Bitcoin has been trading within a limited price range for several weeks now. Once filled with bullish enthusiasm and optimism, the market seems to be losing its momentum. While the sentiment not long ago was leaning towards euphoria, today, skepticism and hesitation are re-emerging—and much of this is due to increasing macroeconomic and geopolitical uncertainty.

A Stagnant Market and Diminishing Momentum

Despite a robust beginning to the year and several significant rallies across crypto assets, Bitcoin now appears to be trapped in a holding pattern. Bulls are demonstrating less conviction with each passing day, while bears seem to be gaining confidence, gradually intensifying their selling pressure.

This constricting range indicates that the market is at a pivotal point. Investors are uncertain whether to push higher or prepare for a possible reversal. Much of this uncertainty is not merely technical—it is macroeconomic.

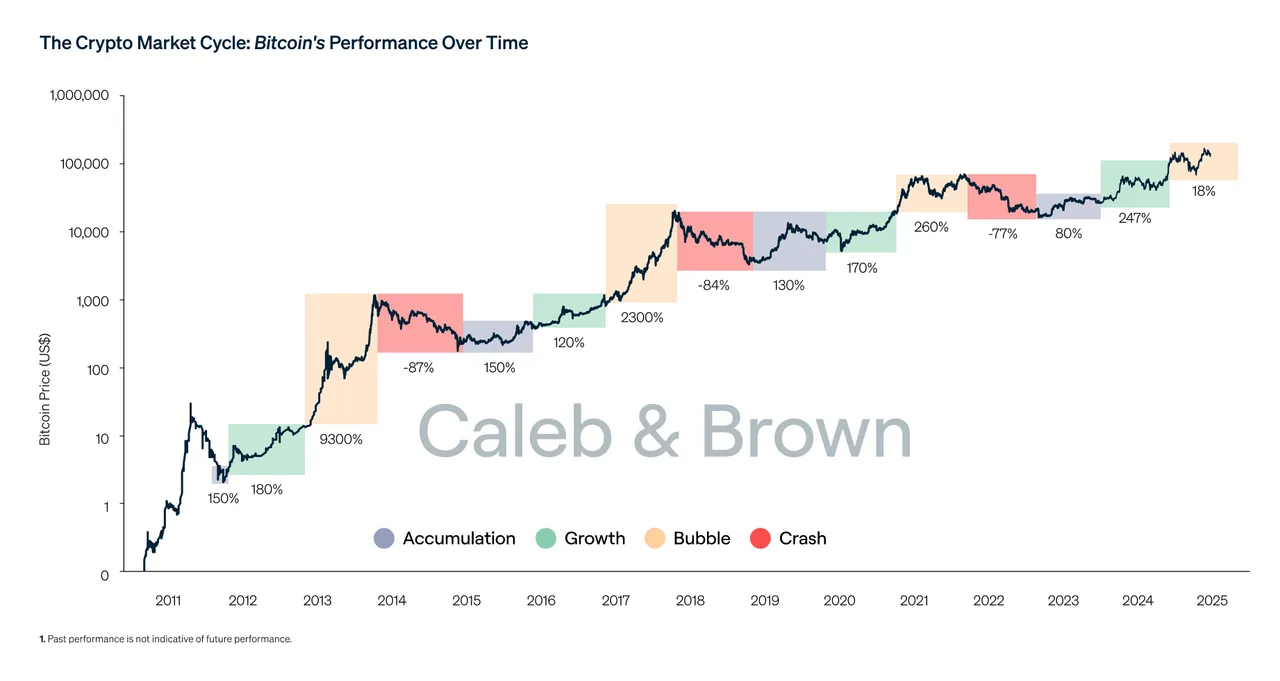

Source: Caleb and Brown

The EU–US Trade Agreement: An Unclear Situation

A significant factor contributing to this indecision is the ambiguous status of global trade agreements—especially the developing trade deal between the European Union and the United States.

Recent news regarding this agreement has been mixed at best. Initial reports indicated that the U.S. dollar would gain and that the deal might be disadvantageous for the EU. However, as more details (or the lack thereof) have emerged, it has become clear that no solid, legally binding agreement has been established.

Even more concerning, Washington and Brussels appear to interpret the same negotiations in completely different manners. This lack of clarity is not only undermining confidence in the trade deal itself but also reflects broader dysfunction in international economic policy.

Conflicting U.S. Policy Actions

The contradictory nature of U.S. economic policy adds to the existing confusion. For example, former President Donald Trump advocated for the revival of domestic manufacturing while simultaneously imposing high tariffs on raw materials—actions that directly elevate input costs for American manufacturers.

Although tariffs generate government revenue, they also lead to increased consumer prices and put pressure on supply chains. The mixed messages from these actions raise questions about the sustainability of growth and underscore the unpredictable character of the current economic strategy.

Source: Le Monde

Bitcoin and the Risk-On Climate

In parallel, Bitcoin’s performance has closely followed the broader risk-on sentiment observed in global financial markets. In recent months, not only has Bitcoin experienced significant gains, but other riskier assets such as Ethereum and XRP have also seen notable increases. This rise in risk appetite is driven by several interconnected factors:

- A robust U.S. economy: Currently, there are few indications of an imminent recession. Consumer spending, employment, and economic output remain strong, prompting investors to embrace greater risk.

- Ongoing U.S. budget deficits: Fiscal responsibility appears to have been sidelined. With the U.S. government continuing to incur substantial deficits—and a lack of willingness for austerity—investors are growing cautious about the long-term stability of the dollar. Consequently, many are shifting towards scarcer assets like Bitcoin and equities.

These combined factors have sparked a significant rally, yet there are increasing indications that this favorable trend may be nearing its conclusion.

Indicators of a Market Peak?

A notable trend currently emerging in the cryptocurrency space is the proliferation of Altcoin Treasury Companies. These entities are amassing significant quantities of Ethereum and various altcoins, akin to the strategy employed by MicroStrategy in building its Bitcoin treasury.

While this development may be seen as a sign of increasing institutional confidence in the crypto market, it also reflects a pattern historically observed near market peaks. In past cycles, new financial entities often arise just as market enthusiasm reaches its zenith. These companies might be acquiring assets at double their actual value, wagering that the upward trend will persist. As long as liquidity remains abundant, their gamble could prove successful.

However, such speculative activities also contribute to market fragility. When asset valuations diverge excessively from underlying fundamentals, corrections can occur abruptly and with significant impact.

Concluding Thoughts: Are We Approaching the Peak?

The narrow trading range of Bitcoin, combined with macroeconomic uncertainties and exuberant altcoin activity, indicates that we may be approaching a critical juncture. This does not imply that a market crash is on the horizon—but it does suggest that a degree of caution is advisable.

The forthcoming major movement in the market may hinge on various factors: the clarity (or ambiguity) of global trade policies, changes in U.S. fiscal strategies, and the overall liquidity landscape. In the meantime, investors should remain vigilant, adaptable, and cautious about excessive exposure.