Tesla may be at the most difficult crossroads in its history. With its sales collapsing across two continents, competition closing in from all sides... one big question looms over the market:

Who will win — Tesla or BYD ?

We’re talking about a true clash of titans in the electric vehicle market. In fact, it’s a battle over who will shape the future of transportation.

SALES DECLINE

Let’s start with the numbers. Because numbers… always tell the truth.

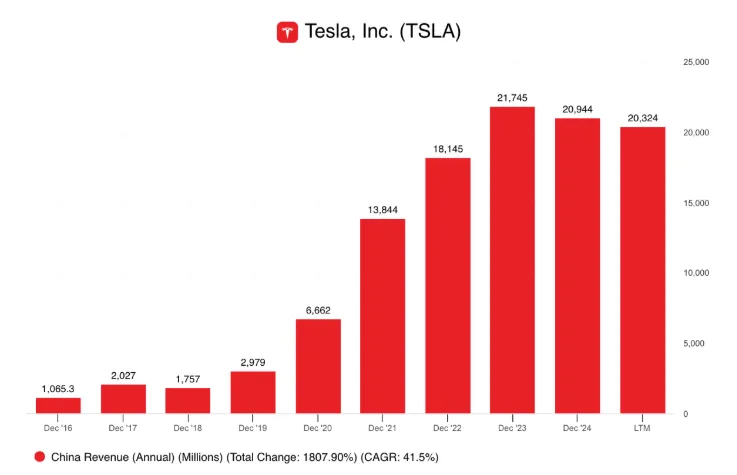

In July, Tesla ($TSLA) sold 67,886 vehicles in China (including exports), marking a year-over-year decline of 8.4% and a month-over-month drop of 5.2% compared to June. That might sound like a lot, but it’s nothing compared to BYD ($BYDDY), which sold over 341,000 vehicles in the same market. And that was actually BYD’s first sales decline of the year!

In Europe, the situation looks even worse for Tesla. According to official data, sales have plummeted in several key countries:

Sweden: –86%

Denmark: –52%

France: –27%

Netherlands: –62%

Belgium: –58%

The picture is clear: Tesla is on a downward trend in terms of volume.

MUSK’S MULTI-BILLION BONUS

And yet, while these worrying numbers make headlines around the world, Elon Musk is set to receive a “small” bonus of 96 million Tesla shares. Yes, you heard that right — 96,000,000 shares, currently worth around $29 billion.

This bonus package is set to vest over two years, as long as he remains CEO or in an executive role. But there’s a twist: if the Delaware Supreme Court rules in Musk’s favor regarding his previous $56 billion compensation plan from 2018, this new package gets canceled.

All of this comes just after a disappointing earnings report:

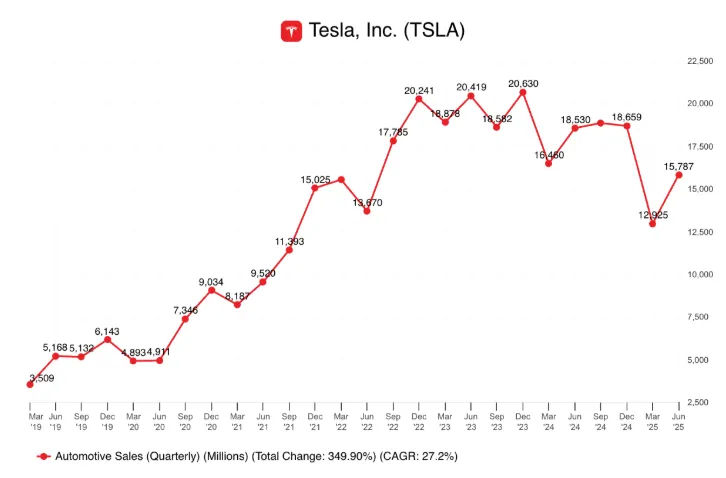

Tesla posted declining sales for the second consecutive quarter

Revenue from vehicles fell by 16%

Musk himself admitted that “difficult quarters may lie ahead”

In short? The company is slowing down, while its CEO’s stock is soaring.

CHINESE COUNTERATTACK

As Tesla pulls back, Chinese competitors are not just rising — they’re exploding.

Despite a slight dip from June, BYD still led the Chinese market with 341,030 deliveries in July. Meanwhile:

XPeng hit a new record: 36,717 deliveries, a 229% YoY increase

Xiaomi delivered over 30,000 vehicles

Huawei’s Aito brand delivered over 47,000 units, with 40,000 from a single model — the Wenjie

Things have gotten so competitive in China that the government had to intervene to cool down an all-out price war.

INVESTMENT OUTLOOK

So, the big investment question is: Who holds the advantage?

On one side, Tesla is the global EV brand. It has:

Huge technological lead

In-house chip and software development

A global network that rivals are still trying to build

On the other, BYD and the Chinese giants:

Already have production scale and massive sales

Are launching new models rapidly

Expanding into Europe

Supported by the Chinese state and moving at lightning speed