Ethanol production in the United States averaged 1.044 million barrels per day (bpd) in the week-ended February 23, 24,000 bpd lower than in the previous week, according to data US Energy Information Administration (EIA) reported on Wednesday.

The reported production was 10,000 bpd, or 0.97%, higher than the same week last year, but below market forecasts. Since the US ethanol production capacity has been consistently expanded over the past few years, output above 1 million bpd seems like the new normal.

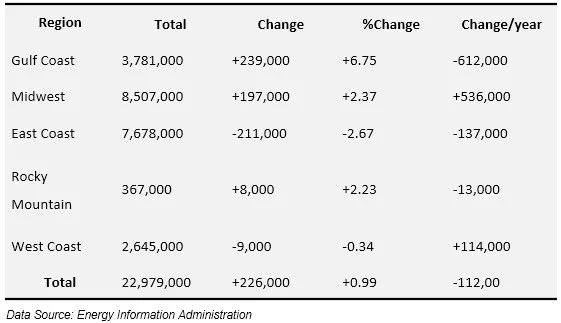

Climbing modestly on the week, total US ethanol supply rose 226,000 barrels, or 0.9%, to 22.979 million barrels.

Compared with the data reported a year ago, total supply dropped by 112,000 barrels, the first time since March 2017 that stocks have been down year on year.

The Gulf Coast recorded the largest stock increase as the region added 239,000 barrels. As exports in the region maintained robust growth, participants on the market were encouraged to carry more product into the area, drawing stocks higher.

The Midwest, with the largest number of ethanol plants out of all US regions, added 197,000 barrels to its stock to finish the week at its highest inventory level in nearly a year.

The recent flooding along the Illinois River may have resulted in some logistical difficulties moving ethanol out of the region.

Conversely, the East Coast posted a stock draw of 211,000 barrels amid the recent-week high stocks in the region as some market participants took advantage of high premiums.

The West Coast also shed inventory with a stock decline of 9,000 barrels. No imports to the area have been reported by the EIA for the past 12 straight weeks. The region is the most common destination for imports as Brazilian sugarcane-based ethanol generates both D5 RINs and Low Carbon Fuel Standard (LCFS) credits under California's LCFS.

The refiner and blender net inputs, a measure for ethanol demand, slumped 9,000 bpd last week to 876,000 bpd, down 6,000 bpd, or 0.7%, from a year earlier.

Meanwhile, the four-week rolling average of gasoline demand dropped 46,000 bpd to 9.008 million bpd, while the weekly average fell 142,000 bpd to 8.860 million bpd.

The ethanol blending rate, calculated by dividing the refiner and blender ethanol input by gasoline demand, rose to 9.64%, up slightly from 9.56% the prior week.

US ethanol inventory on February 23 (in barrels)

Posted from my blog with SteemPress : https://insights.jumoreglobal.com/us-ethanol-stocks-rebound/