Note: All images were screenshot by me from Poloniex Futures Contracts

Introduction

Poloniex Future contracts is one of the amazing features of Poloniex exchange, I am going to highlight it's critical points -

- What is Future contracts

- What is Perpetual contracts

- Trade

- Market

- Position

- Advantages

- Disadvantages

- Conclusion

Futures

- Futures: are the agreements were you buy or sell currencies and financial assets at a predecided price and time, which you may settled it in cash or physically. Futures is also known as FUTURES CONTRACTS. It a trading platform that you interacting with the contract that are representing the asset and not the asset itself. When the contract is executed, then the exchange of the that asset take place.

Poloniex perpetual contracts table

Poloniex perpetual contracts table

Perpetual contracts

- Perpetual contracts: are like futures contracts but have no expirations time. In perpetual contracts you can hold a position for as long as you desired. The perpetual contract price is based on index price, that is to say, that perpetual contracts price are determined by spot markets.

- Trade: Where you open or close a long or short position

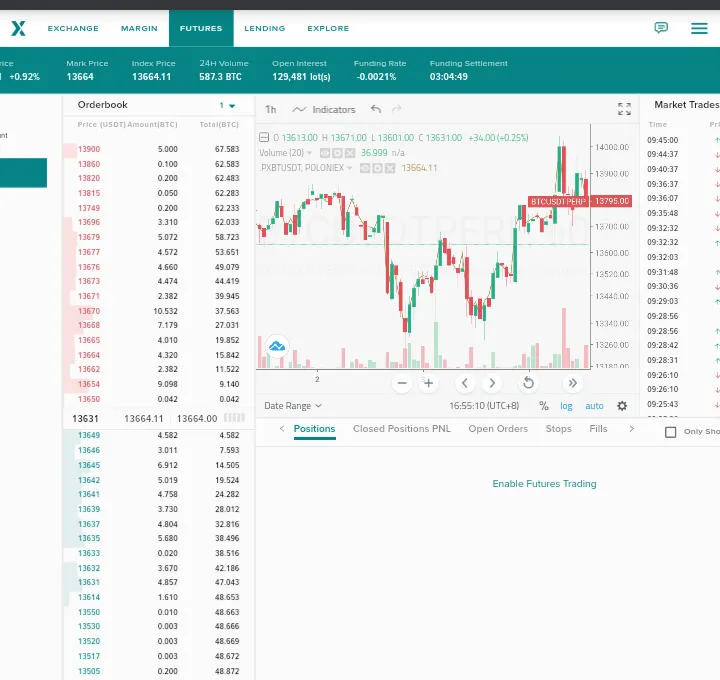

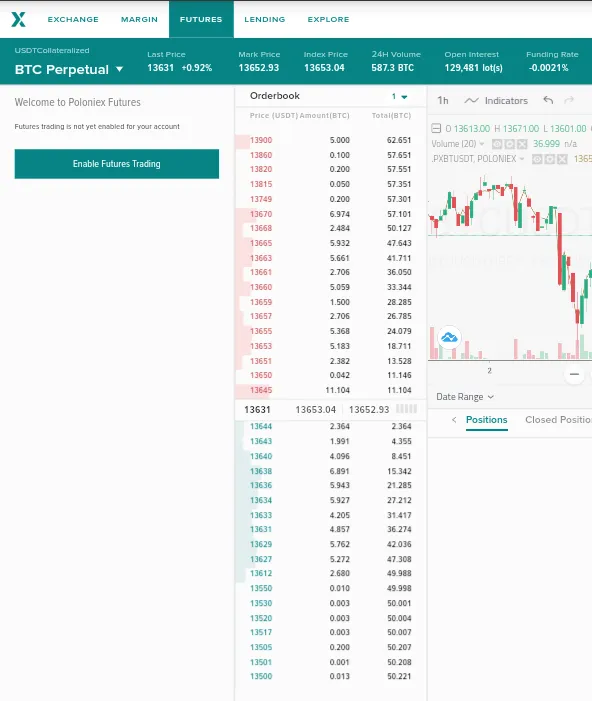

- Market: On the market interface Poloniex Futures provide you with a candlestick chart, market chart, recently trade list and orderbook on it trading interface to display changes for you.

- Positions: The position area are where you check your open positions and order status.

Trade

a) Log In or Sign Up

Log In: A user that have a Poloniex account, log inhere

to start trading on Poloniex Futures

Sign Up: A user that do not have Poloniex account, should sign uphere

and verify your account to begin trading on Poloniex Futures

b) Enable Futures Trading

To start trading on Poloniex Futures, after you have logged in, you have to enable futures trading. Enable it by click the button Enable Futures Trading

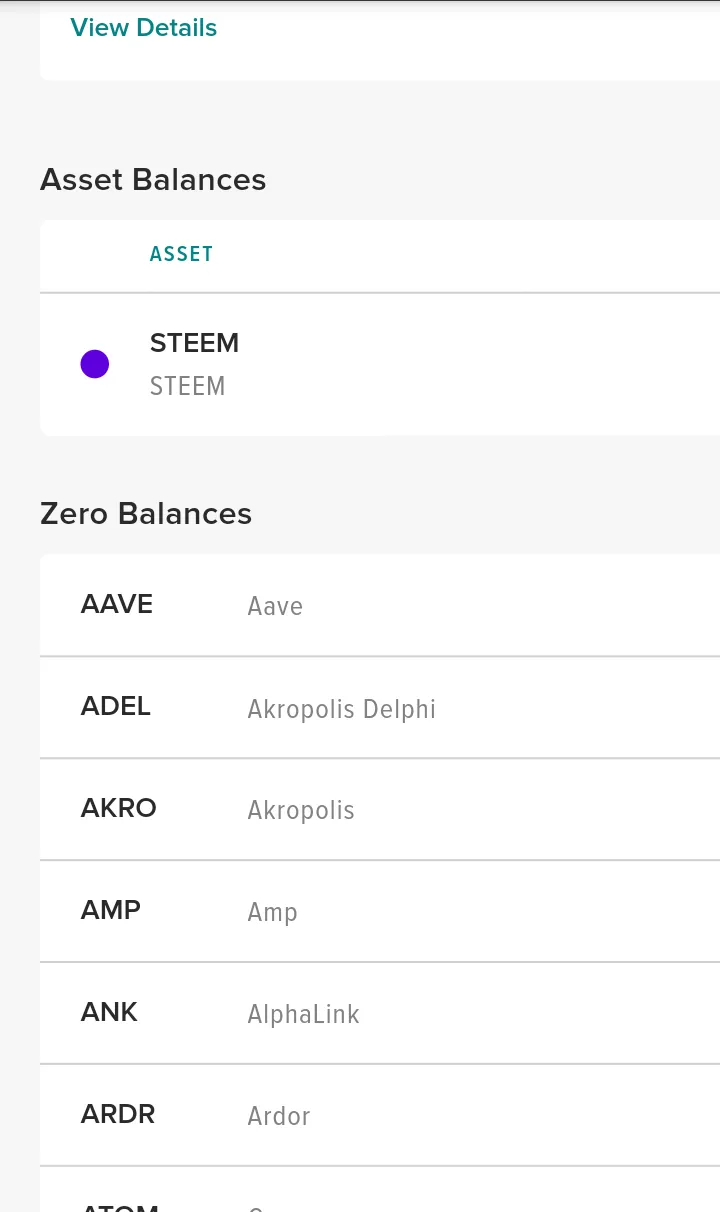

c) Assets and storage

How to check your assets balance on Poloniex, navigate to the right top click on Wallet and then click on Balance and your assets balance will be displayed to you.

When your balances page is displayed to you, all assets held within your Poloniex account can be checked, such as your exchange wallet, lending wallet, margin wallet, and futures wallet.

To start trading on Poloniex Futures, you will fund your Poloniex Futures account. Go to the transfer balances page and transfer USDT from any of these wallets, exchange, lending, or margin wallet to your futures wallet.

Market

To Place an order

Placing an order on Poloniex Futures exchange, you need have to select the order type, leverage, and then enter the amount.

Order Type

Poloniex Futures contracts has three types of orders which are : 1) limit order, 2) market order, 3) stop order.

Limit Order : A limit order is used to pre-indicate the price to buy or sell an asset. Placing order on Poloniex Futures, you will need to enter the price and amount of order and click Buy/Long or Sell/Shortcomfirm placing of the limit order.

Market Order : A market order is an order where you buy or sell the assest at the current market price. Placing order on the futures exchange, you will need to enter only the order amount and click to comfirm Buy/Long or Sell/Short a market order.

Stop Order: This is an order that is triggered only when the given price reaches the pre-specified stop price. On the futures exchange, you will need to select the trigger type and then set stop price, order price and the amount to now place a stop order

Leverage

Leverage is used to boost your gains. When your select a higher leverage, your earnings potential will be higher. Also the higher you leverage, the higher your chance to loss.

Advanced Settings

Poloniex Futures contracts has provision for advanced order settings such as Post Only, Hidden,and Good till cancel, Immediate or cancel etc

Buy/Long & Sell/Short

With futures contracts, you will need to enter a long position or a short position

When you select long position, you will make profit if the price of the asset increases

When you select short position, you will make profit on a short position if the price of the asset decreases.

Cost This is the amount of margin that is required to execute an order.

Position

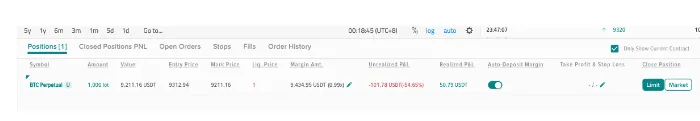

Position Monitoring

When your order is executed, you can monitor your order by checking the details of your position in the Open Positions area on the exchange.

Quantity: This is the number of contracts in an order.

Entry Price: The is the average entry price of your current position.

Liquidation Price: This is the estimated price by which your position will be liquidated.

Unrealized P&L: This is the unrealized profit and loss of your current positions. The profit/loss will be realized as you closing your position.

Realized P&L: This is the realized profit/loss of your position.

Margin: This is the minimum amount of funds that you must hold to keep a position open. Whenever the margin balance drops down below the maintenance margin, immediately your position will now be liquidated.

Auto Deposit Margin: When you enabled Auto Deposit Margin mode,

funds that is in your Wallet will be added to your current positions whenever a liquidation occurs in a bid to prevent your position being liquidated.

Take Profit/Stop Loss: When Take Profit or Stop Loss is enabled, the system will automatically perform the take profit and stop loss operations to help mitigate any risk and/or loss.

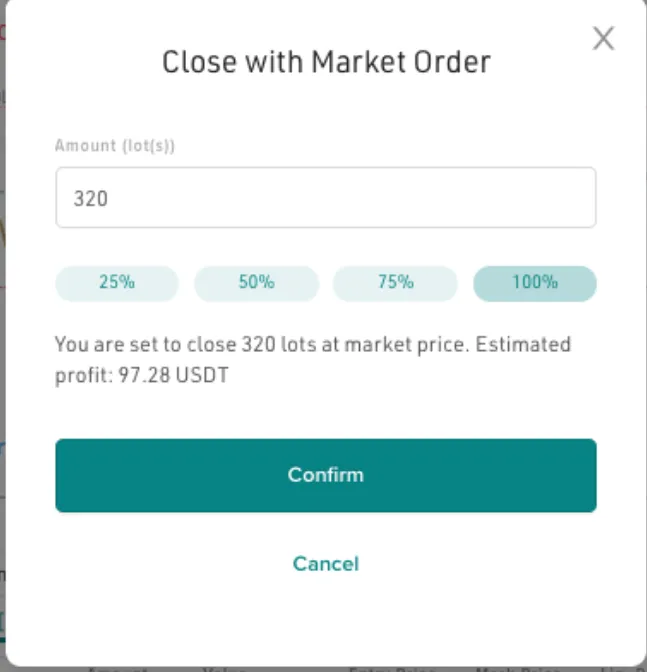

Closing a Position

When you want to close a position, click Close in the position section on the exchange. There are two way that you can close a positions, which are a market or limit order in your position list.

Close with Market Order: You have to enter the position size you desired to close, when you click Confirm, immediately your positions will now closed at the current market price.

Close with Limit Order: When you enter the position price and the position size, then you click Confirm to close your positions.

Advantages

0.026% maker and 0.075% taker.

It has a maker rebates and low taker fees.

You can trade with leverage.

Disadvantages

Trading with leverage and collateral is complex and risky.

There is sometimes substantial losses.

Small price change will have a huge impact on your trading.

Total balance in your futures wallet can be liquidated.

Conclusion

Poloniex Future contracts, offer customers the best trading experience. Poloniex provides a variety of assets and ways to trade. It also gives traders the best fees possible. Poloniex Futures fee structure of -0.026% maker and 0.075% taker provides the best maker rebates and low taker fees for. It gives traders more flexibility.