Even if it doesn't happen quickly, we can become wealthy if we have the right mindset, the right tools, and a strong work ethic, even if our families aren't particularly wealthy.

The important thing is not how much money you make, but rather what you do with it. If we can control ourselves to make sensible financial decisions, we can progressively accumulate wealth. If we are determined and put in the necessary effort, we may even write our own story of rags to riches.

We need discipline, expertise, and an optimistic outlook to go from a person with little to someone who's comfortable with a lot of wiggle room! We have access to a wide range of resources and tactics. Reaching our financial objectives is likely to become a reality if we are persistent and keep our eyes on the future. Recall that money is frequently acquired via skill rather than inheritance.

We need to develop the habit of putting savings ahead of spending. Give it some thought before making that next lavish purchase. Setting aside a certain percentage of your income—ideally 20% or more—to invest or save is essential.

The first step to managing our finances is understanding where they are going. Learn how to create a budget. Let us establish a sensible spending plan and monitor every dollar to make sure you follow it. Although software and applications can facilitate this process, a basic spreadsheet is sufficient.

Manage and restrict our debts. A business loan or mortgage are examples of debt that might be advantageous, but you should always be cautious of piling up high-interest debt. Let us review our money on a regular basis and try to cut down on debt.

Unexpected things happen in life. We have to keep an emergency fund on hand at all times. We don't want our quest to become financially wealthy to be derailed by unforeseen costs! An emergency fund provides a safety net.

Let's spend money on financial literacy! Being knowledgeable is powerful. Attend seminars and read books. Choosing well frequently pays off. Let us spread out our financial holdings because we know that it is possible for the financial market to be erratic. Spread and reduce risk in our investments by spreading them over equities, bonds, real estate, and other assets.

Look for ways to earn extra money outside of our usual work. These might be second enterprises (like this blog), dividends, or rental properties. One can speed up wealth creation significantly using passive income.

And finally, connect and work together. Make connections with people who share our interests. We may still discover chances we hadn't thought about by combining resources, exchanging ideas, or even working together on ventures.

😍#ilikeitalot!😍

Gold and Silver Stacking is not for everyone. Do your own research!

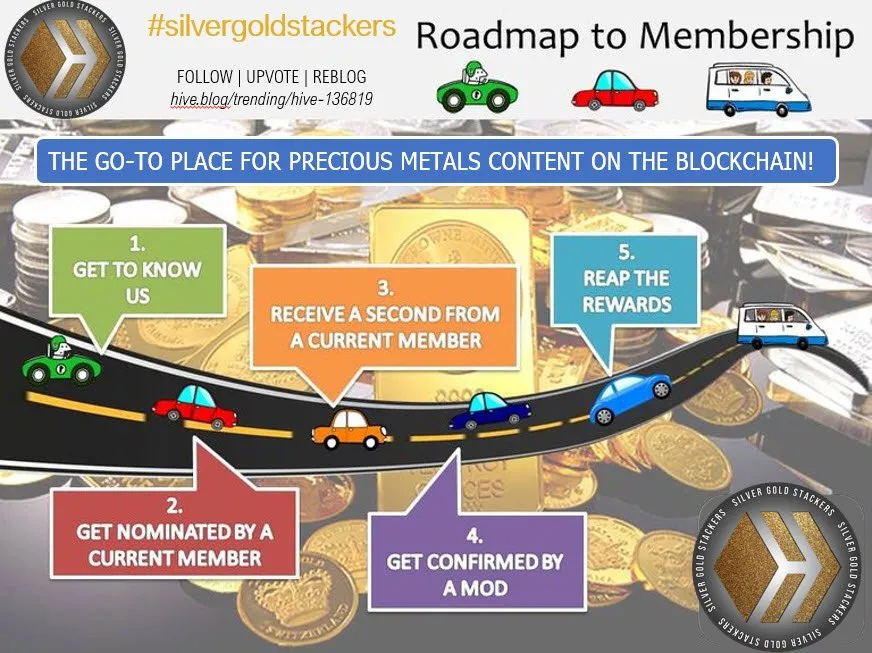

If you want to learn more, we are here at the Silver Gold Stackers Community. Come join us!

Thank you for stopping by to view this article. I hope to see you again soon!

I hope to see you again soon!

Hugs and Kisses 🥰🌺🤙!!!!

I post an article daily. I feature precious metals every other day, and on other days I post articles of general interest. Follow me on my journey to save in silver and gold.