Your Simple Guide to Spotting Potential Altcoin Movers

Hey there! Ready to explore a way some people look for altcoins that might have big potential, right from your phone? This method uses a popular tool called CoinMarketCap to check out something called "liquidity depth." Let's break it down step-by-step.

What You'll Need: Your phone's web browser (not the app for this method).

The Goal: To find altcoins in trending categories that might move in price more easily based on their liquidity.

Let's Go!

- Open CoinMarketCap: Go to CoinMarketCap.com using your phone's web browser, not the mobile app. The browser version has the specific view we need.

- Find Hot Categories: Look for a "Categories" section or filter. You want to see which types of coins (like "Memes," "AI," "Gaming," etc.) have seen the biggest price jumps recently (look for high 24-hour percentage changes). Pick a category that looks active and interesting to you.

- Choose a Coin: Inside your chosen category, pick a specific coin you want to investigate further. Click on it to see its details page.

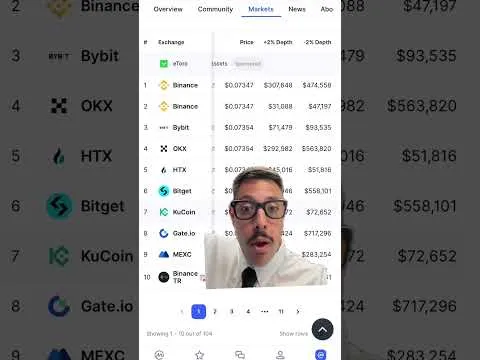

- Go to 'Markets': On the coin's detail page, find and tap the "Markets" tab. This shows you where the coin is being bought and sold (the exchanges).

- Look for "+2% Depth": Scroll the "Markets" table to the right. You should see a column labeled something like "+2% Depth." This number tells you roughly how much money needs to be spent buying the coin on that exchange to push its price up by 2%. Think of it like this: a lower number here means it might take less money to increase the price.

- Get the Average: Here's a trick shown in the video: Take a screenshot showing the "+2% Depth" numbers for the top exchanges listed (maybe the top 10). You can then use an AI tool (like ChatGPT, Google Gemini, or others – just upload the screenshot) and ask it: "Look at the +2% depth for this coin, average the top 10 exchanges, and give me the average +2% liquidity depth." This gives you one average number to represent the coin's liquidity.

- Compare with Top Performers: Go back to the main page for the category you chose in Step 2. Sort the coins in that category by the highest "24h %" change (the biggest recent winners). Now, repeat steps 3-6 for a few of these top-performing coins. See how their average "+2% Depth" compares to the coin you initially researched. The idea some traders use is that coins currently pumping might have lower average liquidity depths, and finding other coins with similarly low depths might indicate potential – though it's definitely not guaranteed!

What This Tells You:

This method helps you find coins in popular areas that could potentially see faster price movements because less money might be needed to influence their price (lower liquidity depth).

Important Note: This is just one research technique some people use. It's focused purely on recent trends and liquidity, not the coin's long-term value, technology, or safety. Lower liquidity can also mean higher risk! Always be careful and remember that crypto investing is speculative.

Like this guide? Follow for more simple crypto tips for beginners!