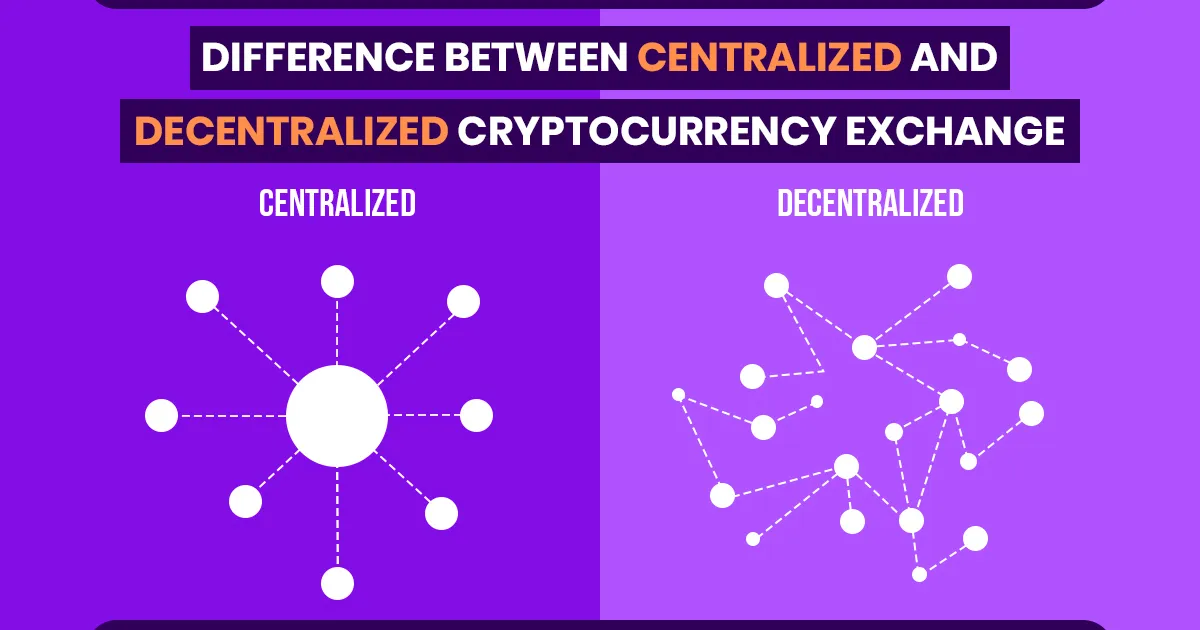

A cryptocurrency exchange is a platform that allows users to trade or swap digital currencies and assets. All crypto exchanges out there can be broadly classified into two types - decentralized exchange (DEX) and centralized exchange.

What is a centralized exchange?

Most of the cryptocurrency trading platforms out there and almost every traditional stock exchange are examples of a centralized exchange.

A centralized crypto exchange facilitates the trading of cryptocurrencies through an intermediary platform owned and managed by third parties (other than buyers and sellers). In other words, such an exchange is controlled and managed by centralized entities and has an owner. Traders will generally need to share their personal details (KYC, etc.) in order to trade with a centralized exchange. Almost always the control is in the hands of the exchange owners and they decide the rules by which the platform is run.

What is a decentralized exchange?

A decentralized exchange or DEX is the exact opposite of a centralized exchange. It operates without middlemen and does not have centralized entities or owners. Trading happens directly between buyers and sellers through smart contracts on a blockchain.

There are many benefits of a DEX, such as high security, improved transparency, low cost, higher speed, and more.

PurpleX is the latest example of a high-quality, feature-rich decentralized cryptocurrency exchange. It’s an advanced DEX based on Binance blockchain technology that offers crypto trading and future services through a user-friendly and extremely secure platform.

Centralized Exchange Vs. DEX

The basic difference between a centralized exchange and a decentralized exchange is the operating process. While a centralized exchange operates through middlemen who are actual people manually validating and processing every transaction in the system, a DEX is run through smart contracts - computer programs written to automatically execute transactions based on the fulfillment of underlying conditions.

Here are some other differences between a centralized exchange and a DEX.

Security

Because DEXs are built on blockchain technology, use smart contracts and have zero human involvement, they are extremely secure with no chance of hacking or other security threats. Decentralized exchanges are nearly impossible to hack.

User-friendliness

This is where centralized exchanges take a lead. Because they have been around for a long time and managed by real people, people are more familiar with these exchanges and love their user-friendliness. Decentralized exchanges being a new entity are not so easy and sometimes too technical to use.

Features

In terms of features, centralized exchanges again prove to be a winner because they offer many features and options such as margin trading and portfolio management tools that are not present in DEXs. However, things are changing now, with new decentralized exchanges adopting more exciting features.

Speed

Because decentralized exchanges are automated and involve peer-to-peer trading of assets, transactions on these exchanges are executed at a faster speed.

Privacy

DEXs offer higher privacy as compared to centralized exchanges that require users to share personal information in order to trade with them. User data and privacy on DEX are very secure.

Regulation

Most of the centralized exchanges are regulated, i.e. they have been licensed by authorities and required to operate under certain rules. DEXs are under no such regulation and can operate freely on their own terms.

Cost/Fees

Because of the need for middlemen, the cost per trade on a centralized exchange is higher as compared to trading fees on a decentralized exchange, where the gas fee is minimal.

To sum up, centralized and decentralized exchanges have their respective pros and cons. However, in terms of security, privacy and trading cost, a DEX is a clear winner.