Global Risk Exchange or GRE is a decentralized and blockchain based open global risk exchange market which seeks to help different individuals, organizations and companies so that they can access their trade and manage their risks. GRE has completely transformed the traditional risk management tool in a decentralized way in order to become the underlying operations system to support derivative transactions and insurance in the world of the blockchain.

Idea behind GRE

The main idea that lies behind the establishment of GRE is that it seeks to create an infrastructure and trading platform for the risk management industry in this era of blockchain and also in the future. It seeks to provide a fundamental protocol for the making of risk events, trading, pricing, oracles and information collection in order to verdict specific risks. This will help individuals all around the world to achieve risk and return equilibrium.

Problems and Solutions Offered By GRE

Some of the main problems that the industry is currently dealing with right now:

The existing value of derivative market and chains of insurance are all controlled by intermediaries who charge a good amount for their services and thus, making the cost of risk hedging very high.

In the traditional insurance market, an individual is asked to submit a lot of personal documents which are then stored on centralized servers. This may lead to the leakage of information to the wrong person.

Usually, it takes a lot of time when a consumer makes an insurance claim because of the traditional process of insurance. The process is very time consuming and then even the transfer of money is done slowly by the banks.

These are some of the main problems that are prevailing in the industry and this is what GRE seeks to solve.

Here are the solutions that are provided by GRE:

• Protection of data through decentralization. This makes all data encrypted and thus, makes it impossible for hackers to get access to all the information.

• GRE seeks to enable instant claims with the help of smart contracts. It enables a claim to be automatically checked if, granted. A smart contract is made to give out instant token payout to the claimant directly.

• GRE also seeks to provide a direct connection between the risk contract buyer and seller so that the transaction can be carried out directly through GRE. This eliminates the need for intermediaries and thus, the cost is reduced.

Token Economics

Here are the details of GRE token economics:

Token Symbol: RISK

Token Price: 1 ETH= 100,000 RISK

Total token supply: 10,000,000,000 RISK

Lock up time: Nil

Soft cap: 2,000 ETH

Hard cap: 20,000 ETH

Start: May 20, 2018

End: June 20, 2018

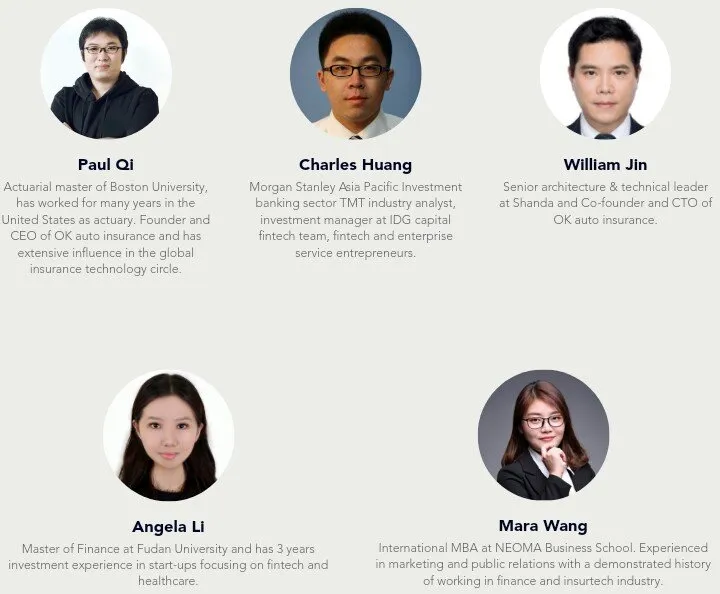

Team

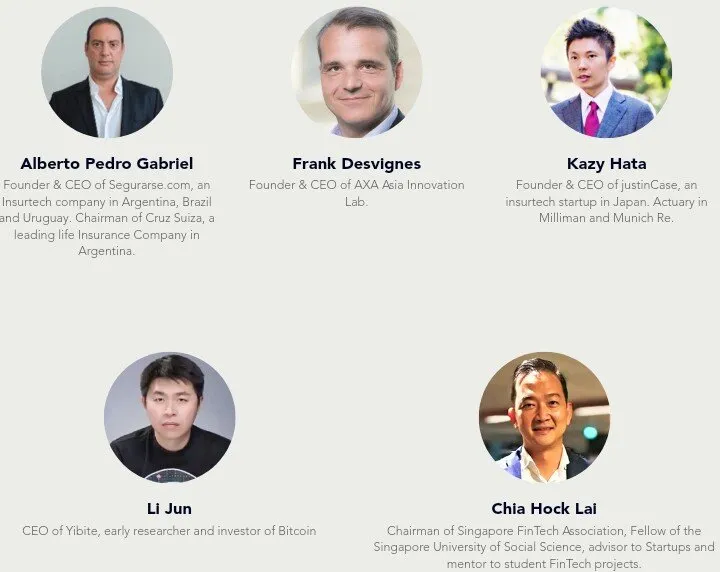

Advisors

Investors

So these are the important information that you needed to know about GRE. If you wish to know more, visit the links below.

Website

Whitepaper

Bitcointalk ANN

Facebook

Twitter

Telegram

Writer: Cryptoflintcode