Hi investors, it's been yet another quiet week in crypto but we've never been so bullish about Ethereum.

Let's dive in!

Bitcoin.

BTC is trading at $9157 USD at the time of writing, the market is trading flat.

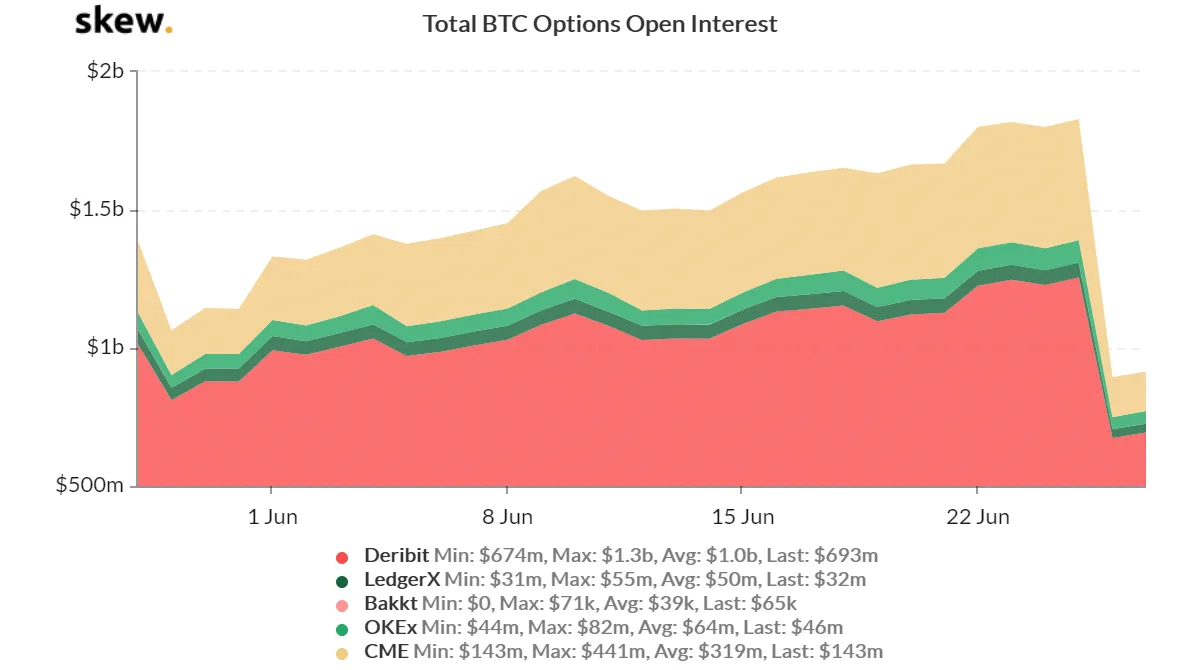

We're down -1.6% from last week and although the volume has picked up, we're nowhere near the apocalyptic levels of volatility prophesied by many crypto outlets in anticipation of the expiry of an historical ATH (nearly 2 billion) in Bitcoin options.

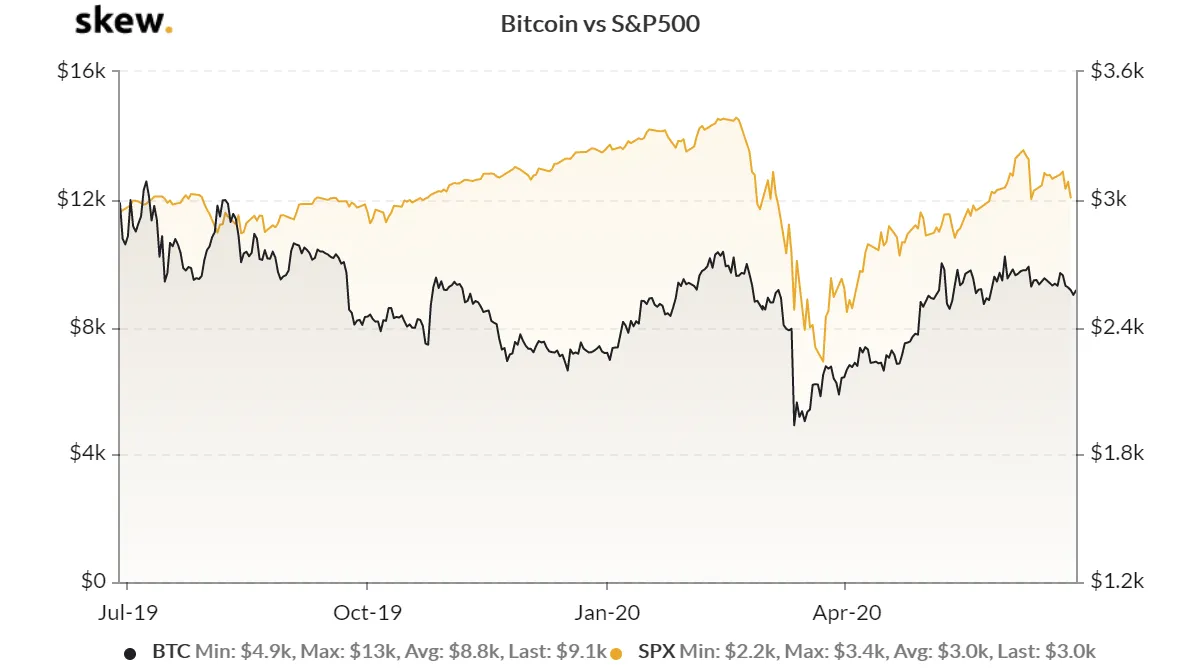

The option story turned out to be a non event and triggered no significant changes in price. Bitcoin is still trading in a flat range and the marginal price action seems firmly tethered to the fluctuations in the stock market:

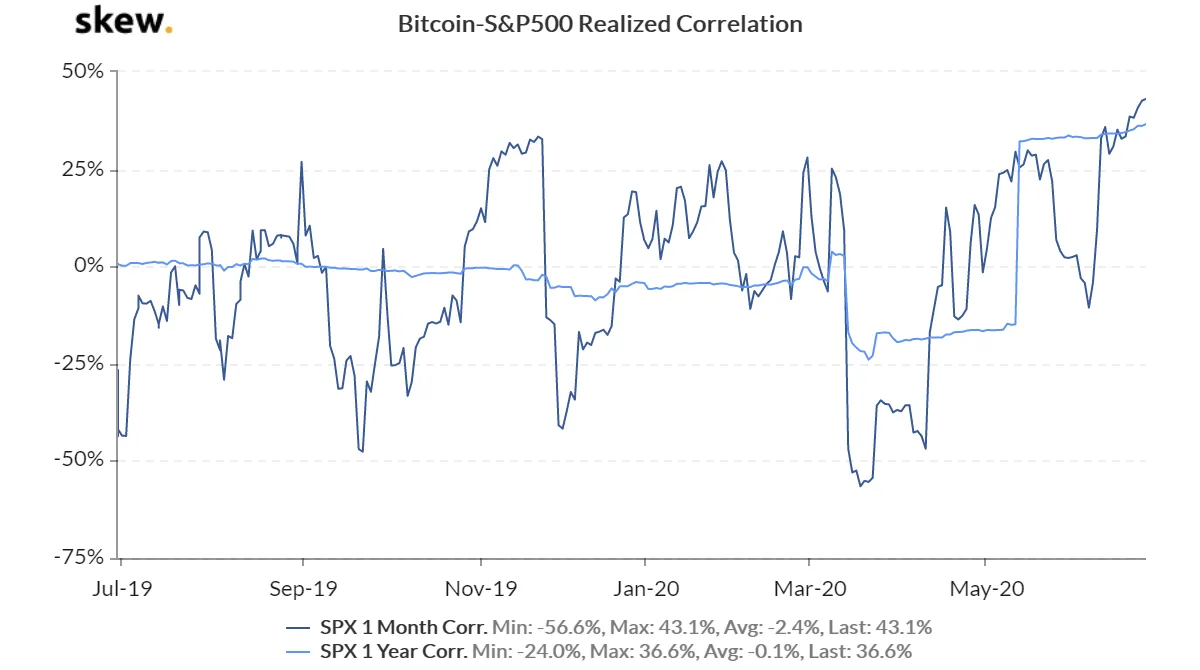

Notice the positive correlation which started at the end of May 2020, right after the halvening:

Some voices have started to raise concern over this new development and what it means for the narrative of Bitcoin being a safe heaven asset.

I personally think that Bitcoin's new correlation with the S&P500 is due to the overlap in market participants across the crypto ad the equity world. I also think it's too early to declare Bitcoin "fundamentally correlated" to the stock market but it's a concerning trend that's definitely worth keeping an eye on.

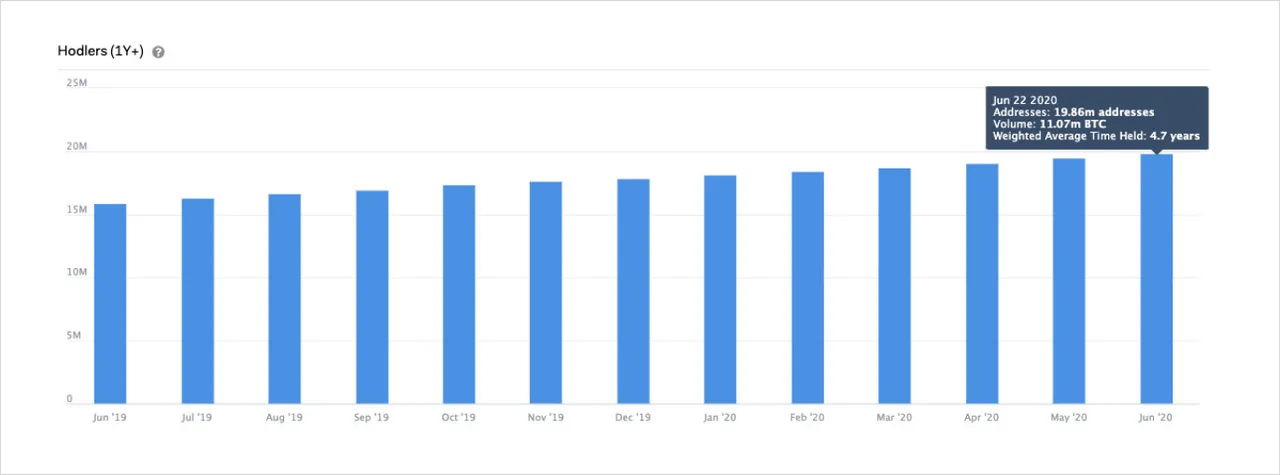

On a brighter note, we're seeing encouraging sign that the digital gold narrative for Bitcoin has been unscathed by the recent economic turmoil.

Notice the steady increase in long-term-hodl addresses throughout the year 2020. We're nearing 20 million "Bitcoin accounts" that have been hodling a staggering 11 million BTC for over a year.

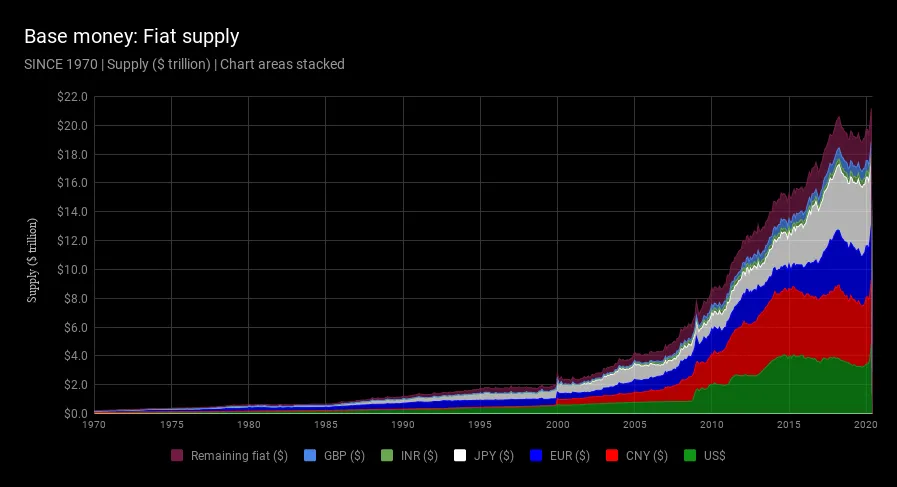

Despite this steady increase in adoption, we've yet to see the price of Bitcoin really live up to the narrative of an inflation hedge... which is quite ironic given the monstrous amount of fiat that has been pumped into the world's economy in the past decade alone:

Despite all money printers going full "brrrrr", the US dollar has remained remarkably strong...

.. and the jury's still out on whether we're headed into deflation, inflation, stagflation, hyperinflation or any kind of "flation".

We. just. don't. know

Personally, my instinct tells me that all this QE orgy is bound to create inflation at some point in the future...

BUT

...the global demand for USD from commerce and the shadow banking system has never been stronger and appears to literally being able to soak up any amount of liquidity, thus preventing monetary inflation to turn into price inflation.

One wonders how long the music will keep playing though. The laws of the market pretty much guarantee that we'll see inflation creep back in at some point in the future so hedging into a store of value commodity like BTC or gold definitely is a reasonable bet at this point.

Patience, again is of the essence.

Now let's have a look at Ethereum.

Ethereum.

The price of ETH ($ 227 USD at press time) has also been very stagnant this past week, down a paltry -0.54% since last week, it's trading mostly flat despite enormous network activity.

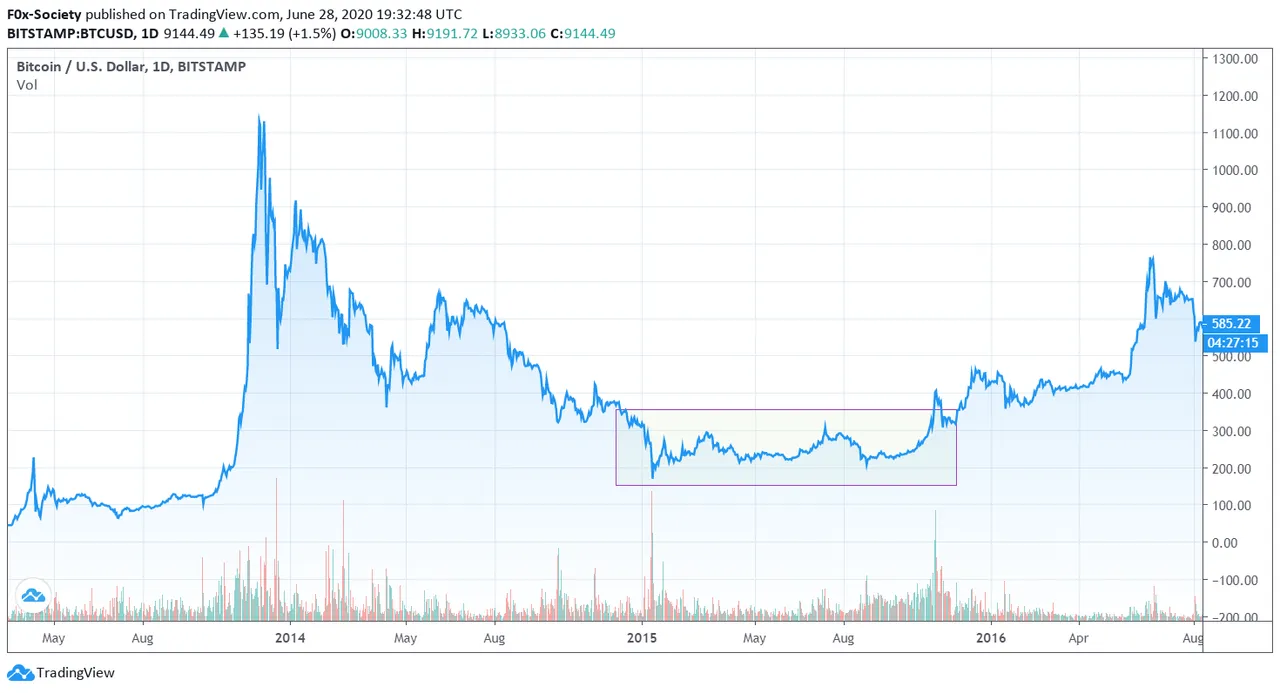

What's clear though is that ETH the asset has seemed to find a bottom, with a price action which curiously resembles Bitcoin circa 2015-2016 at the troth of the crypto winter:

I personally think that the asset is still being largely mispriced by the market.

At the risk of sounding like a broken clock, I've been going on for over 2 months about ETH being terribly undervalued with regards to the fundamentals of the network.

If you're not convinced, here's some data for you.

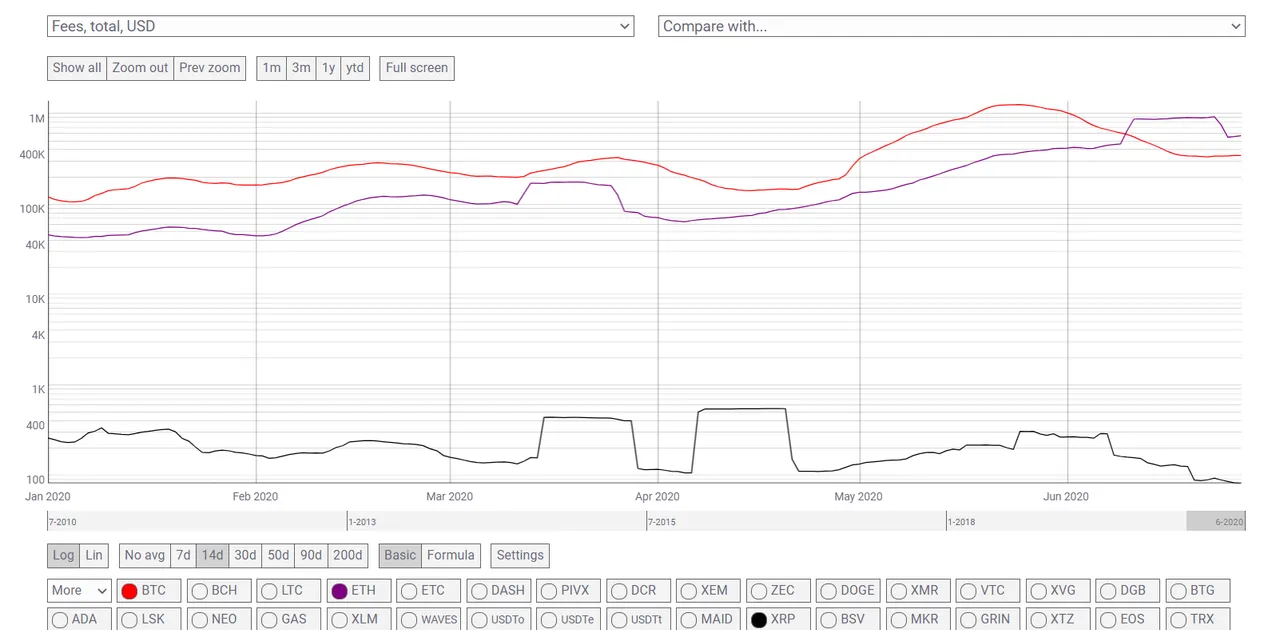

First, Ethereum has now clearly surpassed Bitcoin in terms of on-chain fees for over two weeks (I've added XRP for scale, and also to make the point that any L1 beside Bitcoin and Ethereum are just zombie chains at this point).

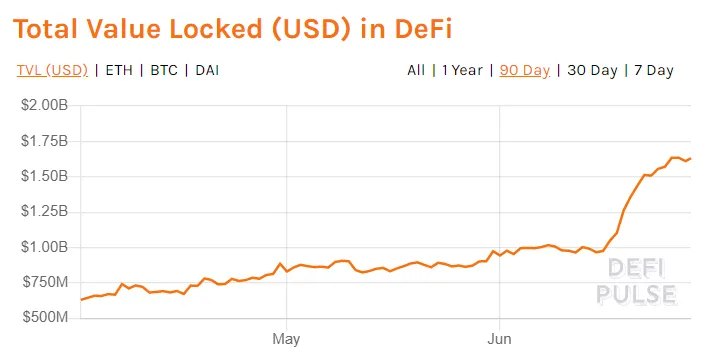

Second, Ethereum's healthy fee market reflects fast-growing user adoption in DeFi...

... and real-world USDt usage for yield farming, trading, saving and international remittances.

Although it's ironic that a crypto-dollars protocol like Tether is the current killer-app on Ethereum, it just goes to show that Ethereum is a real black hole for digital assets.

Tokenized assets now include:

all types of ERC-20 tokens,

non-fungible tokens which trade on specialized DEXes like OpenSea

wrapped Bitcoin (WBTC)

and a whole sleuth of exotic assets such as tokenized real-estate, synthetics and even tokenized mixtapes!

The level of innovation on Ethereum is just mind-boggling and it's honestly difficult to stay on top of all the innovation in the space.

Again, I wouldn't be surprised to see ETH being the real story of the next two years, particularly as POS is being deployed (you can read the latest updates here).

Exciting times ahead for the space.

That's it for this week's analysis, see you next weekend for more market insights.

Until then,

F0x