The Dow Jones Industrial Average index hit strong resistance at the beginning of 2018, and that resistance has been tested three times total since then. This strong resistance is in contrast to the weak support lines, one of which failed spectacularly in December 2018, and will serve as a potential fall back support if liquidity evaporates due to a slow Fed.

But resistance and support aside, I am calling the next 3 months the twilight zone, because technical analysis suggests that we see the index correct soon, but between plunge protection teams and QE4 starting, things might get a little dicey and all bets will be off.

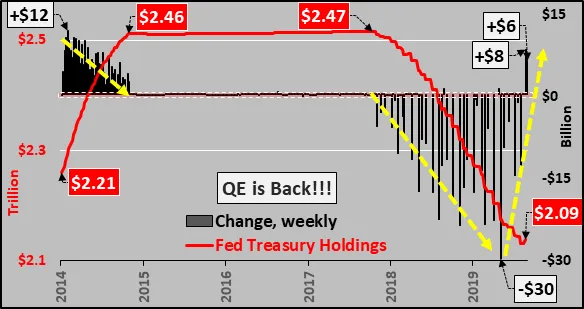

No doubt many have already viewed this next image:

(Source)

As we can see, the Federal Reserve is tentatively back in the business of buying US Treasuries, which may tie into my previous post about some big activity in the US Bond Markets, reverting the yield curve and pumping the Stock Market back up.

These are unprecedented times we are in, truly, and so anyone predicting the next 3 months with accuracy is either lucky or psychic. The Technical analysis and market indicators are well defined, while as usual the message from the top is to keep calm and carry on consuming and buying overpriced derivatives. We'll see just how much they can pull the wool over the eyes of consumers from this point forward, and we should have some clear answers by the end of 2019, or even by mid November if Brexit happens and the dominoes start falling on a global scale.

Some dominoes already have fallen or are in the process of falling, Argentina being a big one, but not the biggest to come in my opinion. Right now the pressure is on the consumer to keep spending, while it appears that consumers are starting to move to safety.

I appreciate you stopping by to read this blog. Stay safe and keep your head up.