About DeFI

With the emergence of Uniswap, it has become one of the most important components of the entire DeFi industry, as it allows users to exchange tokens without trust, meaning that all transactions are carried out from smart contracts without the need for intermediaries or trustees. party.

A new trend has revitalized the cryptocurrency industry, despite the fact that the value of fixed assets is 75% below 2017 levels. This is called DeFi, which stands for decentralized finance. The bottom line is the idea that crypto entrepreneurs can recreate traditional financial instruments in a decentralized architecture without coming under corporate and government control.

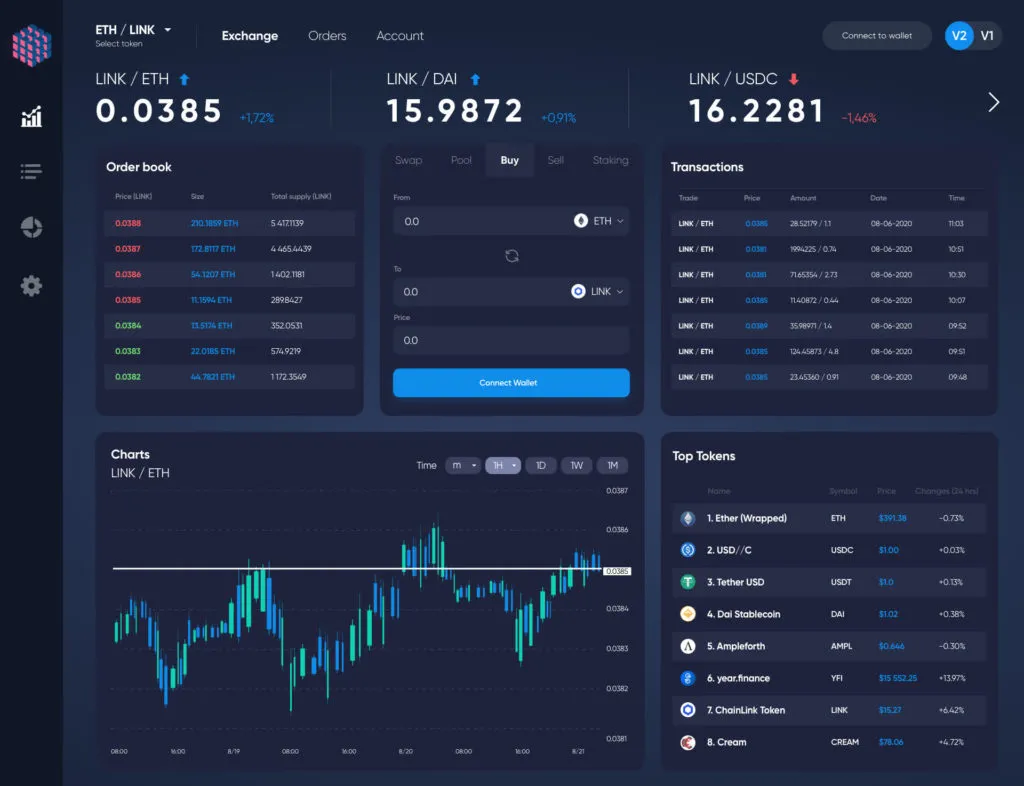

UniDApp distinctive features

Orders: The possibility to set an unlimited number of pending orders for price decline or increase, which is an absolute necessity when a trader follows his strategy, be it using instruments like Eliott Waves or waiting for price fluctuations in the news. The commands will be triggered automatically regardless of whether you are sleeping, driving, or just relaxing.

Notice: Notification of the achievement of the determined price of the given token, which will help experienced traders navigate the market quickly and, if necessary, change their strategy

Monitoring: Ability to monitor the required coins in real time, as well as, if necessary, view a graph of price changes since the coins were listed on Uniswap.

Interface: The interface is simplified and intuitive is simple so that even an inexperienced person can find out and learn the functionality in a matter of minutes.

Performance: Performance due to optimization of all processes.

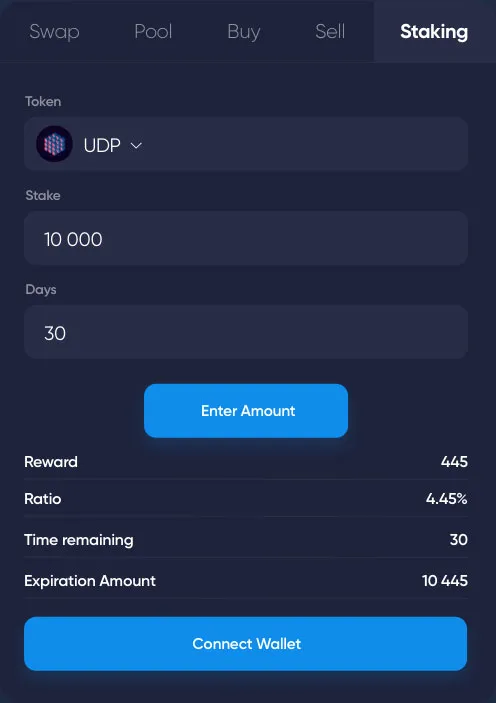

Staking

On the UniDApp platform, in order to make transactions, the user must own a UDP token, which can be purchased on Uniswap after the 3rd round of OTC or any other exchange a few days later.

For each transaction, the commission will be 0.25% of the transaction amount and will be charged automatically in UDP tokens. 90% of the amount charged will go as a reward to the UDP token holders, the remaining 10% will go to the UniDApp fund. The ability of token holders to receive passive income will stimulate the liquidity of the token and the growth of its price.

For more information you can see it below you can see it below:

Website: https://unidapp.app

Twitter: https://twitter.com/UniDApp

Telegram: https://t.me/unidapp

Medium: https://medium.com/@unidapp.project

Author: dey90

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=731808