Hello!

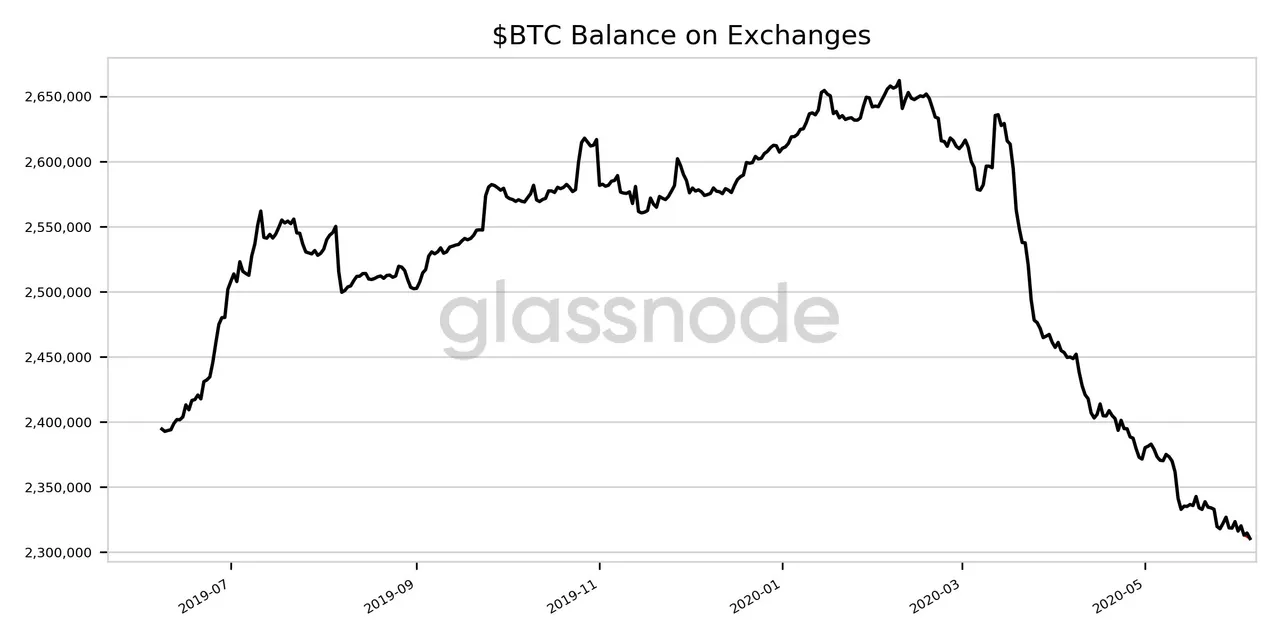

There is a really interesting metric to measure Bitcoin market sentiment, and that is the number of BTC that is sitting on Exchanges waiting to be sold/bought. Normally, if this number is high, it means that there is more people wanting to sell their stake for fiat money or other altcoins.

If this number is low, it means that more Bitcoin is stored in Wallets and is probably going to be HODLed for an specific period of time. In this case, it means that there is less BTC available in the markets, it can add a lot of volatility to the price and it normally will push the price to higher levels.

However, I am not sure if this time is going to push the price to higher levels as we are really close to a strong psychological resistante level 10,000$ per Bitcoin. In any case, it clearly shows that there is more people wanting to HODL their stake. This is a clear message to the markets that there are more investors believing in the true long-term potential of Bitcoin.

AND THIS IS REALLY BULLISH!

Bitcoin Balance on Exchanges

The Bitcoin Balance on Exchanges just reached a 1-year low of 2,300,000 BTC. The previous 1-year low was seen last June of 2019, this is more than a 13% decline since the last March high of 2,650,000 BTC.

I have seen that Glassnode has a really nice tool for analyzing Blockchain metrics called GlassnodeStudio. It looks really interesting and I will definitely take a look, it has a free Standard plan that allows you to see On-chain data for industry spectators and retail investors.

The paid options range from 29$ to 599$ annually, and can be useful for professional traders and experts.

Find below the chart that they shared via Twitter with the data commented:

Enjoy! 🐝