Executive Summary

This report provides a comprehensive analysis of the altcoin cryptocurrency market in 2025, evaluating the best investment opportunities based on market performance, project fundamentals, expert opinions, and risk assessment.

Our research indicates that while Bitcoin remains the dominant cryptocurrency, several altcoins present compelling investment opportunities due to their technological innovation, growing adoption, and strong market positioning.

Based on our analysis, the top altcoin investment opportunities for 2025 are:

- Ethereum (ETH) - The leading smart contract platform with a mature ecosystem and ongoing technological improvements

- Solana (SOL) - A high-performance blockchain with significant institutional adoption and growing ecosystem

- Ripple (XRP) - A payment-focused cryptocurrency with improving regulatory clarity and institutional partnerships

- Fetch.ai (FET) - An emerging AI-blockchain integration project with exceptional growth potential

- Binance Coin (BNB) - An exchange token with a growing ecosystem and strong market position

Each of these cryptocurrencies offers unique value propositions and risk profiles, which are detailed throughout this report. Investors should consider their risk tolerance, investment horizon, and portfolio diversification strategy when allocating investments to these assets.

Market Overview

The cryptocurrency market in 2025 has evolved significantly from its earlier years, with increased institutional participation, regulatory clarity, and technological maturity. Key market trends include:

- Market Capitalization: The total cryptocurrency market cap has grown substantially, with Bitcoin maintaining approximately 50% dominance

- Institutional Adoption: 83% of institutional investors plan to increase their crypto holdings in 2025, with 59% allocating more than 5% of their assets under management to crypto

- Regulatory Environment: Improving regulatory clarity globally, with the US adopting a more crypto-friendly stance and the EU implementing comprehensive frameworks

- Technological Advancement: Significant progress in scalability, interoperability, and real-world applications of blockchain technology

- Market Sectors: DeFi, AI integration, and tokenized real-world assets (RWAs) have emerged as key growth sectors

Top Altcoin Analysis

- Ethereum (ETH)

Market Performance:

Market Cap: $244.31 billion

YTD Growth: +42.8%

Current Price: ~$2,000

Expert Price Predictions: $6,000-$10,000 by end of 2025

Project Fundamentals:

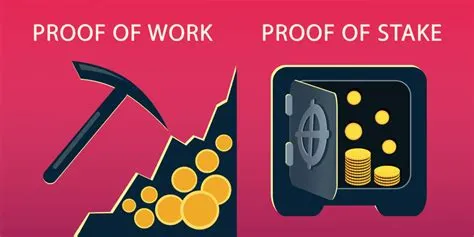

Technology: Leading smart contract platform with successful transition to Proof of Stake and ongoing scaling improvements through Layer 2 solutions

Development Activity: Largest and most active developer community in the blockchain space

Real-World Adoption: Widespread use in DeFi, NFTs, and enterprise applications

Ecosystem Strength: Mature ecosystem with robust security tools and standardized development practices

Strengths:

Dominant smart contract platform with network effects

Successful implementation of major upgrades (Proof of Stake)

Strong institutional backing and developer support

Growing Layer 2 ecosystem improving scalability

Risks:

Scaling challenges and high transaction fees on the base layer

Competition from more scalable Layer 1 alternatives

Potential regulatory scrutiny of staking mechanisms

Execution risk for future technical upgrades

Investment Outlook: Ethereum remains a strong long-term investment with significant upside potential as it continues to improve scalability and maintain its position as the leading smart contract platform. Its mature ecosystem and institutional adoption provide a solid foundation for continued growth.

- Solana (SOL)

Market Performance:

Market Cap: $70.99 billion

YTD Growth: +187.2%

Current Price: ~$150

Expert Price Predictions: $300-$500 by end of 2025

Project Fundamentals:

Technology: High-performance blockchain with exceptional transaction throughput and low fees

Development Activity: Growing developer ecosystem with significant venture capital backing

Real-World Adoption: Integration with PayPal for payments and Coinbase for Bitcoin DeFi

Ecosystem Strength: Rapidly expanding ecosystem across DeFi, NFTs, and gaming

Strengths:

Superior performance metrics (speed and cost)

Strong institutional partnerships (PayPal, Coinbase)

Growing user adoption with Phantom wallet downloads exceeding Coinbase

Effective positioning as a high-performance alternative to Ethereum

Risks:

History of network outages and reliability concerns

Centralization concerns with validator requirements

Competition from other high-performance blockchains

Past association with FTX/Alameda

Investment Outlook: Solana presents a compelling investment opportunity with its high performance, growing institutional adoption, and expanding ecosystem. Its integration with major financial players like PayPal and Coinbase positions it well for continued growth, though investors should be mindful of technical risks.

- Ripple (XRP)

Market Performance:

Market Cap: $137.77 billion

YTD Growth: +156.5%

Current Price: ~$2.50

Expert Price Predictions: $5-$10 by end of 2025

Project Fundamentals:

Technology: Blockchain-based settlement system for cross-border payments

Development Activity: Focused development on RippleNet infrastructure and CBDC initiatives

Real-World Adoption: Growing adoption for cross-border payments and remittances

Ecosystem Strength: Partnerships with traditional financial institutions and payment providers

Strengths:

Improved regulatory clarity following legal resolutions

Strong use case in cross-border payments

Institutional partnerships with banks and payment providers

First global XRP ETF launched in Brazil in February 2025

Risks:

Relatively centralized compared to other cryptocurrencies

Competition from CBDCs and bank-issued stablecoins

Ongoing regulatory challenges in some jurisdictions

Questions about whether Ripple's technology requires XRP

Investment Outlook: XRP has rebounded strongly with improved regulatory clarity and continues to focus on its core use case of cross-border payments. Its institutional partnerships and growing adoption make it a solid investment option, particularly for those interested in payment-focused cryptocurrencies.

- Fetch.ai (FET)

Market Performance:

Market Cap: $15.23 billion

YTD Growth: +215.3%

Current Price: ~$1.80

Expert Price Predictions: $5-$8 by end of 2025

Project Fundamentals:

Technology: AI-focused blockchain platform creating an ecosystem of autonomous economic agents

Development Activity: Explosive growth in developer activity as AI-blockchain integration becomes a major trend

Real-World Adoption: Integration with IoT devices and smart city initiatives

Ecosystem Strength: Growing ecosystem at the intersection of AI and blockchain

Strengths:

Leading position in the emerging AI-blockchain sector

Strong technical team with expertise in both AI and blockchain

First-mover advantage in autonomous agent technology

Alignment with broader AI industry growth

Risks:

Technical complexity of combining AI and blockchain effectively

Competition from both blockchain and traditional AI companies

Regulatory uncertainty around autonomous AI agents

Relatively new project with less established track record

Investment Outlook: Fetch.ai represents a high-potential investment in the emerging AI-blockchain sector. Its impressive growth and positioning at the intersection of two transformative technologies make it an attractive option for investors seeking exposure to innovative projects, albeit with higher risk.

- Binance Coin (BNB)

Market Performance:

Market Cap: $90.69 billion

YTD Growth: +28.4%

Current Price: ~$580

Expert Price Predictions: $800-$1,200 by end of 2025

Project Fundamentals:

Technology: Native token of the BNB Chain with EVM compatibility and high throughput

Development Activity: Continuous improvements to BNB Chain with focus on DeFi and GameFi

Real-World Adoption: Widespread use for fee discounts on Binance and in payment solutions

Ecosystem Strength: Growing ecosystem supported by Binance's resources and user base

Strengths:

Connection to Binance, the world's largest cryptocurrency exchange

Practical utility for trading fee discounts

Growing BNB Chain ecosystem

Regular token burns reducing supply

Risks:

Regulatory scrutiny due to close association with Binance exchange

Centralization concerns compared to more decentralized alternatives

Dependence on Binance's market position

Competition from other exchange tokens and Layer 1 platforms

Investment Outlook: BNB offers a relatively stable investment option with strong fundamentals tied to Binance's market position. While it may not offer the explosive growth potential of some newer projects, its established use cases and ecosystem provide a solid foundation for steady appreciation.

It then broke it down into risk/reward profiles.

Risk-Reward Profiles

Conservative Investment Profile (Lower Risk)

Allocation Suggestion: 50% ETH, 20% BNB, 20% XRP, 10% SOL

Rationale: This portfolio focuses on more established projects with stronger institutional adoption and lower relative volatility. Ethereum provides a solid foundation, while BNB offers stability through its connection to Binance. XRP adds exposure to the payments sector with improving regulatory clarity, and a small SOL position provides growth potential.

Expected Performance: Moderate growth with reduced volatility compared to the broader crypto market

Balanced Investment Profile (Medium Risk)

Allocation Suggestion: 40% ETH, 25% SOL, 15% XRP, 10% BNB, 10% FET

Rationale: This balanced approach provides exposure to established projects while allocating a meaningful portion to higher-growth opportunities. The core ETH position is complemented by significant SOL exposure for growth, with diversification across payment solutions (XRP), exchange tokens (BNB), and emerging AI integration (FET).

Expected Performance: Strong growth potential with moderate volatility

Aggressive Investment Profile (Higher Risk)

Allocation Suggestion: 30% SOL, 25% ETH, 25% FET, 10% XRP, 10% BNB

Rationale: This growth-focused portfolio overweights the highest-performing altcoins with substantial upside potential. The larger allocations to SOL and FET target sectors with exceptional growth (high-performance blockchain and AI integration), while maintaining some exposure to more established projects for risk management.

Expected Performance: Maximum growth potential with higher volatility and drawdown risk

Investment Considerations and Strategies

Timing Considerations

- Market Cyclicality: Cryptocurrency markets tend to move in cycles, with VanEck predicting a market peak in Q1 2025 followed by a correction and recovery later in the year

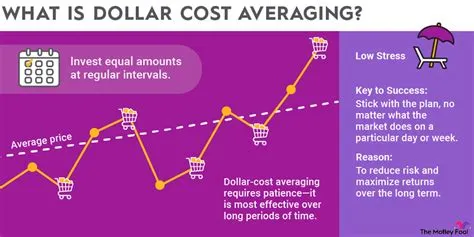

- Dollar-Cost Averaging: Consider implementing a dollar-cost averaging strategy to mitigate the impact of market volatility

- Halving Cycles: Be aware of Bitcoin halving cycles, which historically influence the broader crypto market

- Portfolio Management

- Diversification: Spread investments across multiple cryptocurrencies to reduce project-specific risk

- Rebalancing: Regularly rebalance your portfolio to maintain target allocations as prices fluctuate

- Risk Management: Only invest what you can afford to lose, given the high volatility of cryptocurrency markets

Technical Considerations

- Security: Use hardware wallets for long-term storage and reputable exchanges with strong security measures

- Staking Opportunities: Consider staking opportunities for ETH, SOL, and other proof-of-stake cryptocurrencies to generate yield

- Tax Implications: Be aware of tax implications for cryptocurrency transactions in your jurisdiction

- Regulatory Awareness

- Jurisdictional Differences: Understand the regulatory environment in your region, as approaches vary significantly

- Compliance Requirements: Ensure compliance with any reporting or registration requirements for cryptocurrency holdings

- Policy Monitoring: Stay informed about regulatory developments that could impact cryptocurrency markets

Conclusion

The altcoin market in 2025 presents significant investment opportunities as cryptocurrency adoption continues to grow and mature.

Our analysis identifies Ethereum, Solana, Ripple, Fetch.ai, and Binance Coin as the top altcoin investments based on their market performance, project fundamentals, expert opinions, and risk-reward profiles.

Ethereum remains the dominant smart contract platform with a mature ecosystem and ongoing technological improvements. Solana offers exceptional performance and growing institutional adoption. Ripple provides exposure to the payments sector with improving regulatory clarity. Fetch.ai represents an exciting opportunity in the emerging AI-blockchain integration space. Binance Coin offers stability through its connection to the world's largest cryptocurrency exchange.

Investors should consider their risk tolerance, investment horizon, and portfolio diversification strategy when allocating investments to these assets. The cryptocurrency market remains highly volatile, and a thoughtful, risk-managed approach is essential for long-term success.

The AI then provided a list of it's sources -

References

Gemini Trend Report 2025

Bitwise Asset Management: "The Year Ahead: 10 Crypto Predictions for 2025"

VanEck: "10 Crypto Predictions for 2025"

Chainalysis: "2025 Crypto Crime Trends"

Elliptic: "2025 Crypto regulatory and policy outlook"

Coinbase and EY-Parthenon Survey on Institutional Investment Trends

Forbes: "The Crypto Market In 2025: Crypto Demand Trends"

Glassnode Market Data on Altcoin Performance

Various cryptocurrency project documentation and whitepapers

I'm sure you'll agree a worthwhile exercise and whilst no-one can predict the future there is a lot of positivity to be gleaned from this report.