The U.S. Economy Is Literally… Booming!

This is confirmed by the latest official data from GDP, the labor market, and of course, the most recent FED meeting.

So let’s take a look at why the FED’s decision to hold interest rates steady was absolutely justified — and what the Q2 numbers are telling us about the American economy.

INTEREST RATES

The other day the FED decided not to touch interest rates, keeping them steady in the range of 4.25%–4.5%.

The decision was made with 9 votes in favor and 2 against. The only dissenters were Bowman and Waller, who argued for a rate cut, believing inflation had dropped sufficiently and the labor market may be starting to slow down.

Worth noting: this was the first time since 1993 that two members of the Board voted against the majority.

However, the overall picture says this: the economic indicators remain strong, so stability is currently the wisest choice.

Even Jerome Powell himself stated that uncertainty remains, but there are encouraging signs.

Inflation has eased to around 2.5%, unemployment is at historically low levels, and there are no immediate causes for panic.

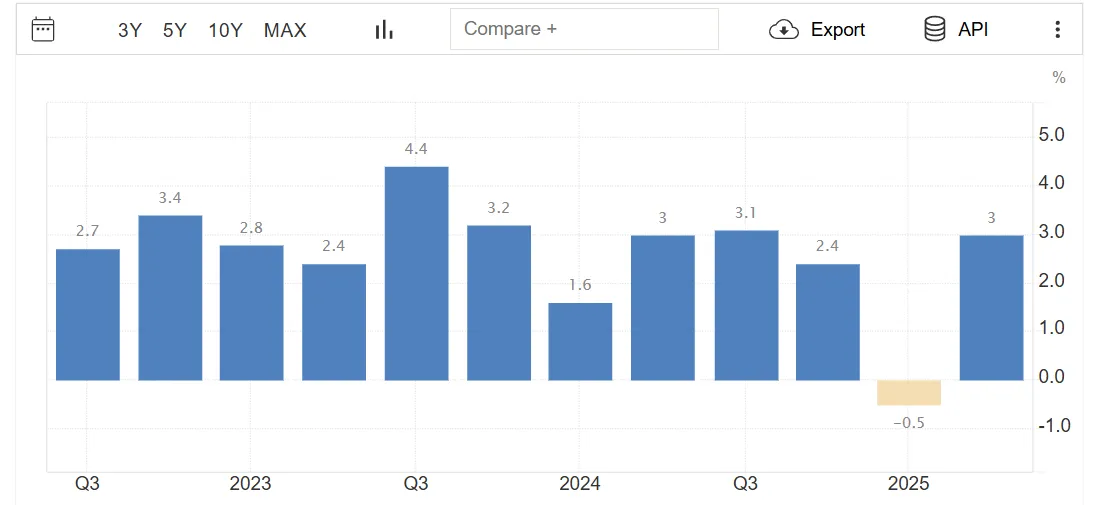

GDP

Now let’s talk about the part that made many economists rub their eyes in disbelief:

Q2 GDP rose by 3%, while forecasts were at just 2.3%.

And we’re talking real, inflation-adjusted numbers.

This growth rate isn't random. It’s driven by:

a 30% drop in imports (after a Q1 surge),

a 1.4% increase in consumer spending,

and contained inflation (PCE at 2.1%, Core PCE at 2.5%).

In short:

Consumers are still spending,

Prices are stabilizing,

Productivity is holding steady.

All of this boosts confidence and strengthens the FED’s case not to rush into rate cuts.

Even Donald Trump, despite criticizing the FED, indirectly acknowledged the economic progress — demanding a rate cut from "Too Late Powell."

The markets, however, didn’t react sharply, as investors likely expected this kind of move.

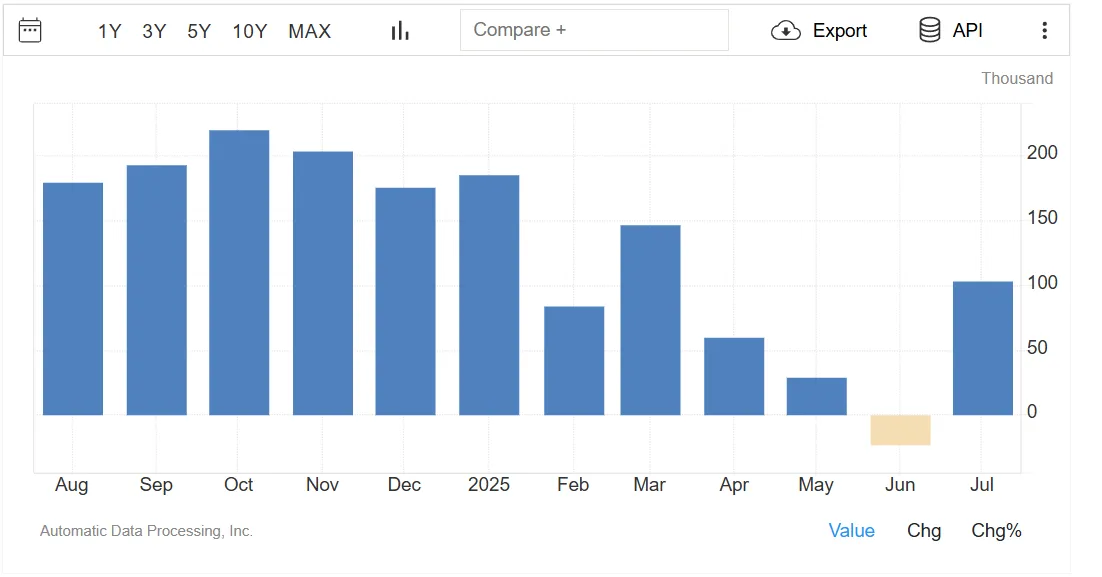

LABOR MARKET

And now, the labor market.

According to ADP, 104,000 new private-sector jobs were added in July.

In contrast, June saw a loss of 23,000 jobs, so we’re talking about a full rebound.

Who led the recovery?

Leisure and hospitality: +46,000 jobs

Financial sector: +28,000

Transportation, construction, and public services also made positive contributions.

On the other hand, the education and health sector saw a decrease of 38,000 jobs.

Still, wages increased by 4.4% year-over-year, which shows that businesses remain competitive and are actively trying to retain talent in what’s still a strong and dynamic job market.

CORE PCE

Core PCE — the index that excludes energy and food prices.

This is done to get a clearer view of underlying inflation trends, without the “noise” from more volatile categories.

For June, the Core PCE rose by 0.3% month-over-month, exactly as analysts expected — but slightly higher than May’s 0.2%.

On an annual basis, Core PCE came in at 2.8%, just above market expectations of 2.7%, and equal to May’s reading, which was revised upward.

In simple terms? The inflation “thermometer” read a bit hotter than expected.

And as long as that continues, the FED has absolutely no reason to cut interest rates. On the contrary, it’s more likely to hold its current stance longer — just as it did in its latest meeting on Wednesday.

PCE

Now let’s look at the headline PCE, which includes energy and food prices.

It’s a more volatile indicator but reflects the reality experienced by everyday consumers.

This index also showed a 0.3% monthly increase, right in line with forecasts, but again slightly higher than the previous month.

On a year-over-year basis, it stood at 2.6%, above the 2.5% forecast, and up from 2.4% in May.

Personal Spending & Income

It's also worth noting what happened with personal spending and income:

Consumer spending rose by 0.3%, indicating that Americans are starting to spend again.

While encouraging for the economy, this could add more pressure to inflation.Personal income also increased by 0.3%, beating expectations — a sign of relative income stability, despite a tough prior month.

The savings rate held steady at 4.5%, which is historically low.

But yes — American consumers are spending more than they’re saving.