The month of February was a crazy month in the crypto world. Bitcoin dropped down to $6000 and it played havoc on all things crypto. Hashflare was no different, the further Bitcoin dropped, the less profitable Hashflare became and their maintenance fees became higher. So much so, I didn't reinvest BTC into my account for the entirety of February. As you can see in the following image, my last reinvest was January 25th.

So lets take a look at my initial investment and dashboard.

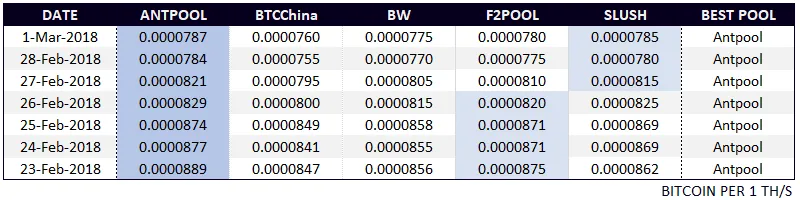

Because I didn't reinvest for the whole month of February I am still at 2.7 TH/s. I mined only on Antpool as it was the highest daily pool for the month. I am wondering if this is the best strategy and this month I think I will do 70% of the highest pool and 30% of the second pool. My reasoning is this, the two top pools are usually relatively close and one pool may be luckier than the other in solving a block resulting in higher rewards.

Now for the revenue. Even with BTC at $10,300 as of this writing, my daily return is only $2.23. My initial investment was $506 for a year contract with a current yearly return of $813. So in essence, $300 a year. So you have to ask yourself, is a $500 investment worth a return of $300? This does not include maintenance costs, listed below.

Quickest way to analyze this, with $10k BTC they are taking a 1/3 of your profits for maintenance. When it was around $7-8k it was half. So that $300 becomes $200 pretty quick. When BTC was at $15k my daily profits were over $5-6 and I was extremely happy with those returns.

So for the month of March, as long as BTC is above $10k I am going to reinvest every day and see where that takes things for the end of the month review. I hope this helps your decision making on whether Hashflare is right for you or not.

Antpool is the winner!!

Antpool for those who don't know, is one of the largest mining pools available and is owned by Bitmain. Creators of the popular ASIC miners such as the Antminer S9.