Inflation is in the news of late, and there seems to be a lot of misunderstanding about what it is, what causes it, how it affects us, and how to fix the problem. Put simply, we have a given supply of money, and a supply of goods and services. The economy trends toward an equilibrium as market actors buy, sell, save, and invest. Of course, there is always a degree of fluctuation as people err in calculation, trends shift, technology changes, and so forth, but there are no pressures that would result in a systemic change in prices aside from minor shifts in aggregate supply and demand. However, when government injects new fiat money into the system, this changes drastically.

All else being equal, when there are more dollars chasing the same goods and services, the prices must adjust to reflect this new money. We tend to think of money and wealth as synonyms, but what we really value are those goods and services. No new wealth was created, just new currency. The rise in prices is the consequence of fiscal policy, not the cause demanding new policy to be implemented.

This current crisis is not because everyone got a few "stimulus" checks during the COVID crisis. No, there was a lot more fiat money creation than just that. The stimmy was just the bait to buy public support for the latest disastrous manifestation of the politician's syllogism. Those bills dumped vast sums of money into the pockets of political crony corporations and special interests, the first alone totaling about 10% of US GDP.

When this kind of spending, debt, and inflation occurs, the effects of the new money are not instantly reflected across the economy. The first to get it can spend at the old prices. Prices then begin to rise in various market sectors based on these signals, sometimes higher than the pure inflation rate as demand spikes. Those of us at the bottom of the economic ladder must ride out these fiscal storms as best we can while we wait for a new equilibrium to arise and our wages to adjust.

But all else is not equal. In addition to "stimulus" inflation, we are also facing a supply chain and production crisis. Two years of lockdowns led to production delays, shipping logjams, bankrupt small businesses, unemployment, and more. Now we also have more than a month of war pressure in Ukraine and the looming threat of global nuclear annihilation, depending on how stupid people in power get. I am not confident they will be sane.

Of course, there are a few favored scapegoats every time inflation concerns are raised.

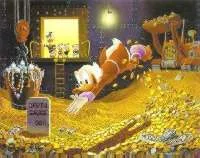

"The rich are just stockpiling money!" Except no, they do not have Scrooge McDuck pools of money. Those with money to spare can leverage that wealth through investments. They pour it into their businesses, invest in other ventures as entrepreneurs, and so forth. Of course, it also seems they have been dumping money into real estate, contributing to the myriad factors driving housing costs sky-high. If they were just sitting on that money, it would actually mitigate inflation by removing money from circulation, increasing the relative value of that which remains.

"Big Oil is raking in money hand-over-fist, and energy runs the economy!" While a key commodity like oil can affect the economy, it is not a root cause of systemic inflation. Prices are signals to the market about supply and demand, and market actors adapt well when those signals are not being distorted. When the value of the dollar falls, higher numbers don't mean as much as you might think. Additionally, in the US, the government makes far more in taxes than Big Oil makes in profits, but no one wants to consider that aspect of the equation lest it raise uncomfortable political questions as tax day looms in the US.

For broader complaints about "The 1%" and wealth concentration, check out the charts at wtfhappenedin1971.com. and the strange correlation of so many factors with Nixon's total decoupling of the dollar from gold. The fiat financial system is designed to work this way,or else this is a happy accident for the political class at our expense. Either way, crypto and bullion are the best solutions available to us.

"But the Great Depression had deflation, so deflation is bad!" Deflation, or falling prices, is a correction in the market when distortions arising from inflation and artificial interest rates collide with the real state of the market. When supply outpaces demand, prices must fall to the market clearing rate. Instead of seeing the situation as the crisis, the good economist examines why that distortion occurred.

For further reading, I recommend Economics in One Lesson by Henry Hazlitt, and What Has Government Done to Our Money? by Murray Rothbard. Neither are especially long, but are superb stepping stones toward greater understanding of how the market works and what unintended consequences are likely to arise when the political class intervenes even if their intentions are pure as the driven snow.

Money chart image credit

Scrooge McDuck image credit