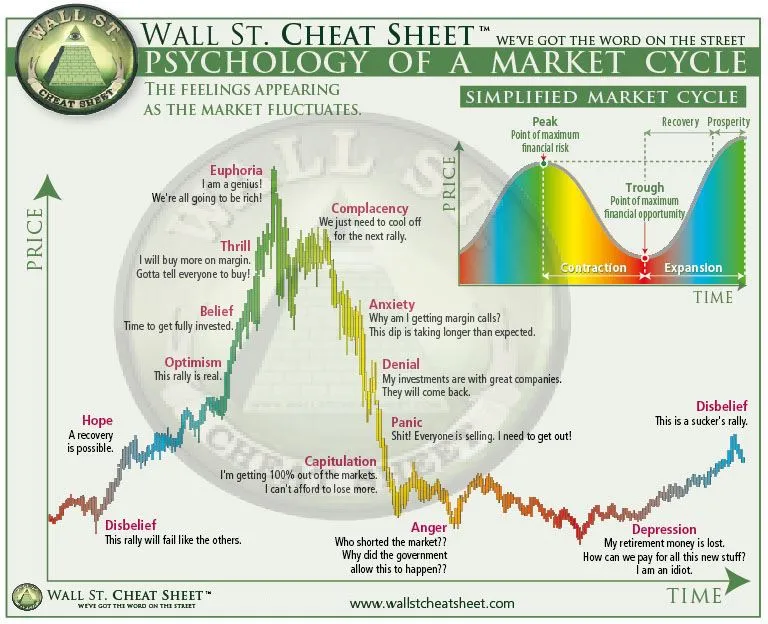

Now, from this angle the current market trough is starting to look more and more like a time of maximum opportunity...

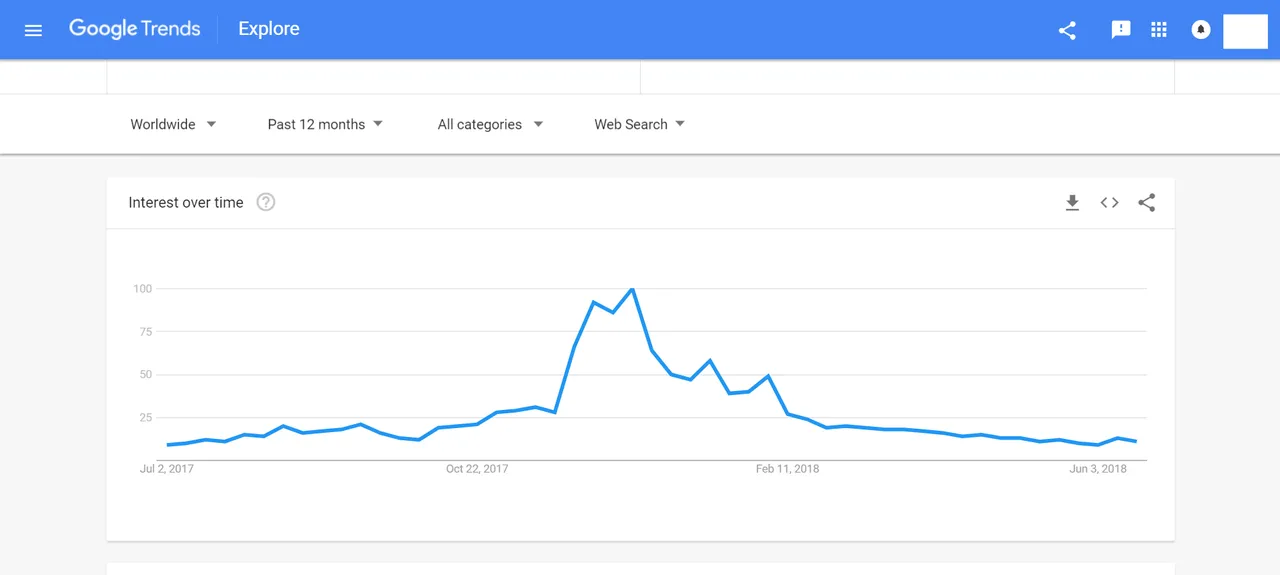

... Bitcoin has fallen from grace in the eyes of the general public...

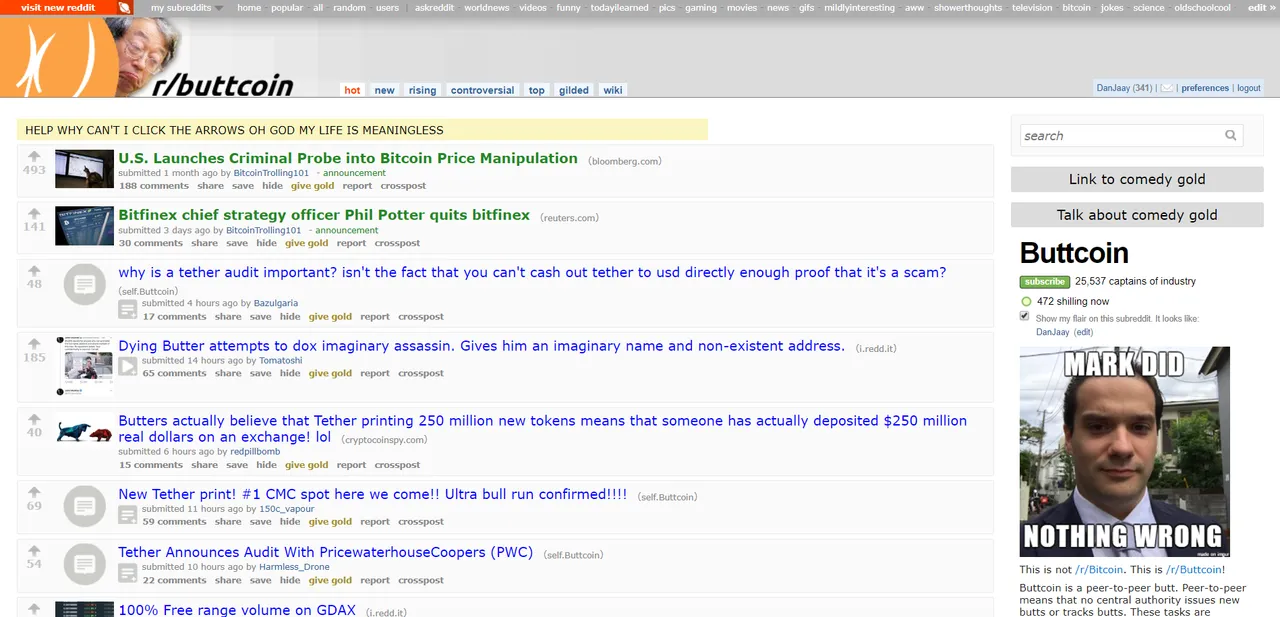

... and market sentiment is very low on social media where emboldened nocoiners spawned from the darkest corners of r/buttcoin have started to come out of the woodwork to troll hodlers.

So, as a contrarian this when I start expecting the market to reverse in the face of those late bears. But since the market doesn't really care what I think, let's take the discussion to a more technical level.

Bitcoin.

Just like I anticipated Bitcoin dumped to $5700 which prompted me to open a starter position on the dip.

Bitcoin is staking on thin ice. It's bounced off of that very thin value node and is forming what could yet be another bearish flag foreshadowing more downside:

- As I explained in my last post, if we start auctioning down that thin value node and chew entirely through it, then there wouldn't be much volume to hold the price and a dump to $4500-ish would be very likely.

- On the flip side, if $6000 holds as it did before in this bear market, then we could see the market start rallying or, more probably, consolidate going into July which would also prompt me to add to my positions.

- At this point I'd say I lean 80% towards the bearish scenario (dump to $4400) and 20% towards consolidation but to tie this in with my crypto rant above, my plan is to substantially increase my trading positions if we get down to $4400. As you can see on the chart, the lower value node is huge...

... thus I think it will provide enough liquidity to absorb a market capitulation and act as a springboard for a rally or lower market accumulation.

What do you think traders?