Economic policies must be regarded as war by other means.

After the First World War the ruling elite of Great Britain had illusions they could hold onto Empire. It is within this context we must understand the intrigue, speculative bubble blowing, defaults, devaluations, interest rate manipulations, deflations/inflations that are all part of the banking sector's arsenal.

Britain tried to re-establish the gold backed British Pound.

In April 1925 the Pound £ was restored to the pre-war gold standard at an exchange rate of $4.86 US dollars. This was supported by Lord Montagu Norman (the Bank of England), assisted by Benjamin Strong (New York Fed) and Hjalmar Schact (German Reichsbank).

However, following the war Britain was essentially bankrupt and her economy could not support the pre-1918 gold standard. After the war, gold was held mostly by the US and France (Russia held some too). Meanwhile British gold reserves had been almost exhausted. In fact, the UK went from an economy with a trade surplus to a country with war debts (owed to the US).

Trying to re-establish the gold-backed Pound had the effect of making British exports very expensive and her workers faced austerity and high unemployment as a result. The wage cuts of this period were a key factor in causing the General Strike of 1926 which was initiated to support the miners fight against wage cuts.

Another consequence of a high pound is that it became a straight jacket on development. As the world's reserve currency this proved to be a straight jacket not just for Britain but for the entire world. Indeed, world trade never recovered its' pre-war high in this period.

The Bankers Racket

In 1927 Britain experienced a balance of payments crisis whose main cause was due to the French asking for convertibility to gold. The solution to this problem was to further cut the wages of British workers. A policy known still today as austerity.

Meanwhile, the racket of the ruling elite was to use a high pound to maximise their purchasing power of global productive assets and resources. A high pound also increased British earnings in the field of insurance and shipping. All in all, this marked a decisive turn by the British ruling elite towards a financialised City of London dominating British and world trade.

Weak Dollar

Benjamin Strong was working on behalf of Norman in the US to achieve a weak dollar with easy credit and low interest rates. In the summer of 1927 the New York Fed lowered its interest rate from 4% to 3.5%. They were also buying US Treasuries in open market operations and as a result banks were flush with cash. This all helped stoke the stock market boom.

Norman and Strong actively encouraged the New York stock exchange speculation and the fermenting of a Bubble Economy. It's interesting to note that at this time the Federal reserve system (a collection of private banks) had not long been in existence. Formed at Jekyll Island in 1910 in complete secrecy. It was sold to Congress as a way to prevent depression, financial panics, devaluations etc.

Hoover is known to have said;

Panics in the future are unthinkable

One major consequence of the above policy was the ebbing of dollars from war damaged European countries where funds were needed for reconstruction. Instead they were channeled through the likes of JP Morgan and Loeb to invest in the US stock market.

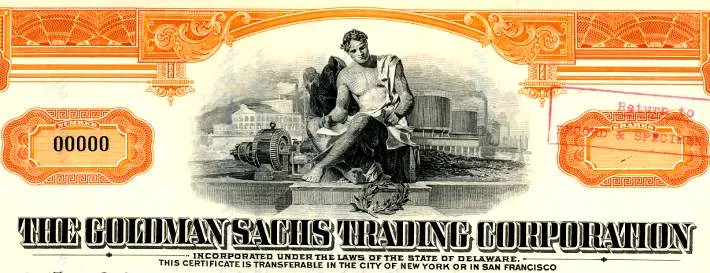

One example is the Trading Corporation set up in 1928 by Goldman Sachs. New shares were issued at regular intervals and were so massively subscribed that the stock just kept rising. Trading Corporation set up even more companies. Trading Corp made $550 million in 9 months without producing a thing, it didn't even trade.

It is fair to say that by 1928 many including Norman and Strong were deeply worried. They were aware that the rigid gold standard they had established couldn't stand for too much longer. The New York stock market was on fire and in vain they issued secret warnings.

All through ought the year 1928 the Bank of England bled gold to the US due to the much higher interest rates to be had in the Wall Street brokers market.

1929

In February 1929 the Bank of England raised its rate from 4.5% to 5.5% in an attempt to repatriate gold home. However, they continued to bleed gold to the US and France.

At a meeting of City of London bankers in early September 1929 the decision was announced by Norman that the American bubble must burst and interest rates were to be raised by the end of the month.

On 20th September 1929 the Clarence Hatry group 'scandal' broke. Scandal meaning insolvency, fraud and forgery. In the autumn of 1929 Hatry was denied bridging loans for a purchase of United Steel Company. He even paid a begging visit to Norman himself.

However, Norman allowed Hatry to fall and then used the Hatry bankruptcy and the concurrent London stock market fall to announce on the 26th September a shock interest rate rise from 5.5% to 6.5%.

The intended effect was money flooding back into Britain pulling the rug out from under Wall Street and precipitating the financial crash of 1929. The London rate had not been as high as this since 1921. This rise was repeated by the central banks of countries close to Britain. All resulting in money being sucked back across the Atlantic.

In tandem media outlets began signaling the end of the New York stock market boom. This included Philip Snowden of the Labour Party, wheeled out to repeatedly declare the market a "speculative orgy".

On Monday 8th October the Financial Times quoted the President of the American Bankers Association;

Bankers are gravely alarmed over the mounting volume of credit being employed in carrying security loans, both by brokers and individuals.

The stock market was not only held up by cheap money, it was held up by belief. The psychological knocks to the stock market bubble were tested and held in September and then again in early October. However by the end of October shares had declined in value by 37%. The bottom though was only reached in 1933 at an 80% collapse.

The Bank of England didn't wait long after the Wall Street Crash to start reducing its rates again. October 31st from the 6.5% high to 6% and then the next two months see further cuts to 5%. Cuts all through 1930 to reach a bottom rate of just 2.5%.

In 1931 the MacMillan Report publicly disclosed the fact that Britain was for the first time an international short term debtor and that the Bank of England's reserves were inadequate relative to her external short term liabilities. In other words she was bankrupt, and this of the guardian of the gold standard.

- All similarities to events, companies and persons of the present is purely coincidental and this work is in no way meant to suggest we can draw parallels of the bankers shenanigans of yesterday with our erstwhile bankers of today.

Sources

Surviving the Cataclysm, Webster Tarpley

The Great Crash, Selwyn Parker

https://www.historic-uk.com/HistoryUK/HistoryofBritain/Great-Depression/

Secrets of the Federal Reserve by Eustace Mullin