Hey All,

There is this famous saying which goes by - Where there is profit there is a loss. You WIN at times and you loose too. So its like I am not always making profit there are losses too that I face but then I make it a point to minimize those looses by average out i.e. apply the dollar cost average rule here. As an example whenever I am into these situations what I normally do is that at every sharp dip I buy more of the stocks where I am facing hefty losses. I will get to the example of Jupiter Wagons stock in a moment but before that lets look into my reasons as to why I decided to invest in this ticker - "JWL"

Top 3 Reasons to Investment in Jupiter Wagons Limited...

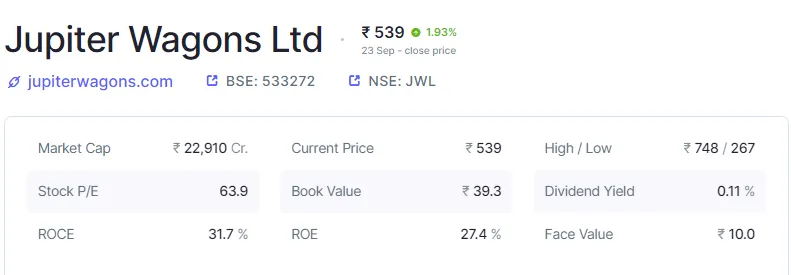

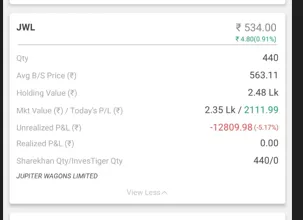

I remember doing a post around it as well, so refer the detailed post - Stock Market 101:: Why I am Investing in Stock - Jupiter Wagons Ltd.... JWL is into a good business of Commercial Engineers & Body Builders Company Ltd aka (CEBBCO) and is primarily involved in the business of manufacturing metal fabrication comprising load bodies for commercial vehicles, rail freight wagons, and components. Business model is associated to government orders i.e. making of freight railway wagons and much more. Overall a good business model and has a market cap of Rs.22K Cr. so not a penny stock company at all. My second reason to pick JWL was tied to comparing it with its peers. Looking at its competitors which are Jyoti CNC Auto, Titagarh Rail, Action Const. Eq. and others Jupiter Wagons price is cheap trading around Rs.530+/- as noted above. Have a look at the following image that showcases my position on JWL shares::

Yes, I have 440 shares of JWL and total investment comes out to be almost Rs.2.5 Lakhs and the average buy price is Rs.563/- currently I am at loss here roughly 5% and that comes out to be Rs.13K+ approximately. And as said it earlier losses are part and parcel of the game. Where there is profit there is a LOSS. At the moment the plan is to accumulate more JWL stocks at every sharp decline and get that average price down and then just wait for the right opportunity. Well that should be it for todays post on the Stock Market 101; series1 on booked profits with real time examples. I will be sharing more of these examples and insights in the upcoming posts to help you navigate the market more confidently. Stay tuned for more tips on making informed decisions and maximizing your returns.. Happy Investing... cheers

Stock Market 101:: Loss ON - Stock - Jupiter Wagons Limited......

#stock #stockmarket #nse #bse #jwl #jupiter #jupiterwagon #investment #finance #strategy #sensex #indiastockmarket

Have Your Say On the Jupiter Wagons; ticker:: JWL

Do you invest in India Stock Markets? What are the different criteria you look into before picking a quality stock? Are you invested in the Jupiter Wagons Limited? Short term Vs Long Term? Please let me know your views in the comment section below...cheers

Image Credits:: screener, pro canva, sharekhan, zerodha

Best Regards

PS:- None of the above is a FINANCIAL Advice. Please DYOR; Do your own research. I've an interest in Blockchain, Stocks & Cryptos and have been investing in many emerging projects.