After nearly a month of mayhem in the UK, the City of London has killed off the Tories economic plans. We say goodbye to another chancellor and time is ticking on the Truss regime. Not really an indicator of stability is it?

Of course what they really mean by stability is wage stability. Stop those damn workers going on strike and asking for pay increases. Even in Britain there has been an increase in industrial militancy and the prospect of coordinated action taking place this winter.

Meanwhile, latest inflation figures released in the UK put inflation at 10.1%. Look at shadow stats by John Williams though, and his inflation figure of 23% feels much more in keeping with lived experience.

Trussonomics

Liz Truss is seen as having blown up her own government with the package of unfunded tax cuts and energy price guarantees. Now she is PM in name only as essentially BlackRock is now dictating to the British government.

It was a major source of embarrassment to be dressed down by the IMF (or International Mafia Fund!) Now the UKs political class are spouting austerity policies. Accompanied by the usual responsibility to balance the books. For example, the energy subsidy which was meant to last for two years, has now been cut to six months.

The mini-budget was only the spark. The root of this particular crisis has been the rate at which the BoE has been raising it’s rates. Those with variable rate mortgages in the UK have seen their rates increase six times this year with another slated for this month.

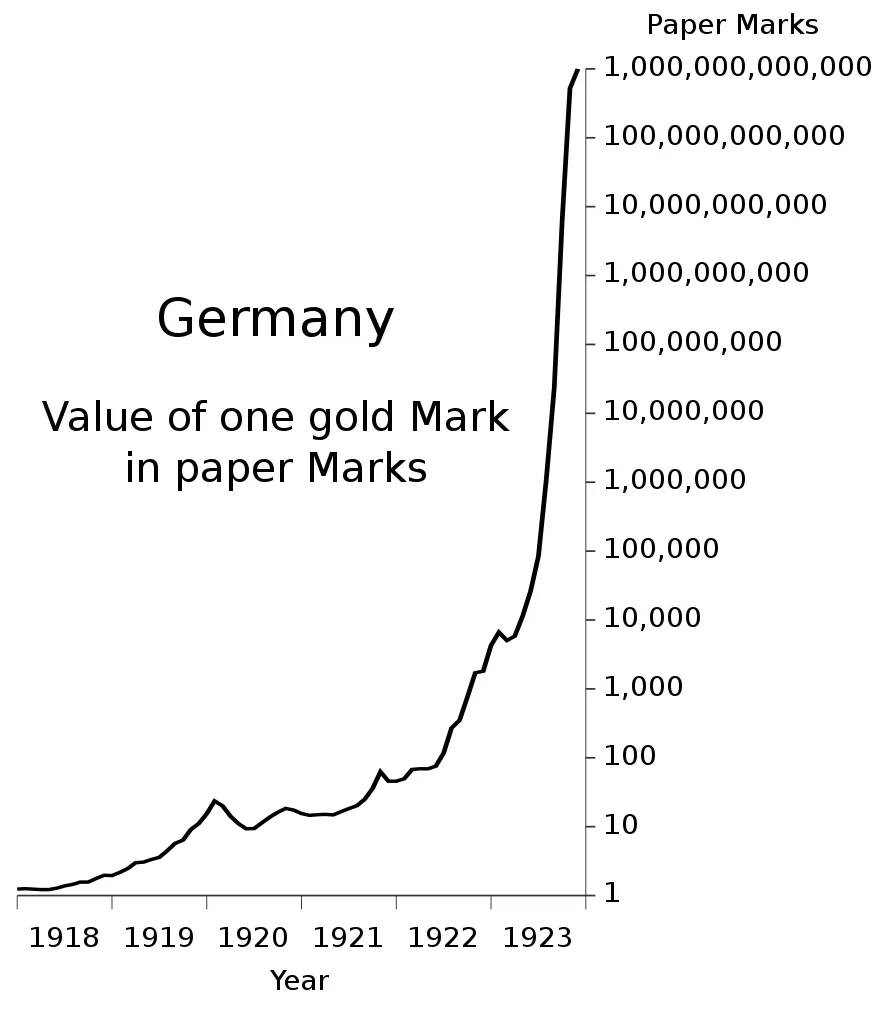

This has done nothing to dent inflation. Which makes sense when you comprehend that inflation is the result of a falling/failing currency which has been printed to infinity by the BoE! They had promised they were going to do QT (quantitative tightening) less than a week before they were forced to U-turn and return to QE (specifically bond buying to support the UK 10 year gilt).

More money printing

Printing money and raising interest rates is the equivalent of driving a car and putting your feet on the accelerator and brakes at the same time. This crisis is really starting to take shape before our eyes. It has moved from alternative channels to being covered in the mainstream media and that is significant.

This has created all the conditions for a deep recession with high inflation. The worst of both worlds.

At some point all this debt had to be unwound. Are we at this inflection point?

Rumours are Credit Suisse are in big trouble and may well have been bailed out by the Fed along with 14 other European banks, identities unknown. Wherever you look in the world the debt is enormous – and so are the derivatives traded off that debt. Unwinding $600 trillion of over the counter derivatives will cause the entire system to collapse.

No way round that. The debt bubble will burst.

Inflation will get progressively higher in order to inflate the debt away and dissolve Western governments from bankruptcy. This has always been the intention.

We could easily wake up one Monday morning. Black Monday they’ll call it. The stock market has collapsed by 80%. The 10 year bond has peaked at 7%. Inflation also hits a peak of 40%, but nobody believes what the authorities have to say anymore. Banks refuse to lend credit to each other let alone anyone else.

Governments will be at panic stations as the entire global financial system implodes. Calls to close the markets will be made. Banks and ATMs will shut down. Nobody knows when or if they will reopen.

Supply chains will collapse. Shops are running out of products. People are now at panic stations. Desperate, with no cash, they will loot and burn. Unable to pay their mortgage they will even be thrown out of their homes or they will sell and rent them back from a private institution.

Remember you will own nothing and you’ll be happy.

Why will people be happy?

Well after months? Years? Of higher and higher inflation and supply shortages, and going cold in the winter, and increased social unrest and political instability, people will be desperate (wouldn’t say happy). They will be desperately happy for the “solution” as offered by the Central banks.

Here’s the spiel.

With our Central Bank Digital Currencies we can control things. We can control the rate of inflation. We will return stability to the markets. Control being the optimal word here.

By raising interest rates central banks will crush the economy. This will most likely be followed by a bond market crash. As in 2008 will this be the catalyst for even more money printing, the like of which we haven’t seen before.

The only real question is when? Well this has been a process, but one that is definitely speeding up. It’s true everything could unravel extremely quickly. Are Central banks ready to push the button with their CBDBs or are they still experiencing technical difficulties?

At its core this is a debt based economic system. Every scheme imaginable has and will be utilised to pull cash into the present. They must continue to inflate the debt at all costs. The cost is hyperinflation and ruination for the country.

The recent strength of the dollar is only a reflection of the growing weakness of all the other currencies as they are in freefall together. How long have you heard it said that the US dollar will come to be seen as the least dirty shirt in the laundry basket. This is where we are at now. Perhaps US banks maybe in slightly better form, but can they resist against a wave of bankrupt European banks? How about the collapse of the Bank of Japan?