Market Overview

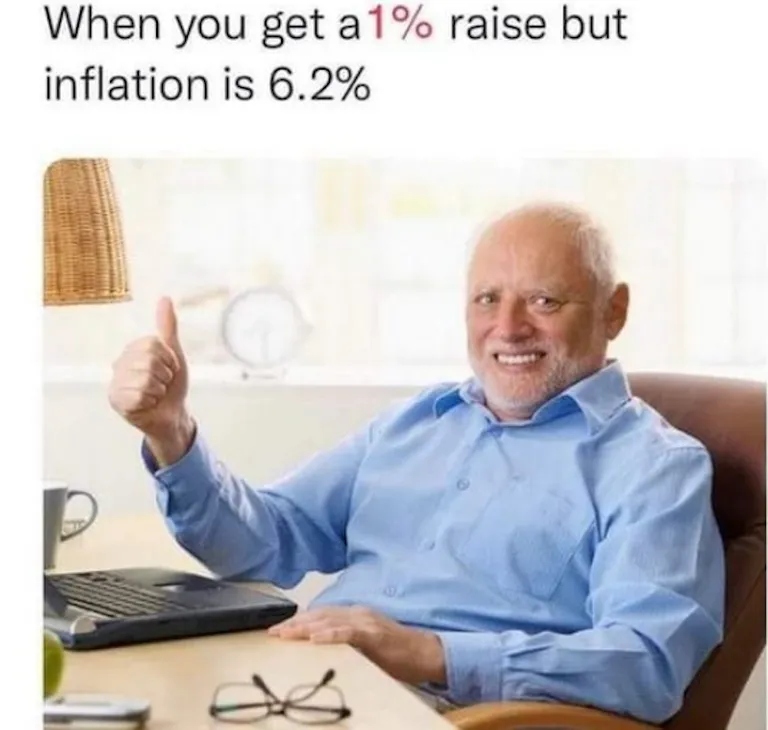

There is a serious disconnect between talks of a strong economy and ordinary day to day life.

A strong economy is measured by the ‘health’ of the stock market by using indicators such as the FTSE in the UK. Currently though they stand in stark contrast to the experience of the person on the street. On one side we have roaring prices reaching all time highs, on the other, a debt burdened, inflation hit Joe Public.

The US stock markets are racking up one of the strongest first quarters in 75 years. Furthermore Wall Street are betting things will go higher. Providing nothing major happens that is, which in our current world is a difficult call.

The Bank of England are warning markets not too price in too many rate cuts citing strong wage dynamics. Although these wage rises haven't kept pace with inflation. However it is Jerome Powell at the Fed who directs the other central banks, and he has been sounding very dovish.

This is, of course, an election year in the US. The Fed desires to keep things stable and wants to see the current office holders re-elected. To that end they need to make voters feel richer and so they will be bringing down interest rates, quite likely starting in June.

This will cause the stock market to keep fueling a boom. However the ordinary person will continue to experience the real 'dragflation' that is happening on the ground. I.e. declining economic growth and rising inflation.

To keep up with the price inflation people have gone further into debt which at the same time has gotten more expensive as rates have risen from roughly 0% to 5% in quick succession. Credit cards are routinely charging 20% plus. Together the major credit card companies have doubled their profits over the last ten years to $92 billion.

This is all without mentioning the impact Covid19 had on many, especially trades people and small businesses. Many people had to dig deep into their reserves to cope with the Covid19 era. As a result personal savings have plummeted.

Paying more for less.

The real fear for concern for many is inflation. Indeed, when interest rates are lowered, is that a signal that the fight against inflation is over?

It is hard to believe official figures haven’t been manipulated to manage perception because when inflation is running too high it becomes a lot more noticeable. For example, for a service such as physio, you can now be paying double for half the time.

Also take for example food shopping. It’s an essential and takes up a higher proportion of a poor person’s budget. As the prices have been rising each and every time you go shopping it becomes very noticeable and impacts how much discretionary spending money people have. After all there’s a limit to how much money people can spend into the economy.

Retail profits have risen due to rising prices rather than sales growth.

When it’s difficult to determine the health of an economy just look at bankruptcies and redundancies. Employers in the US recently announced nearly 85,000 redundancies. The highest February number since 2009. Since the start of the year the tech sector in the US has shed 50,000 jobs.

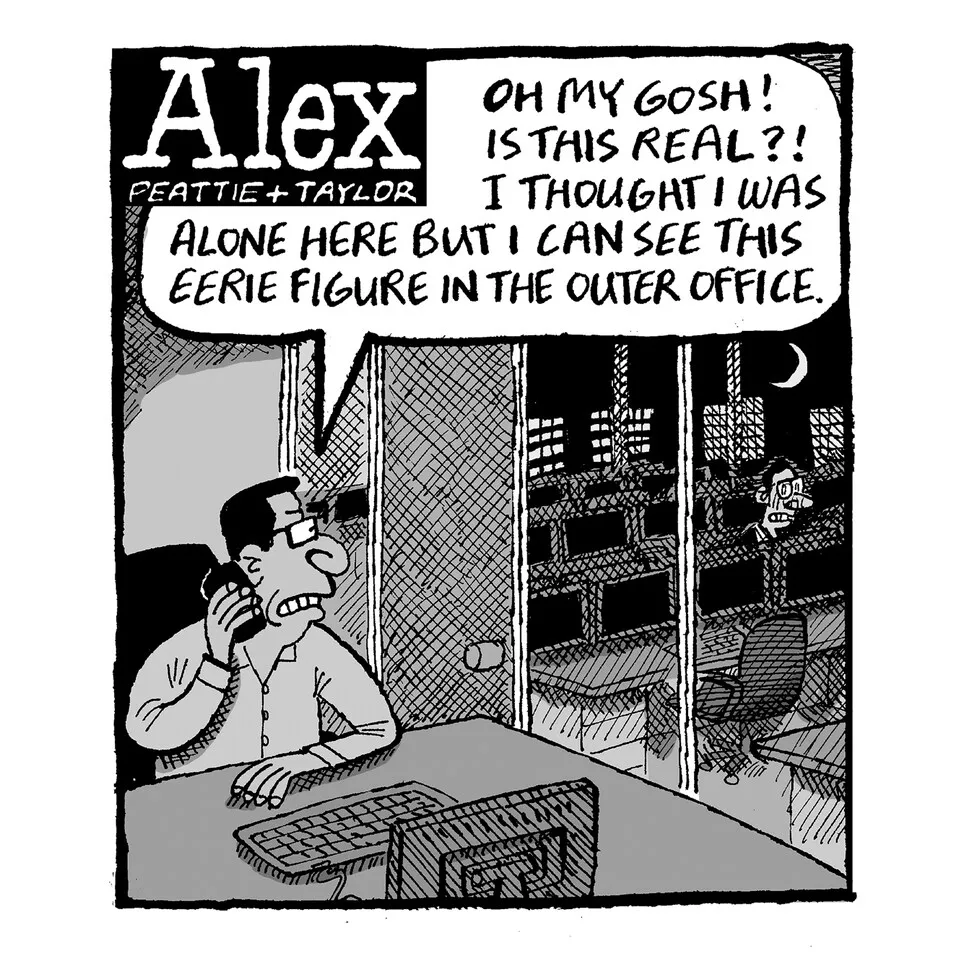

Waiting in the wings to make its entrance on the stage is commercial real estate.

The office sector is in deep trouble. All those empty offices during the plandemic. As companies adjusted to working from home there was not that 100% return to normality that had been anticipated. Now we are looking at 25% non-occupancy rate in New York which according to Moddy's is the highest since 1979.

This is similar in big cities across many countries. As the offices are in trouble so are the banks that lent the commercial real estate market the money to invest.

This is most likely the source of the next great banking crisis to happen in a city near you soon.

New York photo public domain

There is always the safe haven of gold when inflation rears it’s ugly head. Therefore gold should see a good year in 2024. Even if there’s some major event gold should still do well. It’s easy to buy and in the UK British-made is Capital Gains Tax free. Due to tax implications in the UK gold is a better prospect than silver, but silver does has the affordability factor.

Naturally, writing here on Hive I am also in favour of crypto currencies. So long as the juice is flowing to the stock market some of it will find itself to the crypto market. Expect to see BTC trending upwards. How high will it go?

Bitcoin Chart from coinmarketcap.com