After weeks of upward momentum, Bitcoin hits a rough patch as macroeconomic headwinds and market sentiment shift.

Bitcoin has faced significant pressure following a series of adverse macroeconomic indicators. After the U.S. Federal Reserve maintained its stance on interest rates last Wednesday and labor market statistics fell short of expectations on Friday, investor sentiment experienced a sharp decline. At the time of this writing, Bitcoin is trading nearly $10,000 below its peak of $123,300. Currently, there is little on the economic calendar to indicate that a turnaround is on the horizon.

From Euphoria to Reality Check

To provide context, Bitcoin has experienced a remarkable rally since its lows in April. This surge fostered a sense of complacency among investors. Risk was no longer viewed as a significant concern, and optimism prevailed throughout the market. However, last week delivered a sobering reality check. The market was abruptly awakened from its euphoric state by disappointing data and a central bank that showed no inclination to change its course. The narrative shifted dramatically—from one of boundless growth to one of cautious reassessment.

Still No Reason to Panic (Yet)

That being said, it is not entirely bleak. The broader U.S. economy continues to grow, albeit at a more measured pace. While the labor market exhibits signs of cooling, it remains relatively robust. The current downturn in Bitcoin does not necessarily indicate an imminent crash; it may simply represent a natural correction within an overheated market. Nevertheless, the challenge this week is that there is a scarcity of economic data scheduled to influence sentiment or act as a catalyst for recovery.

Source: The Guardian

What is on the Macro Calendar?

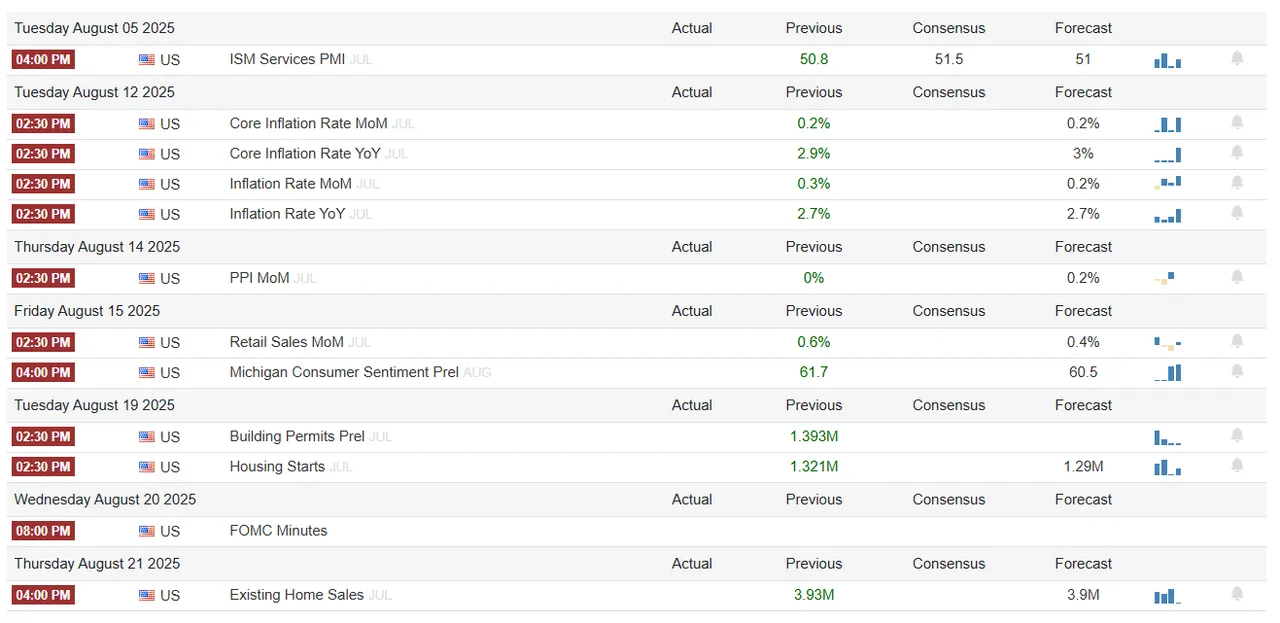

The only significant data release this week is the ISM Services PMI on Tuesday, which serves as a crucial indicator of the U.S. services sector's health. Although it is important, it is improbable that it will significantly influence the markets or trigger a complete rebound in Bitcoin.

Consequently, we may be entering a phase of additional price weakness; however, this should not be interpreted as the onset of a prolonged bear market. Rather, consider it as the market taking a moment to recuperate after a lengthy rally.

Attention on August 12: The Upcoming Major Catalyst

At present, all attention is directed towards Monday, August 12, when the U.S. will publish its Consumer Price Index (CPI), a vital gauge of inflation. Two days later, on August 14, we will receive the Producer Price Index (PPI), followed by Retail Sales data on Friday, August 16.

These reports will provide new insights into the American economy's health and may offer the clarity necessary for Bitcoin (and the broader markets) to regain momentum.

Source: Trading Economics

A Return to Safety—Once More

In the meantime, we may observe short-term panic among retail investors, a phenomenon we have seen numerous times in the past. Recall April during the escalation of Donald Trump’s trade war, when uncertainty prompted widespread selloffs.

While a drastic drop of over 20% like that incident is unlikely at this time, the overall sentiment is more cautious, and some investors are moving away from risk assets. Bitcoin is being liquidated in favor of traditional safe havens such as gold and U.S. Treasury bonds. This minor "flight to safety" doesn’t mean the crypto bull market is over—but it does highlight how fragile confidence can be, especially when there are few short-term catalysts on the horizon.

Final Reflections: No Emergency, Yet No Support Either

Bitcoin is not facing a crisis; however, it is also not receiving any assistance this week. In the absence of significant economic indicators or optimistic triggers, the prevailing weakness may continue. The determination of whether this is merely a fleeting decline or the onset of a more profound correction largely hinges on the forthcoming inflation and consumer spending data.

At this moment, investors should remain vigilant without succumbing to fear. This may be an opportune moment to evaluate risk, reassess entry points, and—most crucially—steer clear of panic-selling amid short-term fluctuations.