Hello dear readers, I would like to take this opportunity to share some contextual information about Bitcoin, namely that miners' bitcoin sales are falling to their lowest level in recent years, considering that miners are sending less Bitcoin to the exchanges.

The flow of bitcoins from miners, both into and out of exchanges, suggests that we will not see a capitulation any time soon, miners are trading their Bitcoin at minimal rates, unlike what might be expected in a bear market that has been going on for over a year now.

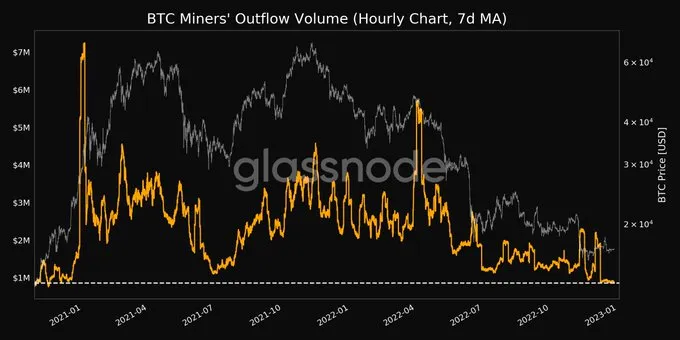

Bitcoin network tracking data from the firm Glassnode shows that the flow of bitcoins from addresses associated with miners has fallen to its lowest level in the last 2 years. Specifically, at the 7-day moving average priced in dollars, with volume just above $850,000.

This data suggests that miners are not moving the BTC obtained from their mining activity to exchange them for fiat money, something they normally do to take profits in bull markets or keep their operations going in bearish times like the current one.

The trend seems to be confirmed and, even, to take a broader dimension through another chart from Glassnode itself: BTC deposits from miners to exchanges have fallen to their lowest level in 5 years.

The 7-day moving average for these deposits has dropped to 2,581 bitcoins, the lowest in the metric since last February 2018. In other words, not only are they moving less BTC, but the BTC they are sending out is not ending up on exchanges for speculative trading.

The flow of miners' sales is usually associated with bitcoin price drops. Unlike traders and speculators, many times large farms must sell their BTC, even at a loss, to fund their operations. Particularly in bear markets as steep as the current one.

SOURCES CONSULTED

Glassnodealerts $BTC Miners' Outflow Volume (7d MA) just reached a 2-year low of $854,798.05. Link

OBSERVATION:

The cover image was designed by the author: @lupafilotaxia, incorporating image background: Glassnodealerts