Gone are the days, when crypto investors passively held their crypto without earning any rewards. In today's day and age in crypto, we have DEFI applications that give yields and rewards to crypto investors for depositing their crypto into DEFI protocols to provide liquidity to swap pairs, or lending their crypto and earning interests.

This DEFI age began trending in 2020 with DEFI protocols like Compound, Uniswap, Aave in the early days, now of course we know there are hundreds of DeFI protocols across Blockchains. One such new age DEFI Super App that's now an active parachain in Polkadot Blockchain is Parallel Finance.

Parallel Analytics>> Active Web3 financial services in Parallel Finance for DEFI users…

Parallel Finance's colossal contribution to the #Dotsuma ecosystem with its Crowdloan services

Parallel Finance has been buzzing since its launch with DOT users using the platform's Crowdloan pallet to contribute their DOT to Polkadot's Parachain crowdloans. Parallel Finance, itself launched after securing a parachain slot in Polkadot after winning one of Polkadot's Parachain auctions.

You can take a look at the DEFI activities buzzing at Parallel Finance Super DEFI app checking their analytics page here >>

Parallel Analytics >> Various active DEFI operations in Parallel Finance have attracted over 550 million Total Value locked in this Super DEFI app!!

Parallel Finance has been contributing to the #Dotsuma ecosystem already with its Crowdloan pallet functions having had over 130$ million worth of DOT crowdloan contributions locked on chain.

Parallel Analytics>> DOT Crowdloan contributions from Parallel Finance's Crowdloan Pallet forms 22.41% of the overall Crowdloan DOT contributions in the entire #Dotsuma Ecosystem.

Therefore, Parallel Finance started as a DEFI app offering valuable services to DOT users before it developed other functionalities.

Innovative liquid DOT derivative solution, cDOT to unlock liquidity of locked Crowdloaned DOT

Being a new age app, Parallel Finance offered liquid Crowdloan DOT derivative; cDOT, so that the liquidity of the Crowdloaned DOT gets utilised in DEFI.

You can check Parallel Finance's analytics and find that cDOT holders are earning as liquidity providers.

Parallel Analytics >> cDOT holders earn yields in Parallel Finance.

Parallel Analytics >> Amount of cDOT assets locked in Parallel Finance, these assets can be employed in Parallel Finance to earn yields.

Yields for cDOT holders as LP providers and lenders in Parallel Finance

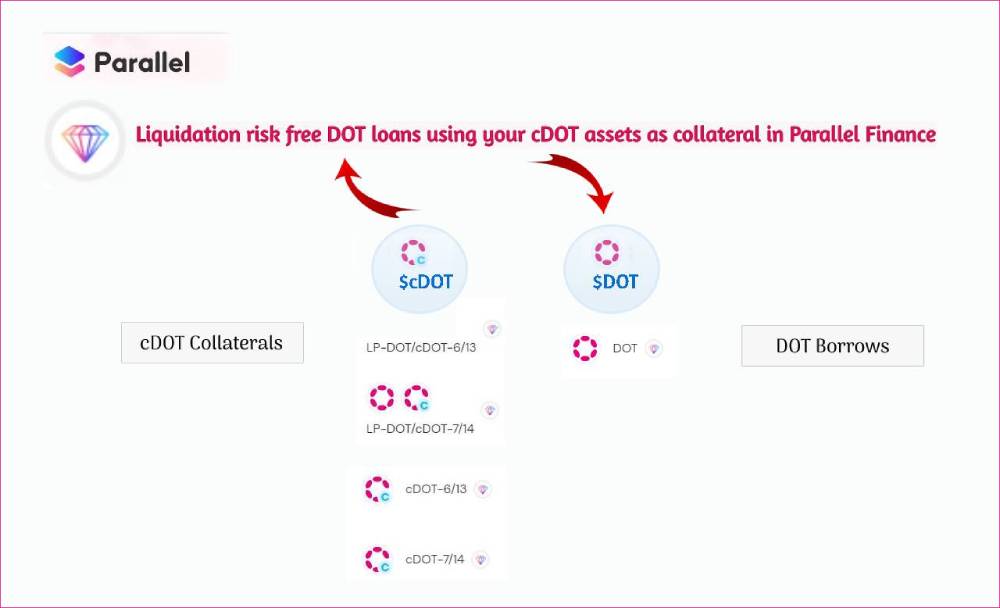

cDOT holders who provide liquidity to DOT-cDOT pairs have benefits as they can earn stable LP rewards in DOT or corresponding cDOT derivative (no impermanent loss danger), plus they can lend these LP rewards in the Money Market and borrow DOT against these LP rewards.

Note, that loans taken providing LP-DOT/cDOT assets as collateral are eligible for liquidation risk free DOT loans.

So, DOT holders who have contributed their DOT to Parachains using Parallel Finance's crowdloan pallet will be delighted that their DOT contributions are back to be used in DEFI in cDOT form, and it's even possible to get DOT with their cDOT as LP rewards from DOT-cDOT pairs can be used to borrow DOT with no risk of liquidation!!

So, Parallel Finance is more than a mere DEFI app with generic DEFI functions, it is a Super DEFI App with the goal of offering capital efficient DEFI, where users get most out of their deposited assets and supplied in Parallel Finance.

New Age Super DEFI App's innovative liquid staking DOT(sDOT) solution

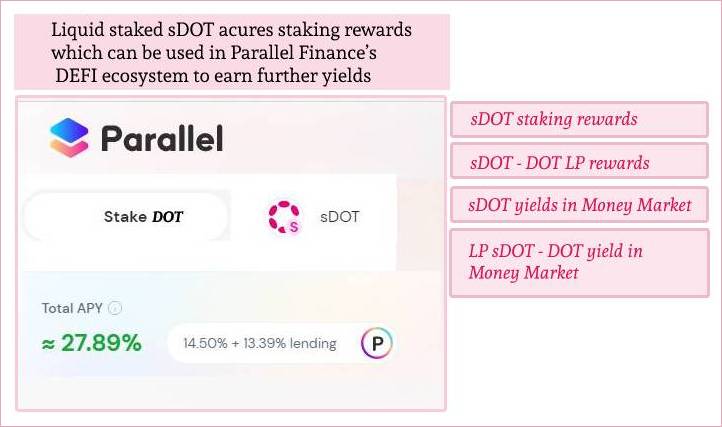

Being a new age DEFI Super APP, Parallel Finance offers DOT liquid staking services with staked DOT derivative, sDOT which can be used in DEFI as well. So, while sDOT holders keep accumulating staking rewards, they can employ sDOT by lending the asset in the Money Market and providing liquidity to DOT-sDOT pairs in Parallel Finance's Liquidity Module

A one stop DEFI Hub for DOT holders - Parallel FInance

So, Parallel Finance is indeed a valuable one stop app for DOT users with many services offered for them where they can easily contribute to Polkadot's crowdloans, liquid stake their DOT and even make recurring payments with DOT over a period of time to an address utilising Parallel Finance's Dao Fi services offered with Stream payment module.

Scheduling automatic periodic payments using Stream Protocol

I have explained about Stream payment functions of Parallel Finance in earlier articles. This is a Web3 payment solution for payroll and token distribution.

You can check Parallel Finance's analytics and see that Stream is a well utilised product where Para, HKO, DOT and Kusama assets can be scheduled to be periodically sent and received.

Know about Parallel Finance -

Parallel Finance Super DEFI App offers a range of valuable web3 financial services to the Dotsuma community and other crypto investors. Parallel Finance is committed to be a secure DEFI Hub providing valuable DEFI services that will attract atleast 1 billion users in the near future. The DEFI services in Parallel Finance are designed to be capital efficient where users get most out of their assets they deposit and supply in the DEFI app.

Website - https://parallel.fi/index.html

Twitter - https://twitter.com/ParallelFi

Discort - https://discord.gg/DeyEntFT

White paper - https://parallelfi.gitbook.io/parallel-finance/polkadot-network/white-paper

This Author's articles can also be read on these platforms -

https://www.publish0x.com/@greenchic

https://medium.com/@kikctikcy