The Hive Power is an essential parameter for the Hive ecosystem. Hive Power holders are the ones that vote for witnesses, DHF proposals, curate posts, and receive curation rewards. It’s the main asset on the chain.

Holding powered up HIVE is a big commitment from its users as it takes three months to power it down.

The HIVE price impacts this parameter as many other things as well. Usually when the prices are down we can see more powering up and when they are up users tend to power down more. We have seen this in the past. In the recent months there has been some spikes in the Hive price and the overall trend is powering down.

Let’s take a look at the data.

We will be looking at:

- Hive Powered Up by Date

- Hive Powered Up by Month

- Hive Power Supply

- Hive Power historical Share

- Top Accounts That Powered up

- Top Accounts That Powered Down

Note that in the daily amount of powered up HIVE I have included the HP that is rewarded daily to hive users, as that HP enters in circulation and adds on top of the existing HP.

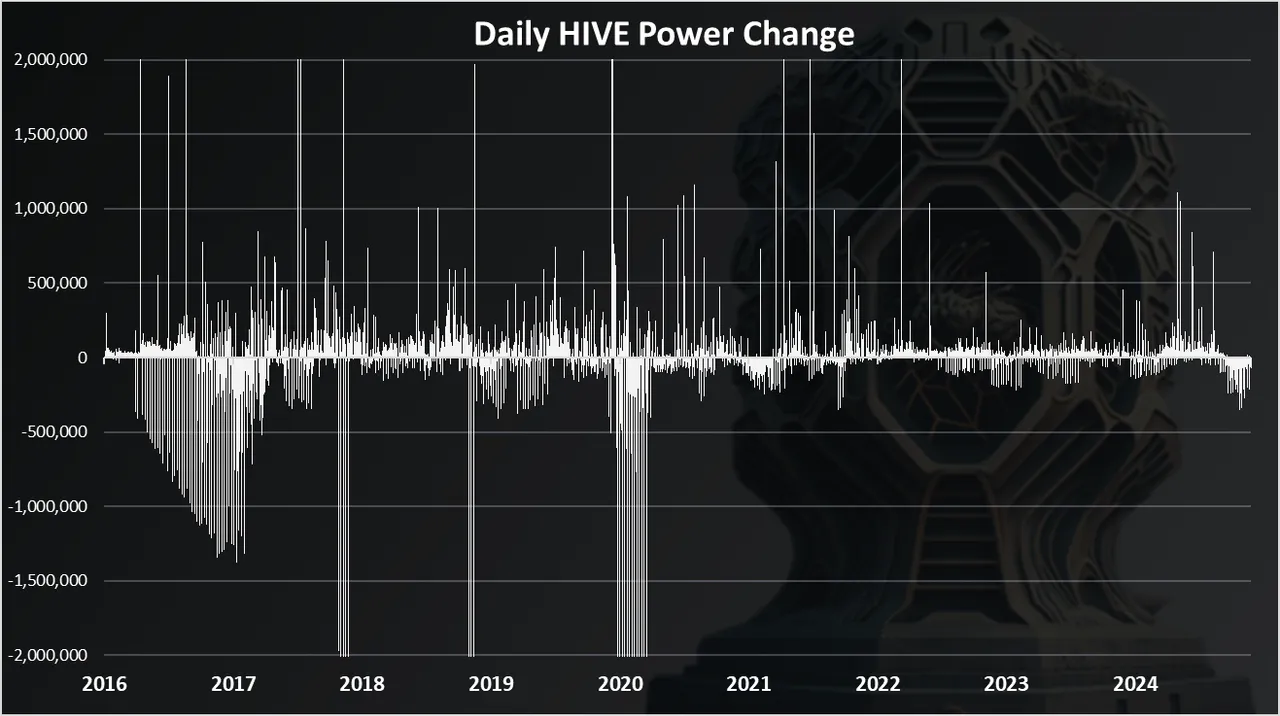

Daily Hive Power Changes

Here is the chart.

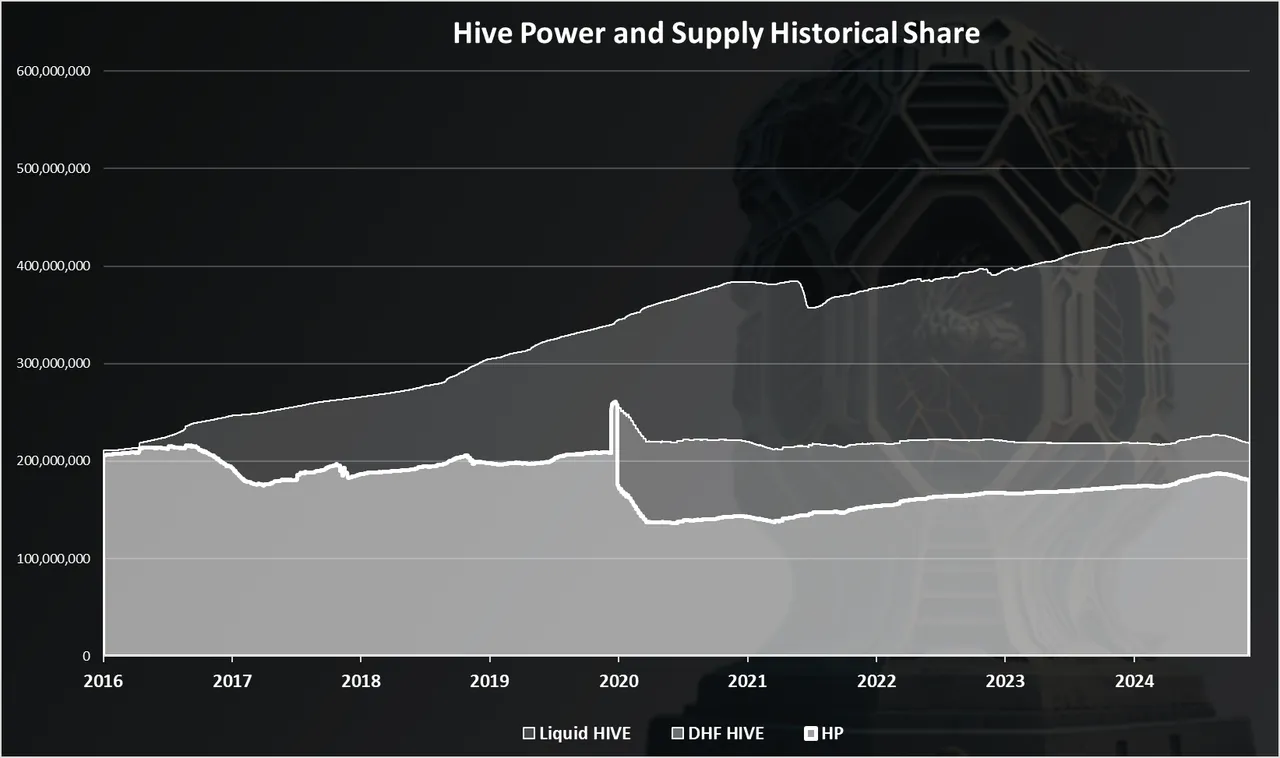

This chart dates to 2016 for context.

As we can see there was a lot of powering down back in 2016-2017. This is because the token started with all the HIVE, or STEEM back then, powered up, and there were no liquid tokens to trade on exchanges.

Another spike in the powering downs is at the beginning of 2018, and again in April 2020 when the Hive fork happened and there was a lot of turbulence like exchanges powering up and then down.

In the last years we can notice that the volatility has dropped a lot and there is more stability around Hive Power.

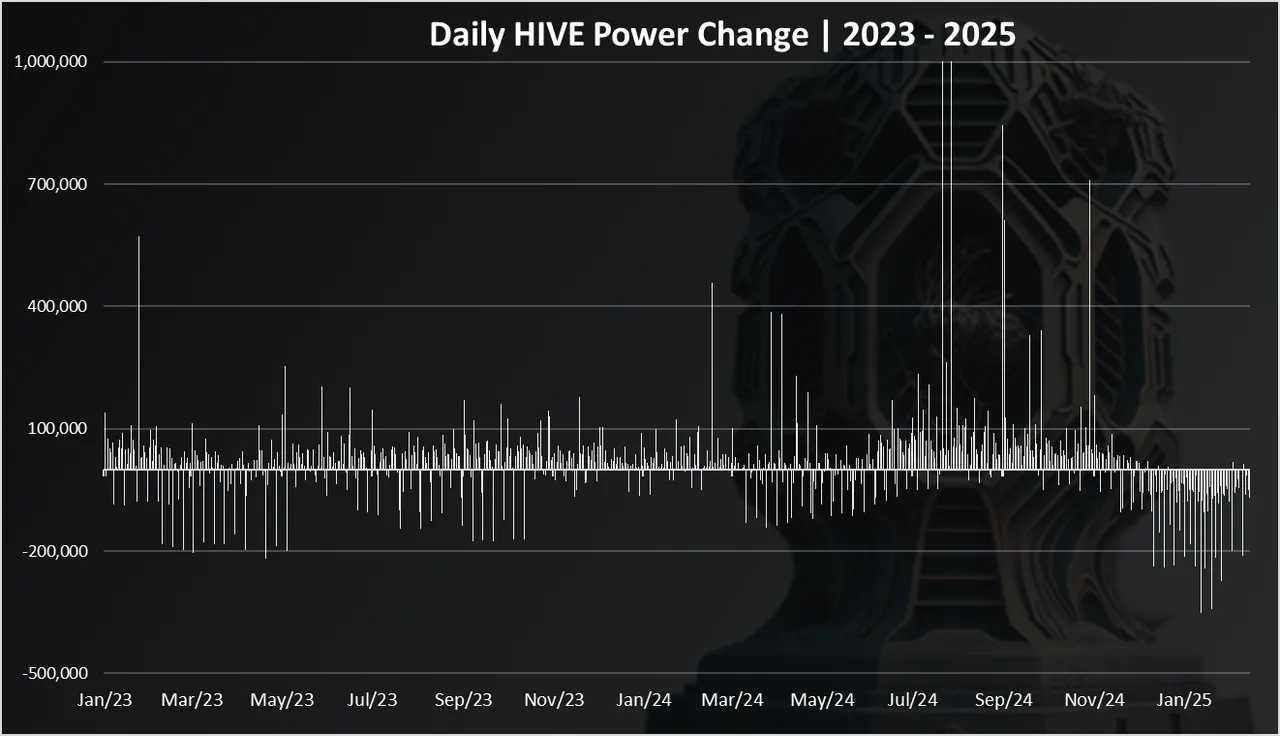

When we zoom in 2023-2025 we get this:

While we can notice the ups and downs, the volatility is much lower than the previous years, and in the range of -200k to +200k HP daily with occasional spikes.

What is noticeable here is the latest spikes in powering up, first in July 2024 on a few occasions there was more than 1M HIVE powered per day, and again at the beginning of September on few occasions around 500k HIVE was powered up.

In the last months, starting from December 2024 there is a continues trend of powering down as we can see at the end of the chart. Still not a big spikes, but a constant trend with and average of 100k HP powering down daily.

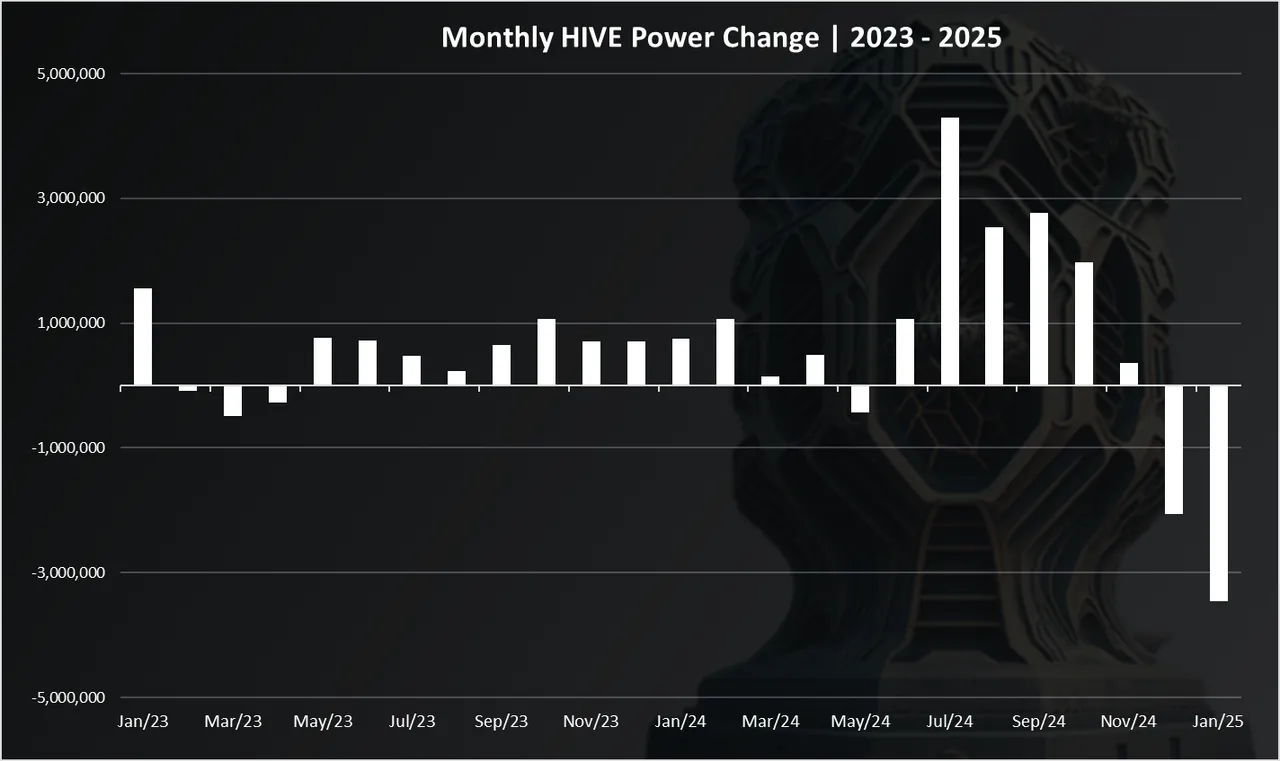

On a monthly basis we have this:

A relativley quite 2023 and then a spike in July 2024 with more than 4M HIVE powered up. The next months of the summer also had more than usualy HIVE powered up. The HIVE price dropped in this period so we can see users powering up.

In the last moths, December 2024 and January 2025 we can see powering down, a total of 2M HIVE in December and 3.5M in January. February is half way trough and it is around 700k.

Note that the new HIVE that is entering in circulation is as HP, around 2M per month and this chart is taking into account that as well.

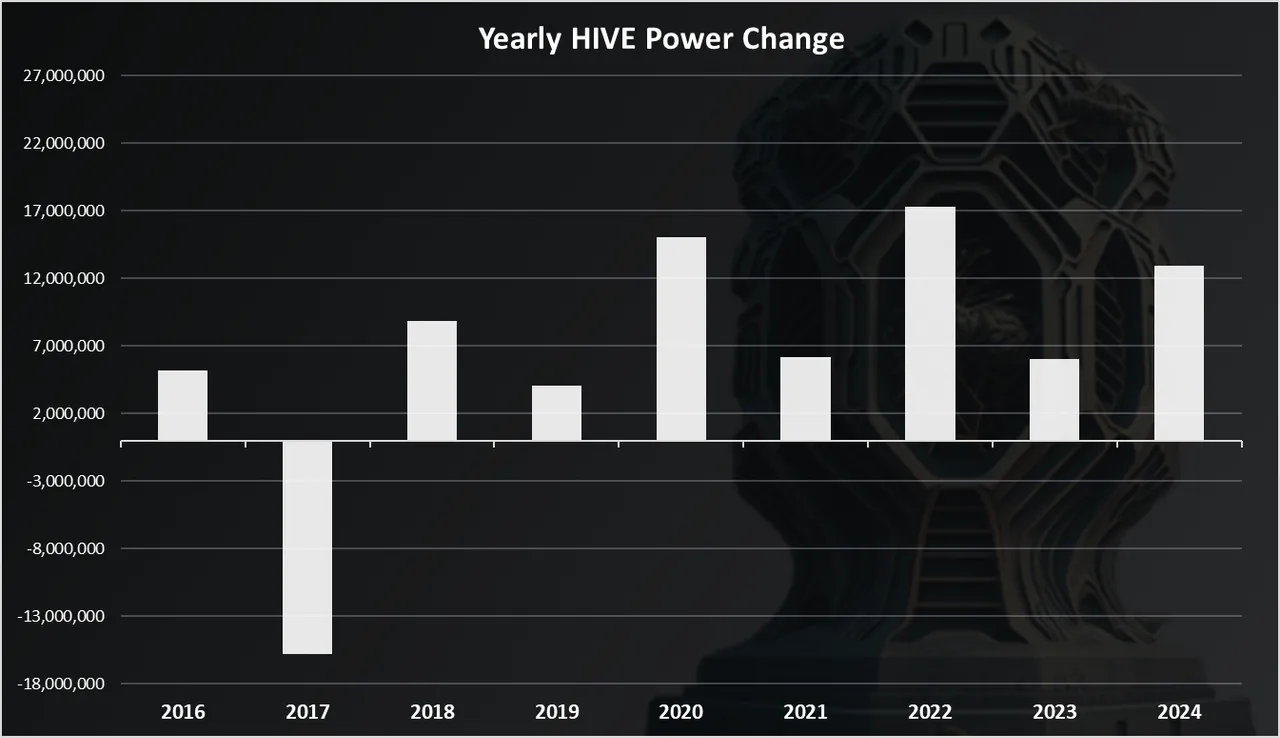

The yearly chart looks like this:

2017 has been the one year with more HIVE powered down. A net 15M HIVE powered down in 2017. 2022 has been a record high year for HP added with 17.5M HP. In 2023 we were around 6M HP while for 2024 we are at 13M more HP added in circulation.

HIVE Power Cumulative Supply

When we plot the cumulative HIVE power in the period, against the total supply we get this.

The bottom strongest white is HP, while the share in the middle is the HIVE that is locked up in the DHF. The top is liquid HIVE.

We can notice that in the last years there has been an uptrend in the amount of HIVE Power.

The HIVE in the DHF was previously powered up, but then it was transferred in the DHF and is now slowly converted to HBD over a period of five years. This is also locked HIVE.

We can notice the ups and downs in March 2020 when the hostile takeover happened.

Overall, the HIVE Power has been growing slowly in the whole period, but the liquid HIVE has even more aggressive expansion up until 2021. The other thing that influences the liquid HIVE supply is HBD, and when HIVE to HBD conversions happen that reduces the liquid HIVE. The liquid HIVE is attacked so to speak from two sides, HP and HBD.

Hive Power 2020 - 2025

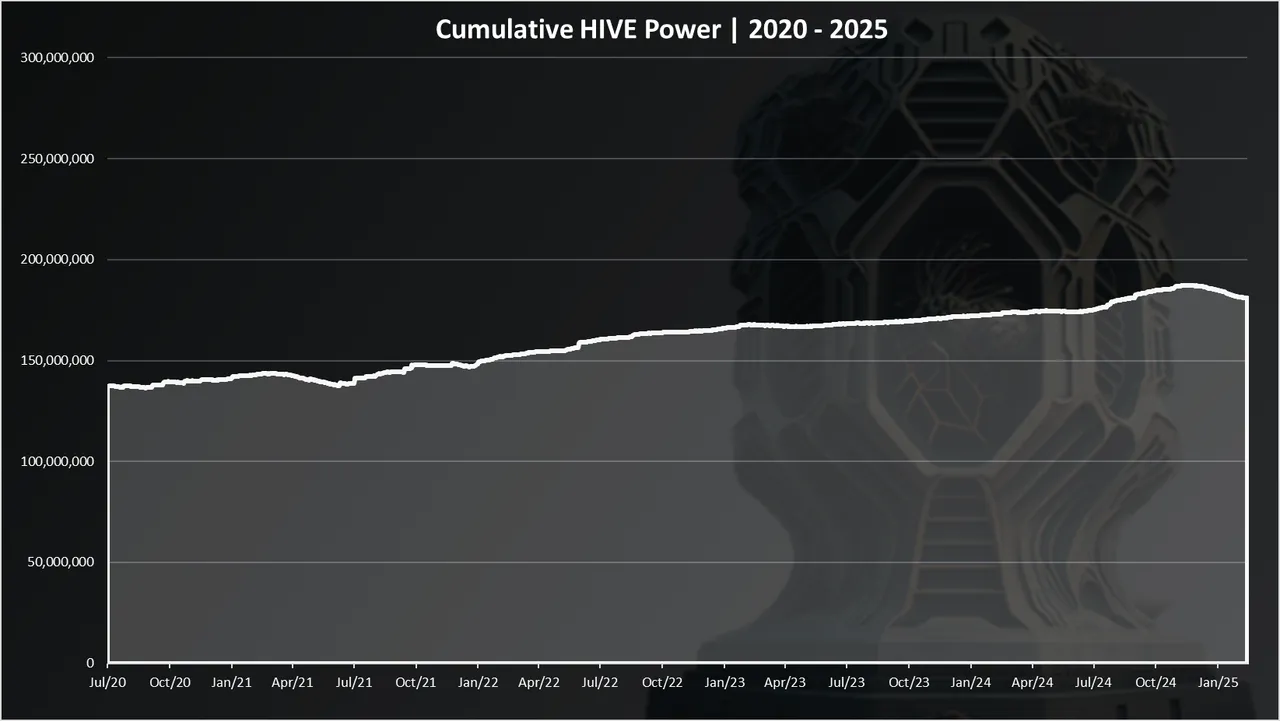

When we zoom in on Hive Power only, we get this:

A slow increase in the amount of HIVE powered up, from 140M HP in 2020, to 180M HP now. We can notice the drop in the last months here as well. A few months back we were at 187M HIVE powered up.

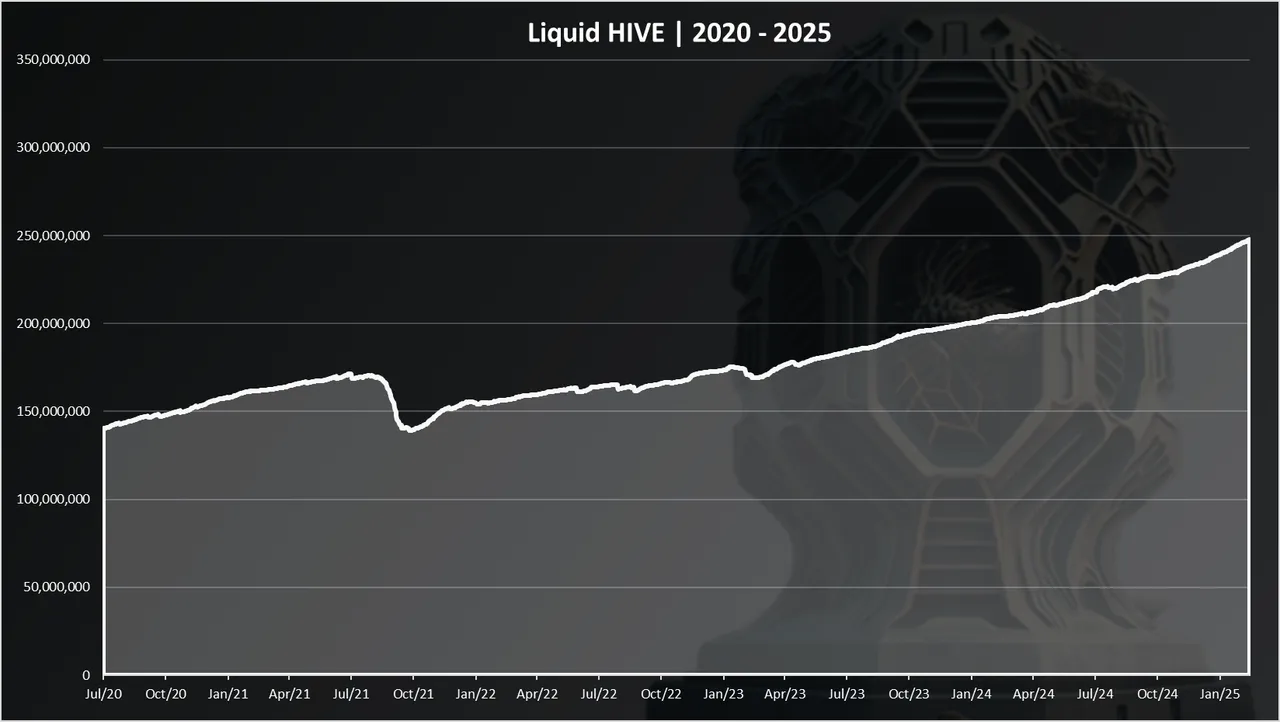

The chart for the liquid HIVE looks like this:

A steady uptrend here as well with some spikes on the downside. This happens usually when there are conversions to HBD.

We can see the drop back in September 2021, when there were a lot of conversions to HBD. A recent smaller drop in February 2023 as well.

In 2020 there was around 145M liquid HIVE and now we are at 247M.

Hive Power Share [%]

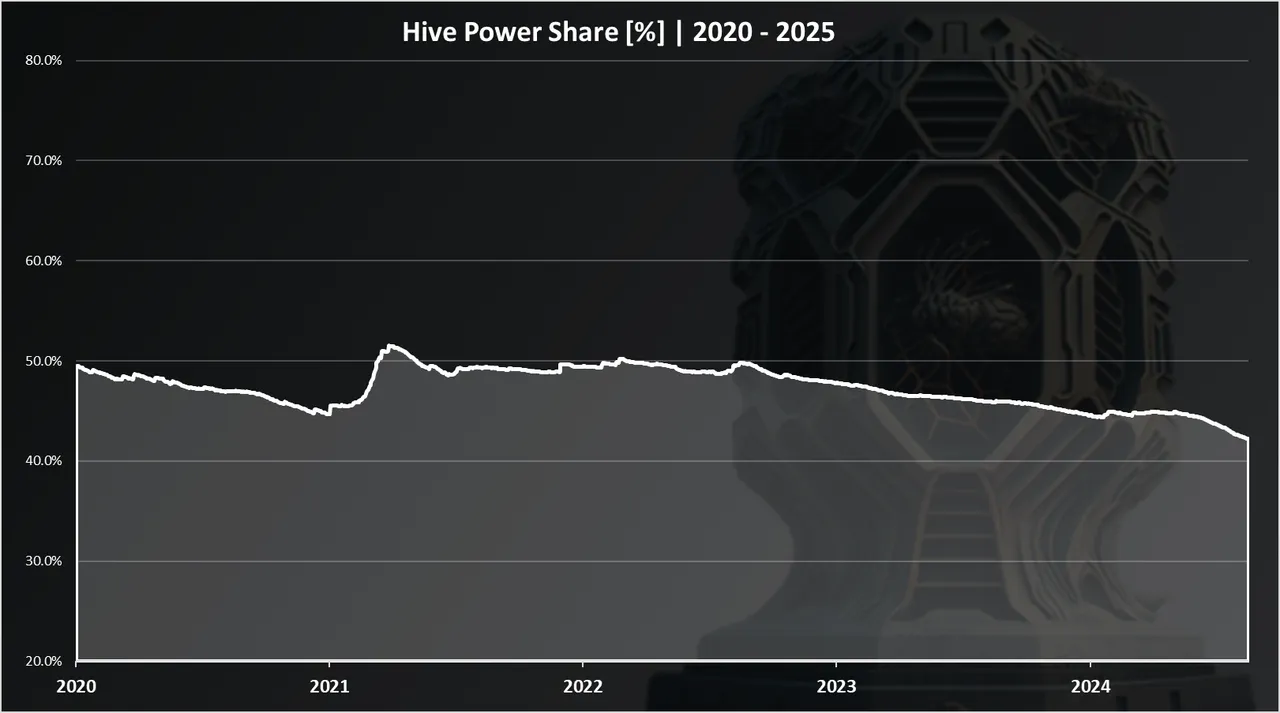

Here is the chart in percentage points.

This is from the start of the Hive fork in March 2020.

We can notice that the HP share has been hovering close to 50% in 2021 and 2022.

Since 2023 the HP shared started to gradually go down and continued in 2024 with even sharper drop in the last months. We are now at 42% HP share and it is the lowest it has been in the Hive lifetime.

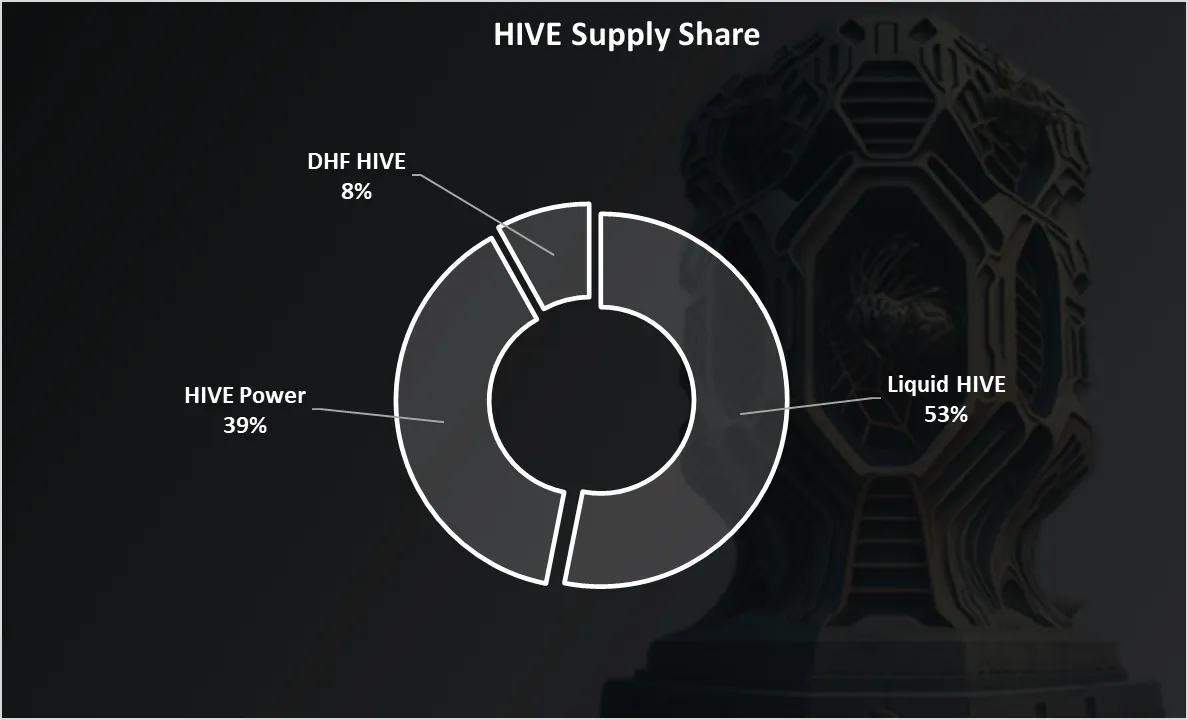

HIVE Supply Share

When we plot the current supply on a pie, we get this.

- 39% Hive Power

- 53% Liquid HIVE

- 8% HIVE in the DHF

Having in mind that the HIVE in the DHF is locked we can say that a cumulative 47% of the HIVE supply is powered up / locked.

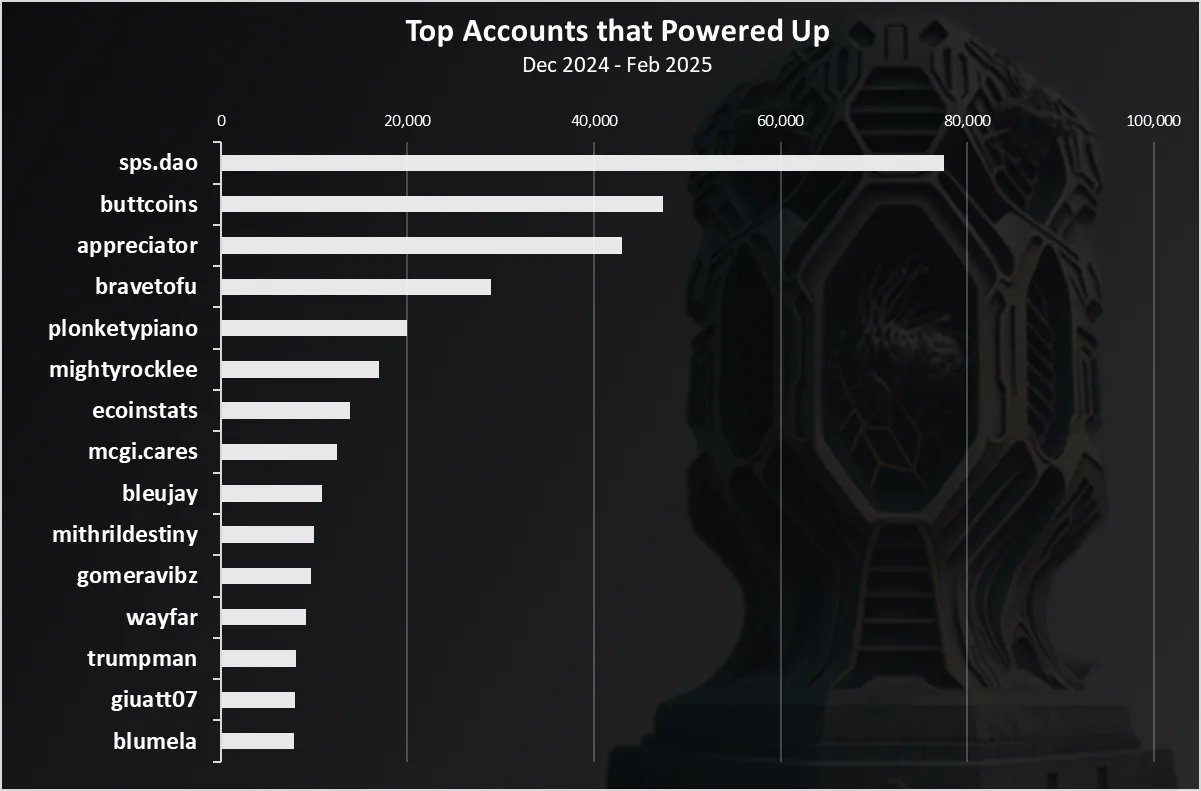

Top Accounts that Powered Up in the Last Months

Who is powering up the most?

Here is the chart for the last months.

The Splinterlands @sps.dao is on the top here with close to 80k HIVE, followed by @buttcoins. Notice the overall amounts in this chart are quite low.

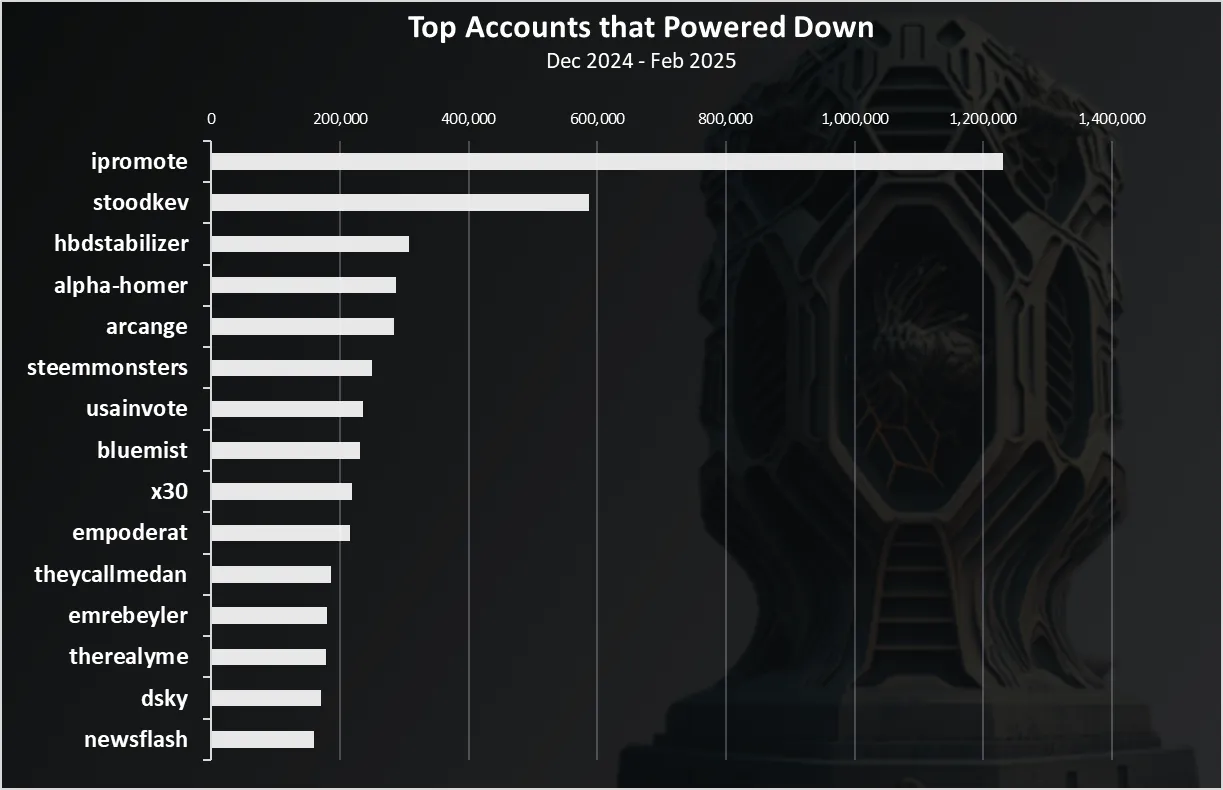

Top Accounts that Powered Down

Who is powering down the most?

The @ipromote account has been powering down the most with more than 1.2M HIVE, followed by @stoodkev.

The HIVE power share is at record lows now. A positive thing from this is the HP holders will get even more rewards because the staking share from the inflation goes to less HP. The HIVE price has increased and has caused some users to play on the market, that is quite a natural thing. A total of 7M HIVE was powered down in the last two and a half months.

All the best

@dalz