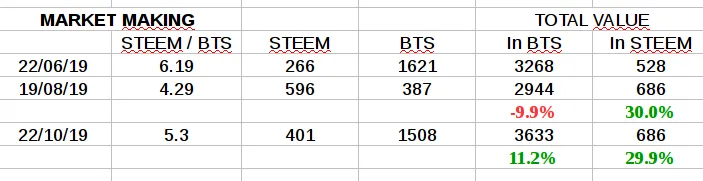

This post is an update to Market Making vs HODL. Short Profitability Review. Another 2 months have passed. While the overall market was bearish, price volatility was rather small and prices remained within the set price range. After 4 months the exchange rate almost went back to the initial value. Swings around the starting rate value are an ideal environment for neutral staggered orders strategy. Two months ago price almost escape boundaries and bot was close to stopping trading.

At 5.3 BTS per STEEM portfolio value increased when calculated in BTS by ~10% from the initial value 4 months ago, while value in STEEM is quite the same as 2 months ago, but 30% higher than in June.

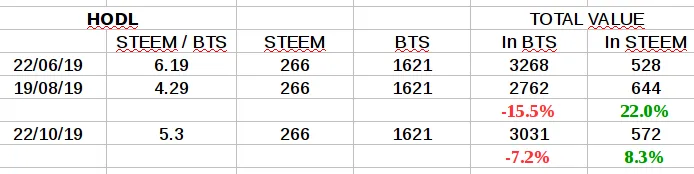

For comparison, the below table shows the keep-and-hold strategy outcome.

Conclusion

In relatively low market volatility conditions, neutral staggered orders strategy is more profitable than simple buy and hold strategy. In addition, running market maker provides liquidity for causal STEEM sellers and buyers.