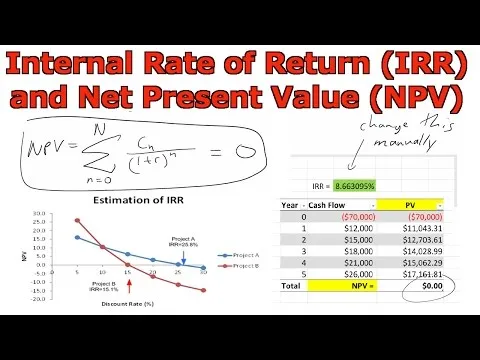

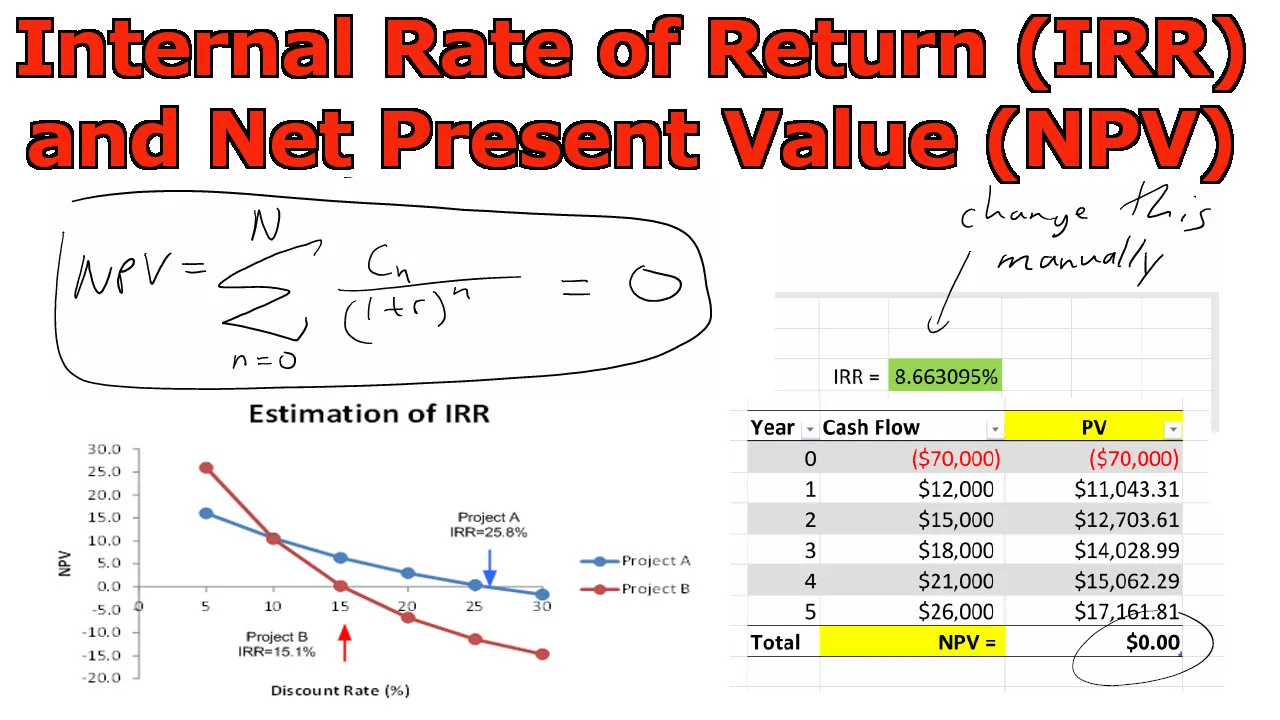

In this video I go over through some basics in economics and financing and discuss the Internal Rate of Return (IRR) as well as derive the formula for the Net Present Value (NPV). In financial budgeting and investment analysis, to compare different projects or investments the interest rate at which all current and future cash flows break even in terms of their present values is called the internal rate of return (IRR) and is simply an interest or discount rate. The Present Value (PV) is the value of any future cash flows but set to the date of valuation. The value of money increases with time so $1 today is worth more than $1 tomorrow due to the ability to gain value through interest. The NPV is simply the sum of all the PVs and when equal to 0, the corresponding interest rate is the IRR.

In this video I go over an example in which I derive the NPV formula and solve for the IRR using a Microsoft Excel spreadsheet to manipulate the IRR until the NPV = 0. This is a very useful introductory video to financing and investing so make sure to watch it!

Watch Video On:

Download Video Notes:

- PDF Notes: https://1drv.ms/b/s!As32ynv0LoaIhddf6KOQLiv9qVe6rA

- Excel Notes: https://1drv.ms/x/s!As32ynv0LoaIhddOr55GW0Cf_Bgmyw

View Video Notes Below!

Download These Notes: Link is in Video Description.

View These Notes as an Article: https://steemit.com/@mes

Subscribe via Email: http://mes.fm/subscribe

Donate! :) https://mes.fm/donateReuse of My Videos:

- Feel free to make use of / re-upload / monetize my videos as long as you provide a link to the original video.

Fight Back Against Censorship:

- Bookmark sites/channels/accounts and check periodically

- Remember to always archive website pages in case they get deleted/changed.

Join my private Discord Chat Room: https://mes.fm/chatroom

Check out my Reddit and Voat Math Forums:

Buy "Where Did The Towers Go?" by Dr. Judy Wood: https://mes.fm/judywoodbook

Follow My #FreeEnergy Video Series: https://mes.fm/freeenergy-playlist

Watch my #AntiGravity Video Series: https://steemit.com/antigravity/@mes/series

- See Part 6 for my Self Appointed PhD and #MESDuality Breakthrough Concept!

Follow My #MESExperiments Video Series: https://steemit.com/mesexperiments/@mes/list

NOTE #1: If you don't have time to watch this whole video:

- Skip to the end for Summary and Conclusions (If Available)

- Play this video at a faster speed.

-- TOP SECRET LIFE HACK: Your brain gets used to faster speed. (#Try2xSpeed)

-- Try 4X+ Speed by Browser Extensions or Modifying Source Code.

-- Browser Extension Recommendation: https://mes.fm/videospeed-extension

-- See my tutorial to learn more: https://steemit.com/video/@mes/play-videos-at-faster-or-slower-speeds-on-any-website- Download and Read Notes.

- Read notes on Steemit #GetOnSteem

- Watch the video in parts.

NOTE #2: If video volume is too low at any part of the video:

- Download this Browser Extension Recommendation: https://mes.fm/volume-extension

Internal Rate of Return and Net Present Value

Rate of Return

- The profit of an investment over a period of time, expressed as a proportion of the original investment.

Internal Rate of Return (IRR):

- Also called:

- Economic Rate of Return (ERR)

- Discounted Cash Flow Rate of Return (DCFROR)

- Effective Interest Rate (EIR)

- It is a rate of return of the an investment used in capital budgeting to measure and compare the profitability of investments

- It is called internal because it's calculation does not include environmental factors (such as inflation or interest rate, etc.)

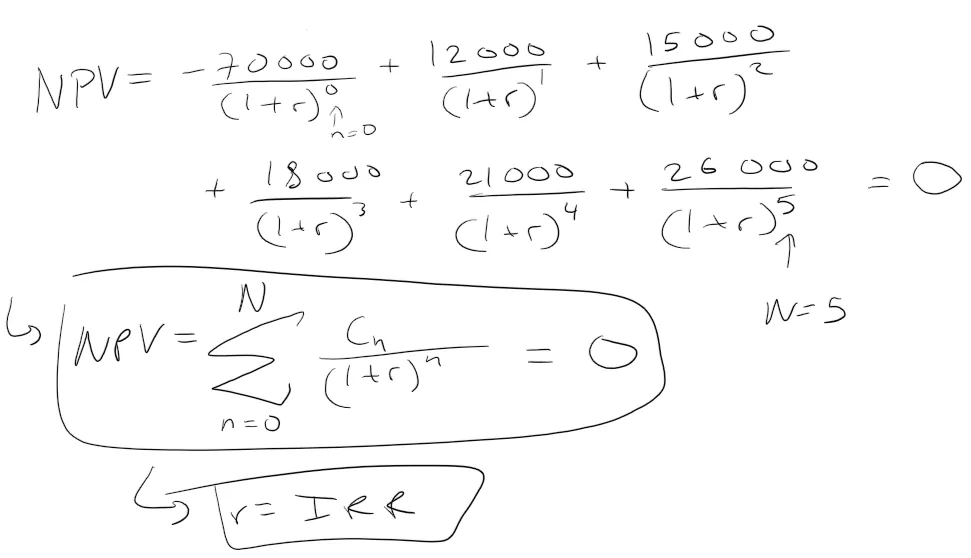

- It is calculated by setting the Net Present Value to 0 and solving for the discount rate or interest rate on the investment

- Basically it is the interest rate on a loan or investment where the cash flows breakeven.

- The higher the IRR the more desirable the investment is.

Present Value (PV)

- The value of any future cash flow determined at the date of valuation

- Usually less than the future value because money has interest-earning potential (except during times of negative interest rates)

- This is referred to as the Time Value of Money

- "A dollar today is worth more than a dollar tomorrow"

- This is referred to as the Time Value of Money

Net Present Value (NPV)

- The sum of the Present Values of all incoming and outgoing cash flows over a period of time

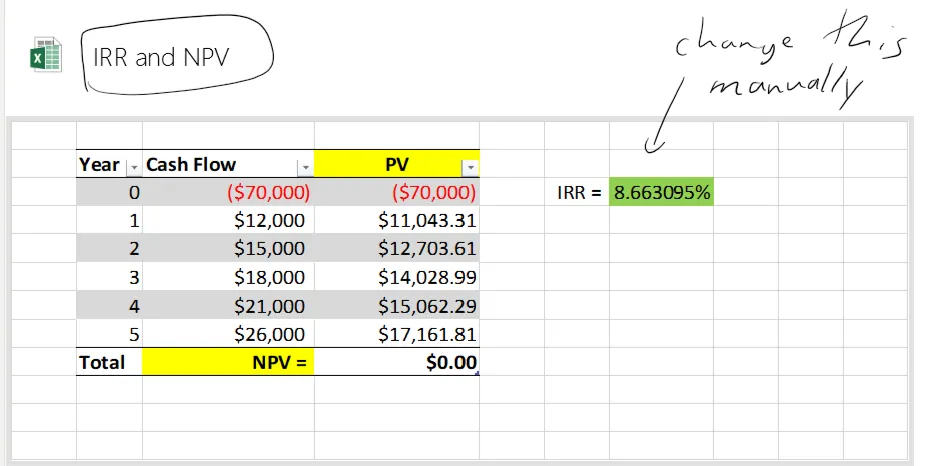

IRR Calculation:

where:

- n = time period and is a positive integer

- N = total number of time periods

- r = IRR

- Cn = Cash flow at time period n

Simple Summary:

The above definitions can seem overly technical and complex so to simplify the definition, IRR can be considered as the average interest rate on an investment that have all cash flows breakeven.

The higher the IRR the better because it means that an investment can be profitable even at very high interest rates.

Example and Derivation of Formula:

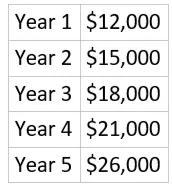

You put $70,000 down for an investment and have the following cash flows from the investment:

From the given info what is the IRR? Also derive and explain the formula for NPV.

Solution:

To understand the IRR, we first look at what the PV's are for each cash flow in each year.

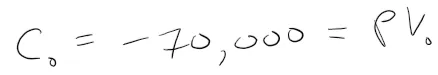

Year 0: This is the initial start of the year in which we have to lower or discount all other cash flows to. This is also when we get our loan. Thus we have:

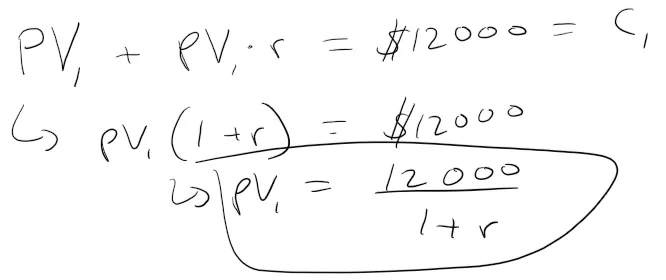

Year 1: At the end of the first year we have a cash flow of $12,000. Since this is the at the end of the year we have to find out how much the $12,000 is worth at the very start of our investment. This is because, as stated earlier, the time value of money and its ability to increase in value due to interest/inflation, etc. Thus we assume that the PV of the cash flow increases year by year by the IRR:

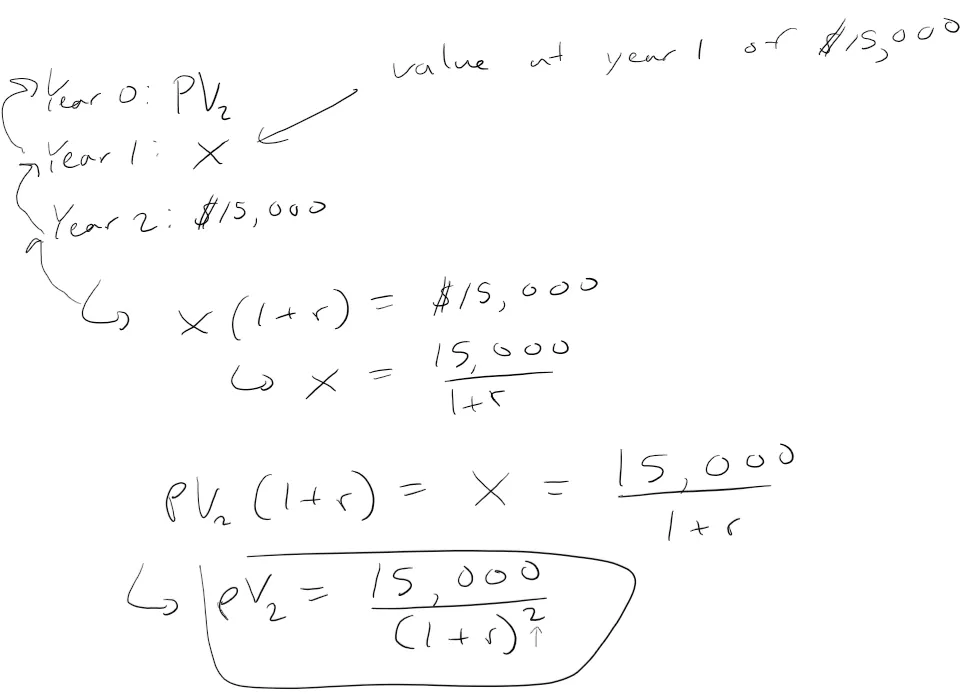

Year 2: As with year 1 we need to go backwards in time and figure out what the PV is at the start of our investment but this time we need to go back 2 years. After year 2 the cash flow is $15,000 thus the PV is derived as shown below:

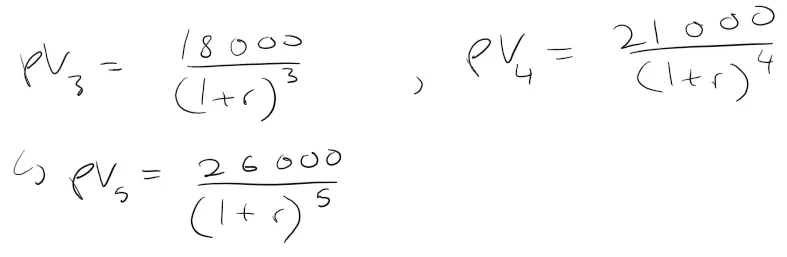

Thus for years 3, 4 and 5 we get:

Thus putting this all together we get our net present value:

https://1drv.ms/x/s!As32ynv0LoaIhddOstzID9RthXuu8Q