EmerCoin (EMC) is a cryptocurrency that is in some ways similar to Namecoin (NMC) and Peercoin (PPC). It was launched in December 2013 and announced three days before launch in order to notify miners in advance.

EMC offers distributed blockchain services for business and personal use that is easy and low cost. In addition to being used for the payment of goods and services, Emercoin provides a platform for a wealth of novel applications such as decentralized domain names and advertising networks.

Emercoin employs both proof-of-work (PoW) mining and proof-of-stake (PoS) minting and uses SHA-256 hashes. EMC is a blockchain platform for a wide range of distributed trusted services. Distinctive features include – high reliability, robustness and 3-in-one hybrid mining (PoW + MergedMining + PoS). Currently, the Emercoin platform already runs network security services EmerSSL/EmerSSH, decentralized domain system EmerDNS, counterfeit solution EmerDPO, VOIP solution ENUMER and bundle of other services.

Developers propose Emercoin as a foundation for multiple possible services, rather than simply a currency:

Oleg Khovayko, Emercoin Lead Developer, has stated, “Key difference in Emercoin from other cryptocurrencies is that we are using blockchain not just for transfer credit values. We consider Emercoin as a technological platform for distributed, censorship–proof and scalable services. So we developed a suite of services running on top of the Emercoin blockchain that will be very useful for a lot of companies and even private persons.”

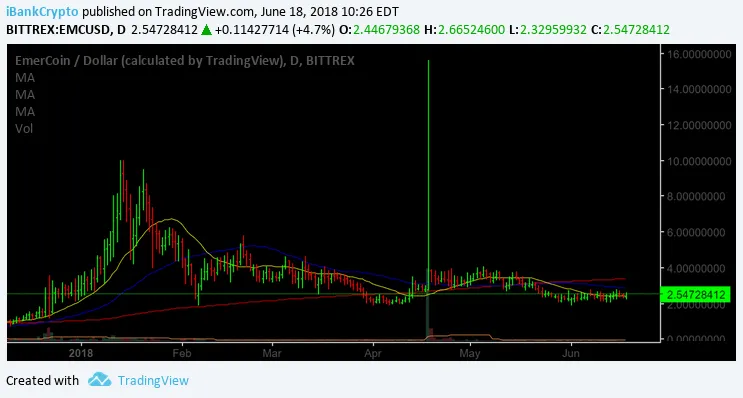

With that in the rear-view, let’s take a look at EMC from a technical perspective to see what may be in store moving forward.

As we can observe from the daily chart above, EMC continues to trade below both its 50 (blue line) as well as its 200 (red line) day moving averages, depicting and unfavorable intermediate and long-term technical posture from the daily time-frame.

However, while the overall cryptocurrency climate has found itself in deterioration mode these past several months and weeks, EMC has managed to trade slightly above and below its 20 (yellow line) day moving average, continuing to do battle as well as attempting to base.

Thus, while the climate remains tenuous at best, EMC is starting to show some signs that the worst may be behind it, although, should overall market conditions deteriorate in the days/weeks ahead, EMC would more than likely follow the path of least resistance along with the entire space.

By iBankCrypto

GlobalCoin Report

https://globalcoinreport.com/emercoin-emc-technical-analysis-emc-on-watch/